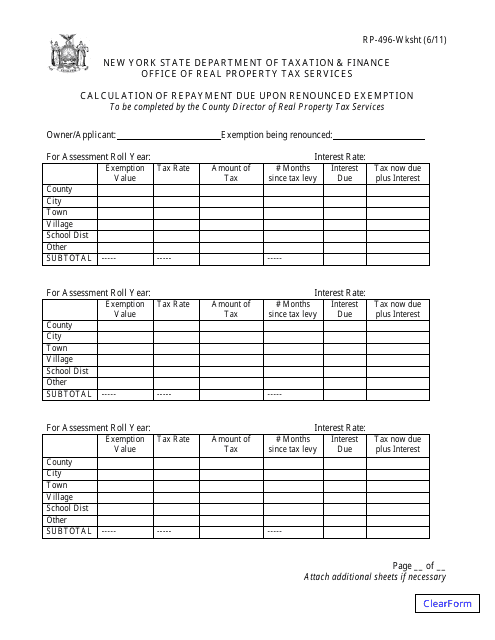

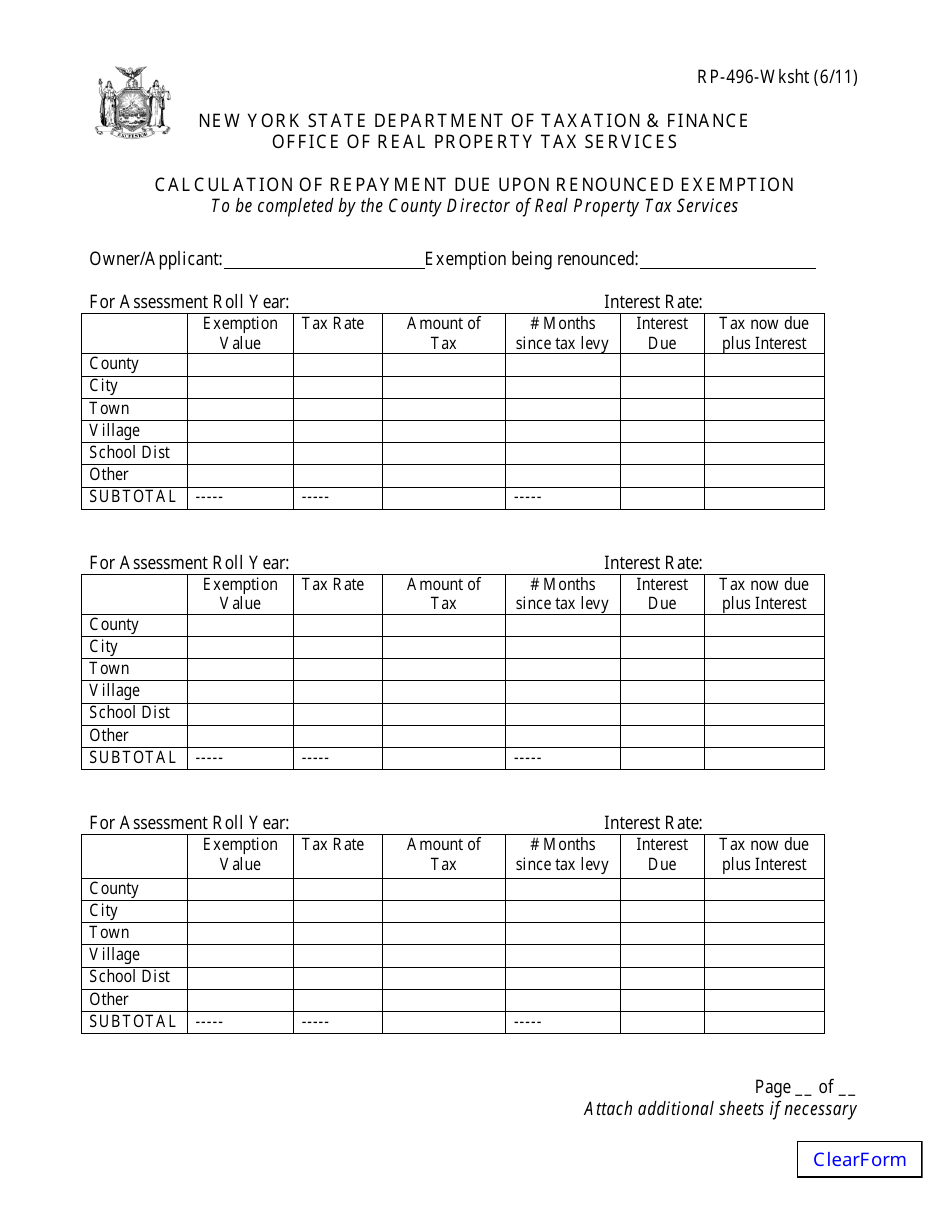

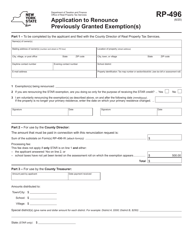

Form RP-496-Wksht Calculation of Repayment Due Upon Renounced Exemption - New York

What Is Form RP-496-Wksht?

This is a legal form that was released by the New York State Department of Taxation and Finance - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form RP-496-Wksht?

A: Form RP-496-Wksht is a worksheet used in New York to calculate the repayment due upon renounced exemption.

Q: What does Form RP-496-Wksht calculate?

A: Form RP-496-Wksht calculates the repayment amount that needs to be made when a tax exemption is renounced.

Q: When is Form RP-496-Wksht used?

A: Form RP-496-Wksht is used when a taxpayer renounces a previously claimed tax exemption in New York.

Q: Why would someone need to renounce a tax exemption?

A: Someone may need to renounce a tax exemption if they no longer qualify for the exemption or if they want to repay the benefits they received from the exemption.

Q: Is Form RP-496-Wksht specific to New York?

A: Yes, Form RP-496-Wksht is specific to New York and is used to calculate the repayment amount for renounced exemptions in the state.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the New York State Department of Taxation and Finance;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form RP-496-Wksht by clicking the link below or browse more documents and templates provided by the New York State Department of Taxation and Finance.