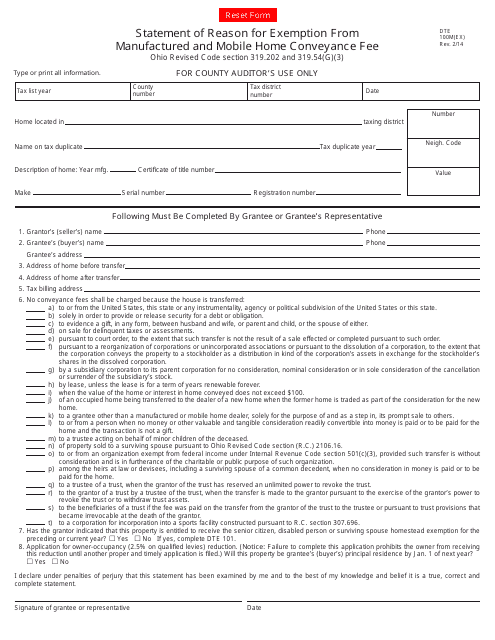

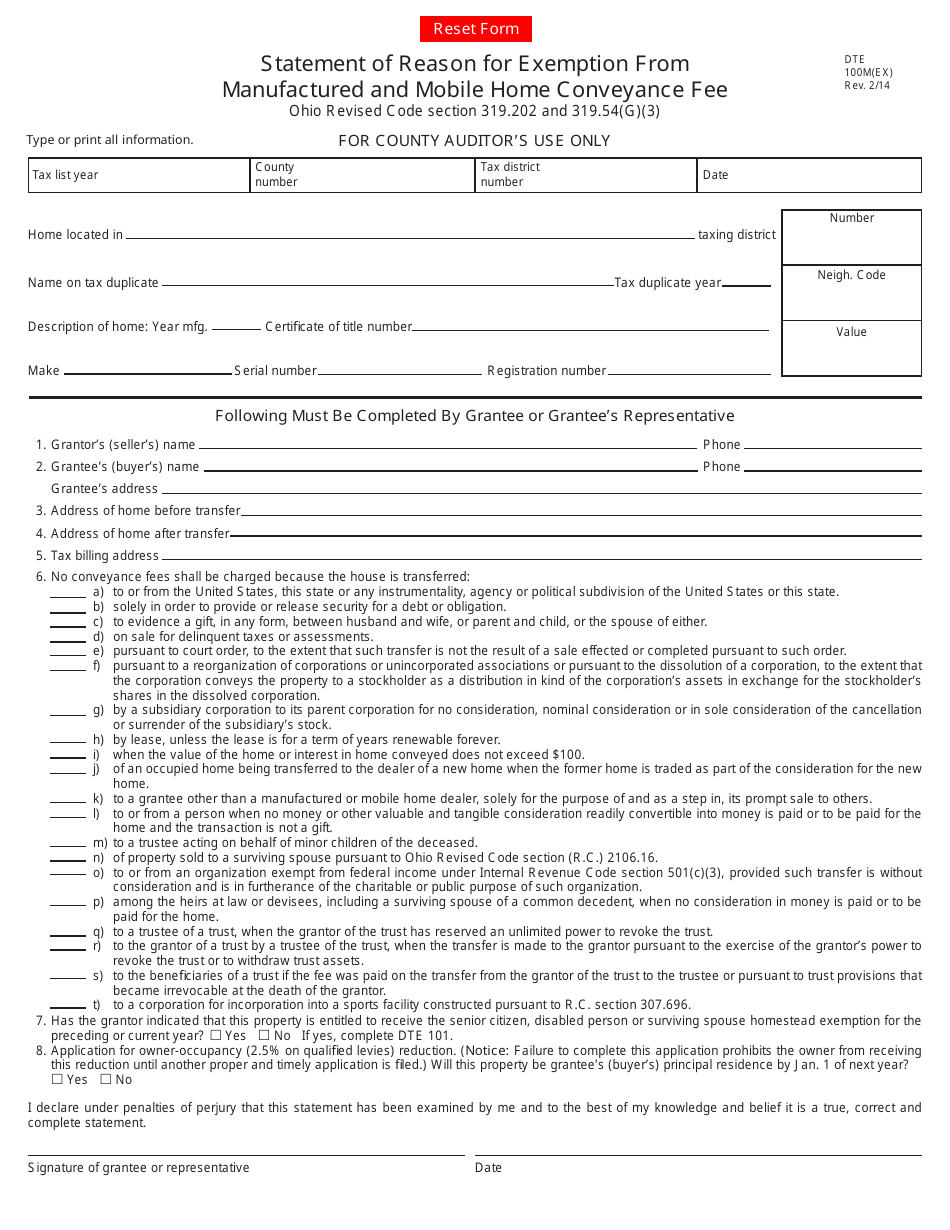

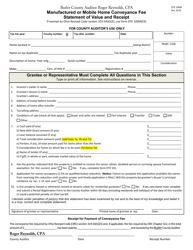

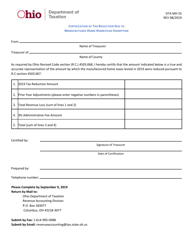

Form DTE100M(EX) Statement of Reason for Exemption From Manufactured and Mobile Home Conveyance Fee - Ohio

What Is Form DTE100M(EX)?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is DTE100M(EX)?

A: DTE100M(EX) is a form in Ohio used to apply for an exemption from the Manufactured and Mobile Home Conveyance Fee.

