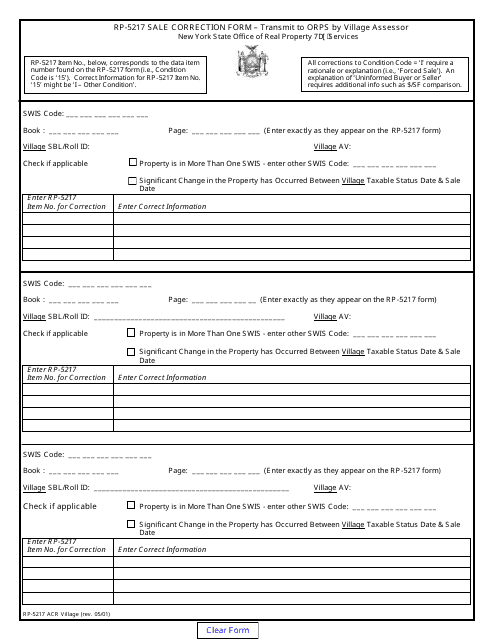

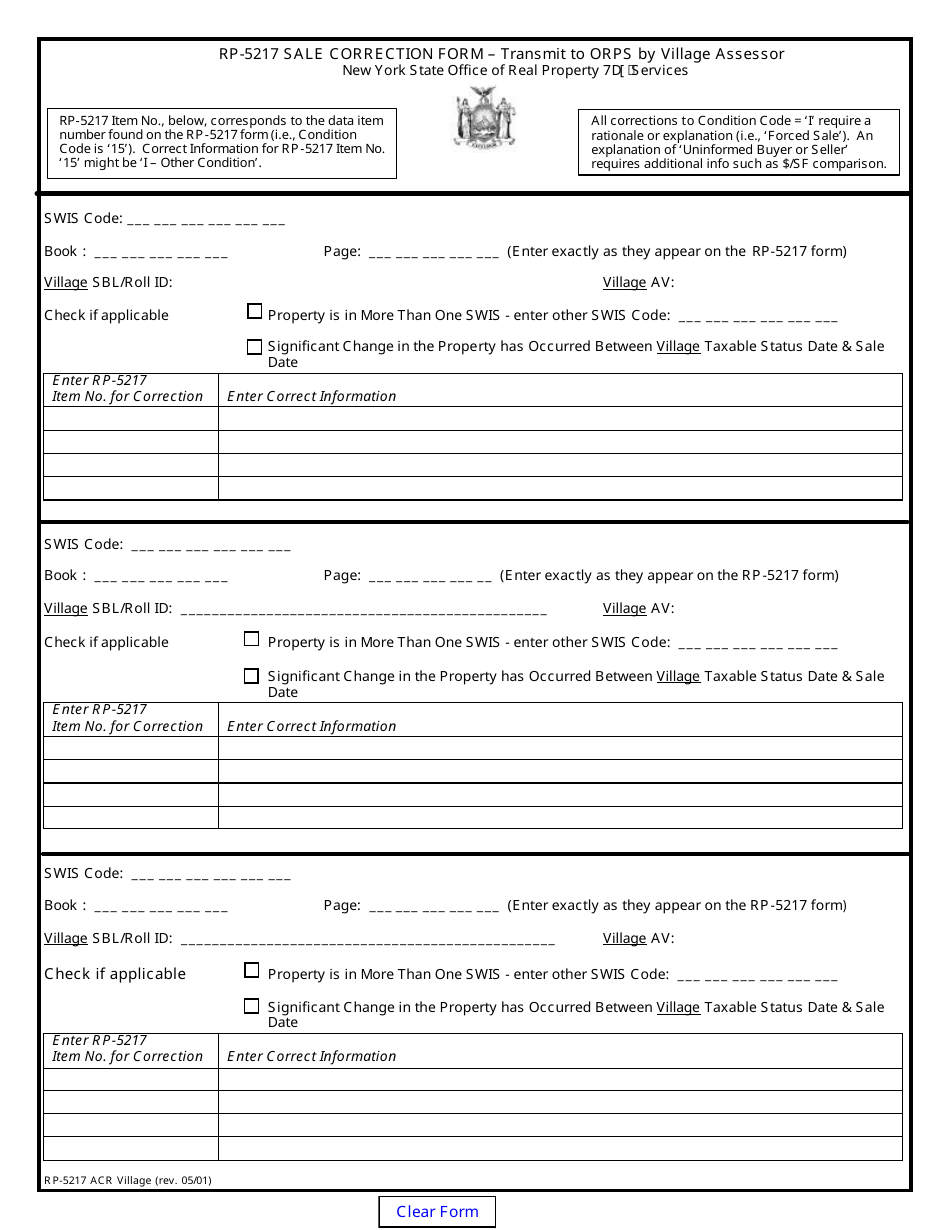

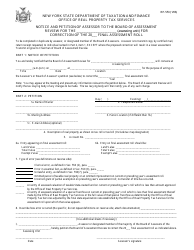

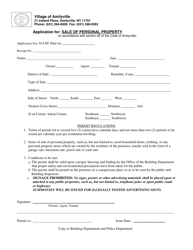

Form RP-5217 ACR Village Sale Correction Form - New York

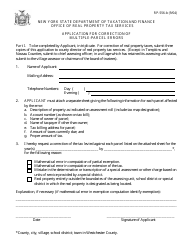

What Is Form RP-5217 ACR Village?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-5217 ACR?

A: Form RP-5217 ACR is a Village Sale Correction Form used in the state of New York.

Q: What is the purpose of Form RP-5217 ACR?

A: The purpose of Form RP-5217 ACR is to correct errors or omissions on previously filed RP-5217 forms for property sales in villages.

Q: Who needs to fill out Form RP-5217 ACR?

A: Form RP-5217 ACR needs to be filled out by anyone who needs to make corrections to a previously filed RP-5217 form in relation to a property sale in a village in New York.

Q: Are there any fees associated with filing Form RP-5217 ACR?

A: There are no fees associated with filing Form RP-5217 ACR.

Q: When should Form RP-5217 ACR be filed?

A: Form RP-5217 ACR should be filed as soon as possible after discovering an error or omission on a previously filed RP-5217 form.

Q: What information is required on Form RP-5217 ACR?

A: The required information on Form RP-5217 ACR includes the original transaction number, the correct information, and a detailed explanation of the correction being made.

Q: What are the consequences of not filing Form RP-5217 ACR?

A: Failure to file Form RP-5217 ACR to correct errors or omissions may result in penalties or other legal consequences.

Form Details:

- Released on May 5, 2001;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-5217 ACR Village by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.