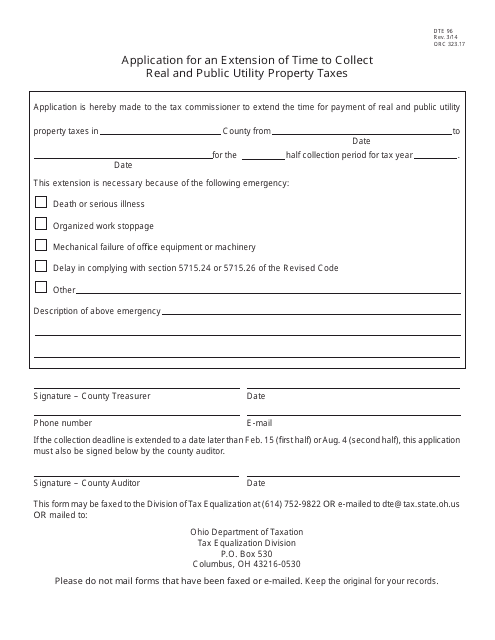

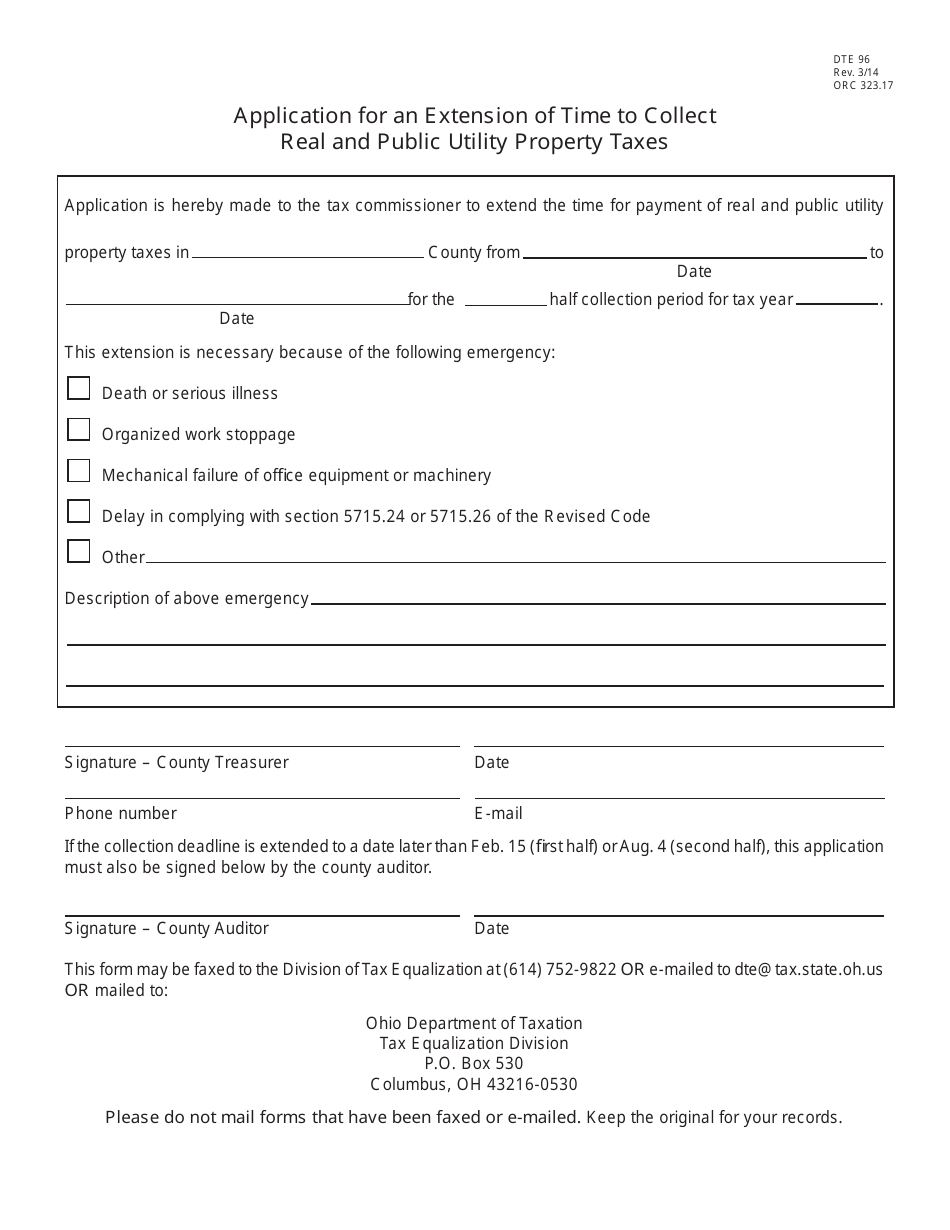

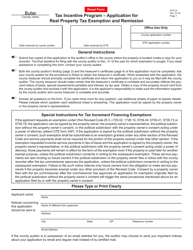

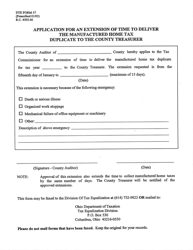

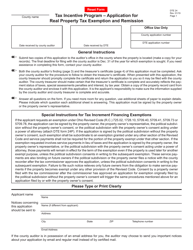

Form DTE96 Application for an Extension of Time to Collect Real and Public Utility Property Taxes - Ohio

What Is Form DTE96?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

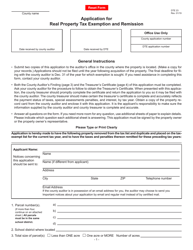

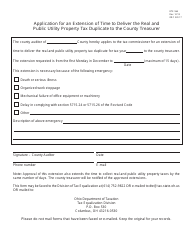

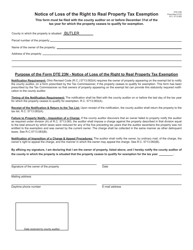

Q: What is Form DTE96?

A: Form DTE96 is an application for an extension of time to collect real and public utility property taxes in Ohio.

Q: Who can use Form DTE96?

A: Property owners in Ohio who need extra time to collect real and public utility property taxes can use Form DTE96.

Q: What is the purpose of Form DTE96?

A: The purpose of Form DTE96 is to request an extension of time to collect real and public utility property taxes in Ohio.

Q: When should I submit Form DTE96?

A: You should submit Form DTE96 as soon as possible, but no later than the due date for real and public utility property taxes in Ohio.

Q: Is there a fee for submitting Form DTE96?

A: No, there is no fee for submitting Form DTE96.

Q: Who should I contact for assistance with Form DTE96?

A: If you need assistance with Form DTE96, you can contact the Ohio Department of Taxation or your local county auditor's office.

Form Details:

- Released on March 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DTE96 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.