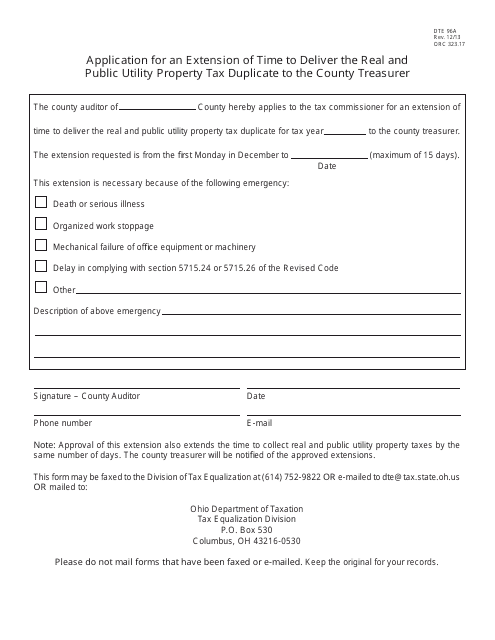

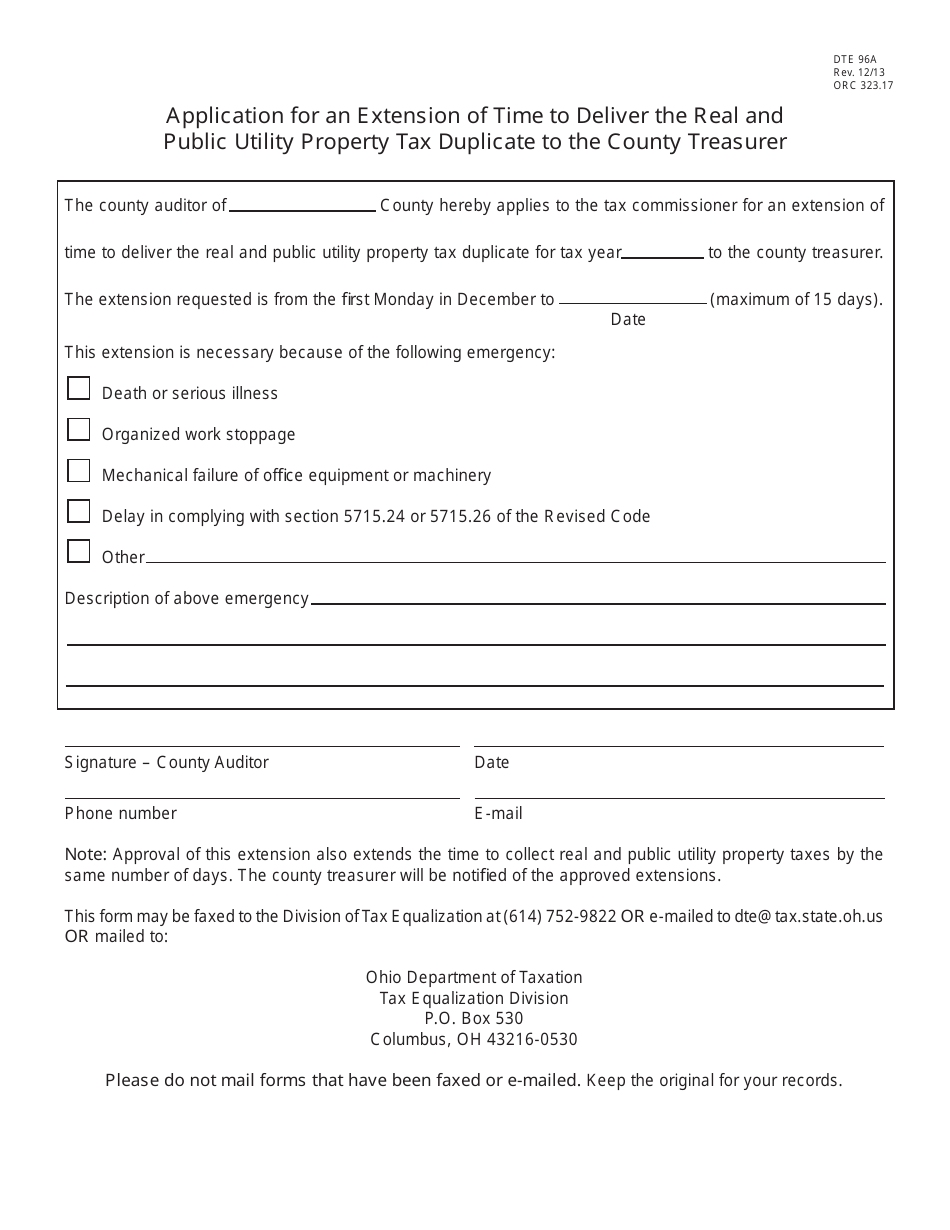

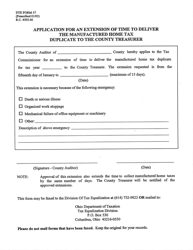

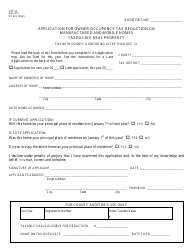

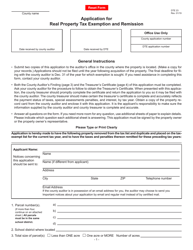

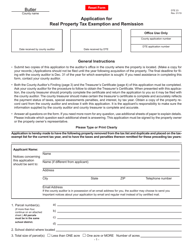

Form DTE96A Application for an Extension of Time to Deliver the Real and Public Utility Property Tax Duplicate to the County Treasurer - Ohio

What Is Form DTE96A?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE96A?

A: Form DTE96A is an application for an extension of time to deliver the real and public utility property tax duplicate to the County Treasurer in Ohio.

Q: Who needs to fill out Form DTE96A?

A: Any individual or business owner in Ohio who requires an extension of time to submit the real and public utility property tax duplicate to the County Treasurer needs to fill out Form DTE96A.

Q: What is the purpose of Form DTE96A?

A: The purpose of Form DTE96A is to request an extension of time to deliver the real and public utility property tax duplicate to the County Treasurer in Ohio.

Q: Is there a deadline to submit Form DTE96A?

A: Yes, Form DTE96A must be submitted before the original deadline for delivering the real and public utility property tax duplicate to the County Treasurer in Ohio.

Q: What happens if Form DTE96A is not submitted?

A: If Form DTE96A is not submitted, there may be penalties or late fees imposed by the County Treasurer in Ohio for failing to deliver the real and public utility property tax duplicate on time.

Form Details:

- Released on December 1, 2013;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTE96A by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.