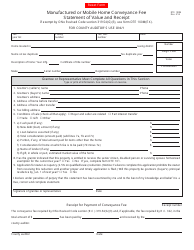

Q: What is the Manufactured and Mobile Home Conveyance Fee?

A: The Manufactured and Mobile Home Conveyance Fee is a fee imposed in Ohio on the sale or transfer of manufactured and mobile homes.

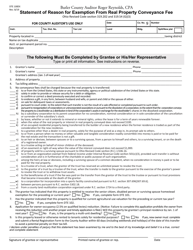

Q: Who can apply for an exemption from the fee?

A: Any individual or entity who meets the qualifying criteria can apply for an exemption from the Manufactured and Mobile Home Conveyance Fee.

Q: What is the purpose of the exemption?

A: The exemption is designed to provide relief from the fee for certain circumstances, such as transfers between family members or transfers due to divorce or inheritance.

Q: How can I apply for an exemption?

A: You can apply for an exemption by completing and submitting the DTE100M(EX) form.

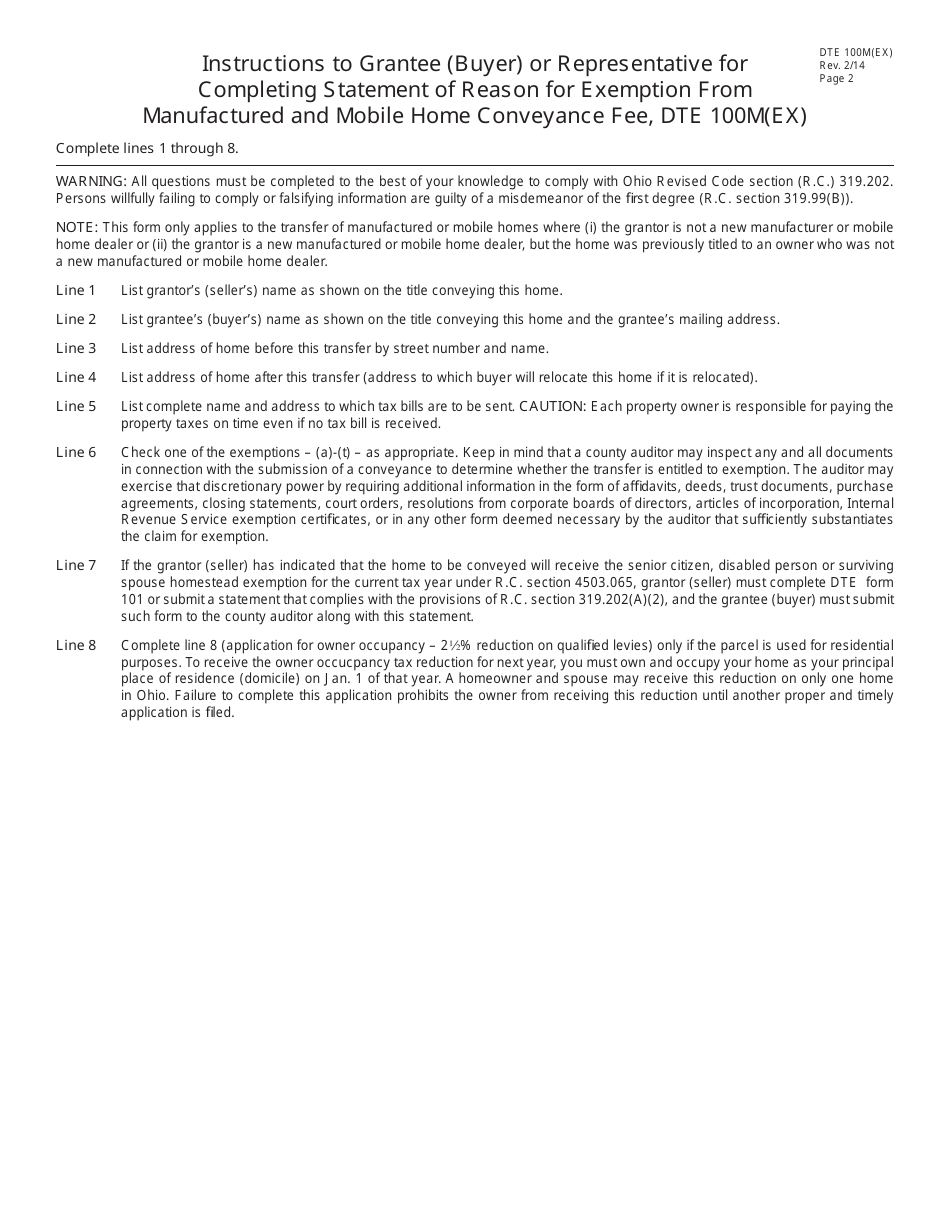

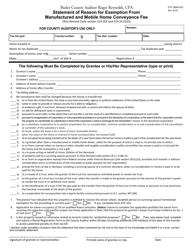

Q: What information is required on the form?

A: The form requires you to provide details about the property, the transaction, and the reason for the exemption.

Q: Are there any deadlines for submitting the form?

A: Yes, the form must be filed within 30 days of the date of the transfer of the manufactured or mobile home.

Q: What happens after I submit the form?

A: Once you submit the form, it will be reviewed by the Department of Taxation, and if approved, you will be exempted from paying the Manufactured and Mobile Home Conveyance Fee.

Q: What should I do if my exemption application is denied?

A: If your application is denied, you may appeal the decision by following the instructions provided by the Department of Taxation.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE100M(EX) by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.