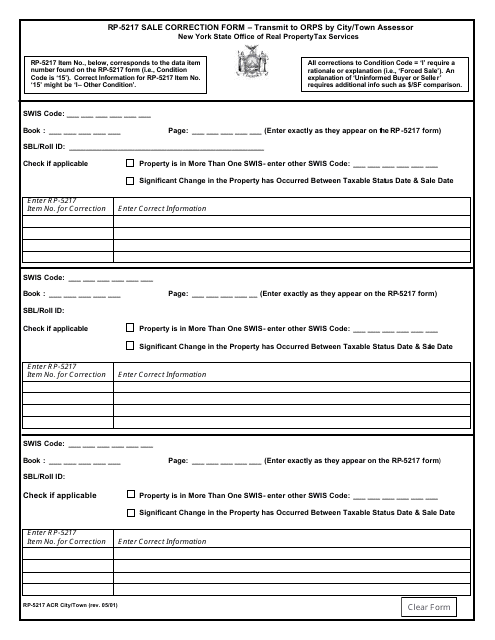

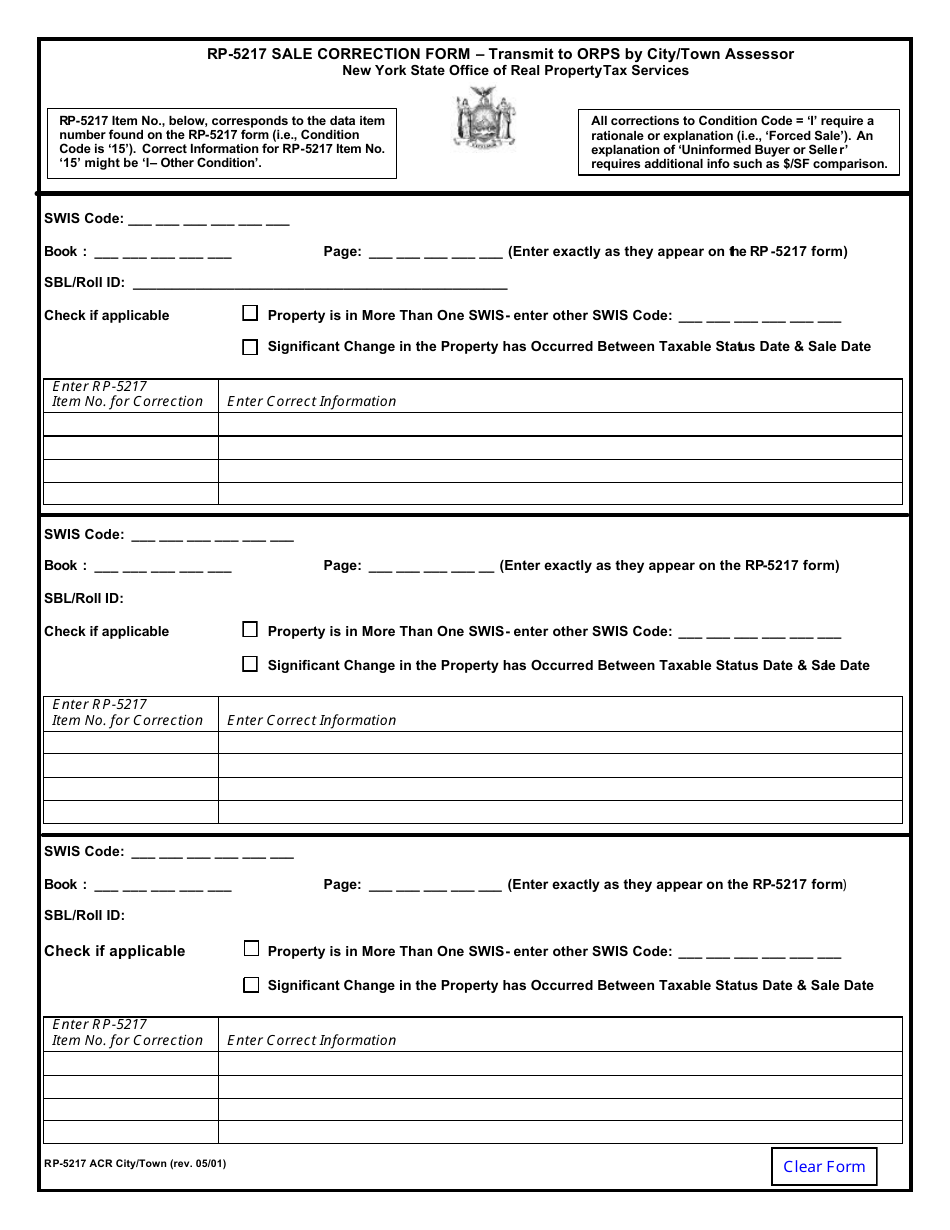

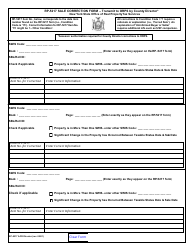

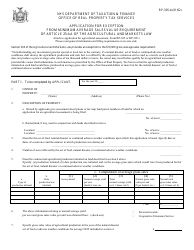

Form RP-5217 ACR City / Town Sale Correction Form - New York

What Is Form RP-5217 ACR City/Town?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-5217 ACR?

A: Form RP-5217 ACR is the City/Town Sale Correction Form in New York.

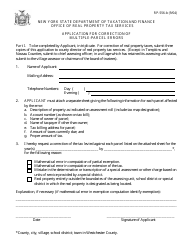

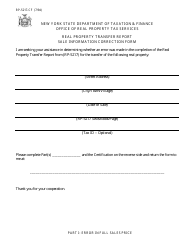

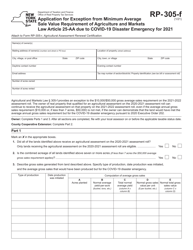

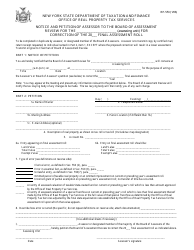

Q: What is the purpose of Form RP-5217 ACR?

A: Form RP-5217 ACR is used to correct errors or omissions on previously filed real property transfer tax forms.

Q: Why do I need to use Form RP-5217 ACR?

A: You need to use Form RP-5217 ACR if you need to correct any mistakes on a previously filed real property transfer tax form.

Q: How do I fill out Form RP-5217 ACR?

A: You should follow the instructions provided with the form to properly fill out Form RP-5217 ACR.

Q: Is there a deadline to submit Form RP-5217 ACR?

A: Yes, you must submit Form RP-5217 ACR within certain timeframes. The specific deadline can be found in the instructions of the form.

Q: Can I submit Form RP-5217 ACR electronically?

A: No, Form RP-5217 ACR cannot be submitted electronically. It must be submitted by mail.

Q: What should I do if I have any questions about Form RP-5217 ACR?

A: If you have any questions about Form RP-5217 ACR, you can contact the New York State Department of Taxation and Finance for assistance.

Form Details:

- Released on May 1, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5217 ACR City/Town by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.