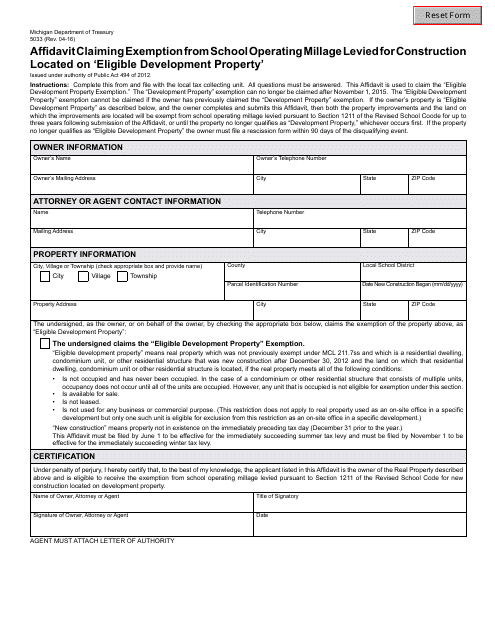

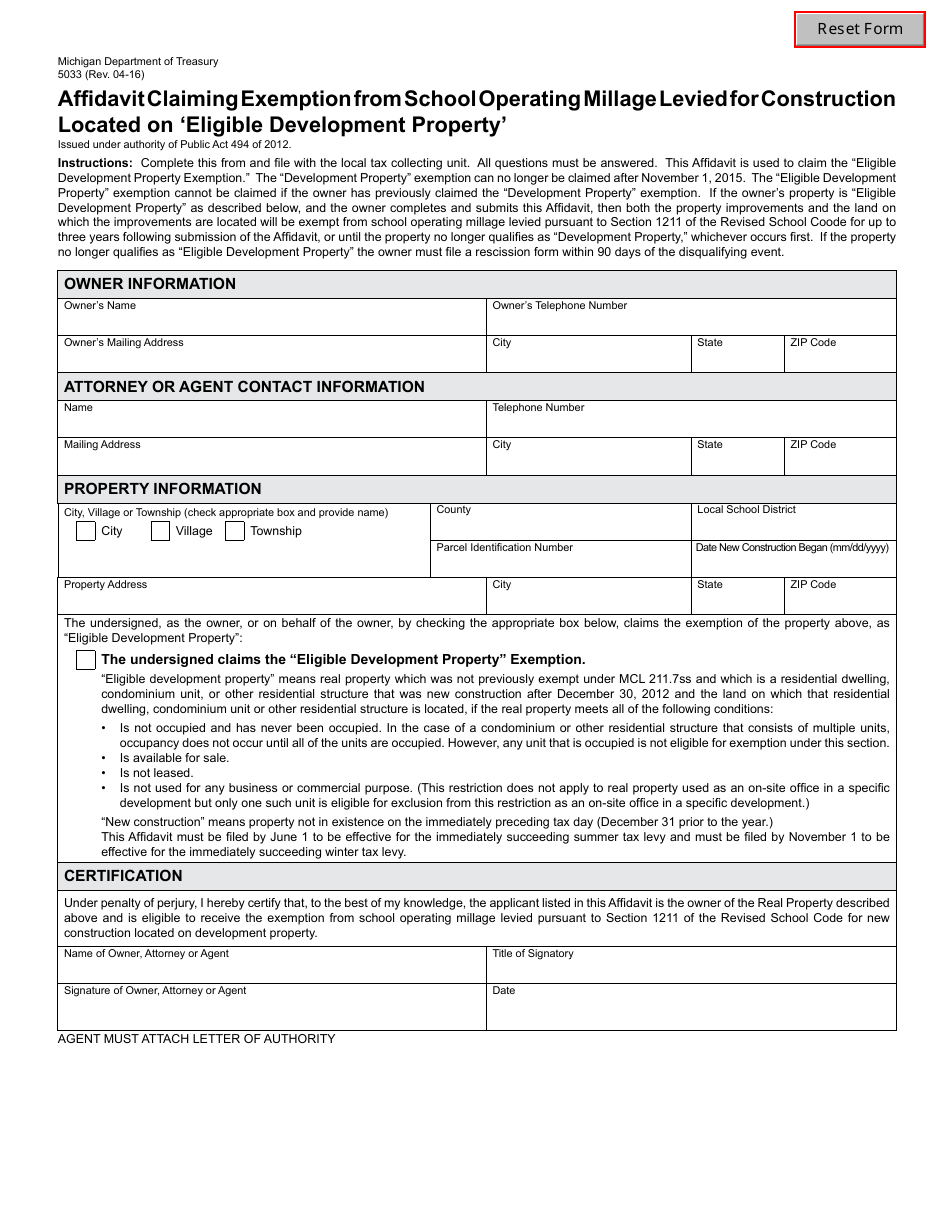

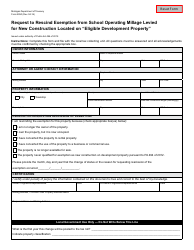

Form 5033 Affidavit Claiming Exemption From School Operating Millage Leveled for Constructions Located on "eligible Development Property" - Michigan

What Is Form 5033?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 5033?

A: Form 5033 is an affidavit used in Michigan to claim exemption from school operating millage for constructions on eligible development property.

Q: What does the Form 5033 affidavit claim exemption from?

A: The Form 5033 affidavit claims exemption from school operating millage.

Q: What is eligible development property?

A: Eligible development property refers to the property that meets certain criteria specified by the state of Michigan.

Q: What is the purpose of claiming exemption from school operating millage?

A: The purpose is to avoid paying the school operating millage on constructions made on eligible development property.

Q: Who can use Form 5033?

A: Anyone who meets the eligibility requirements for claiming exemption from school operating millage in Michigan can use Form 5033.

Form Details:

- Released on April 1, 2016;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 5033 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.