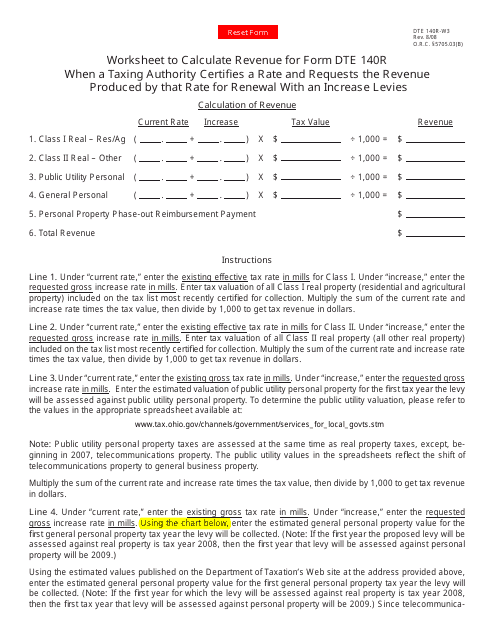

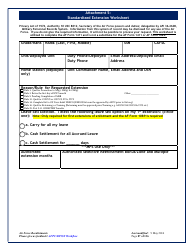

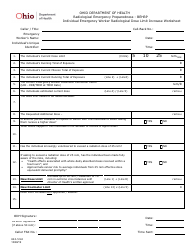

Form DTE140R-W3 140r Worksheet for Renewal With an Increase Levies - Ohio

What Is Form DTE140R-W3?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140R-W3?

A: Form DTE140R-W3 is a worksheet for renewal with an increase in levies in the state of Ohio.

Q: What is the purpose of Form DTE140R-W3?

A: The purpose of Form DTE140R-W3 is to provide a worksheet for schools and local governments in Ohio to calculate the necessary levy amounts for renewal and increase.

Q: Who needs to fill out Form DTE140R-W3?

A: Schools and local governments in Ohio that are seeking to renew levies with an increase need to fill out Form DTE140R-W3.

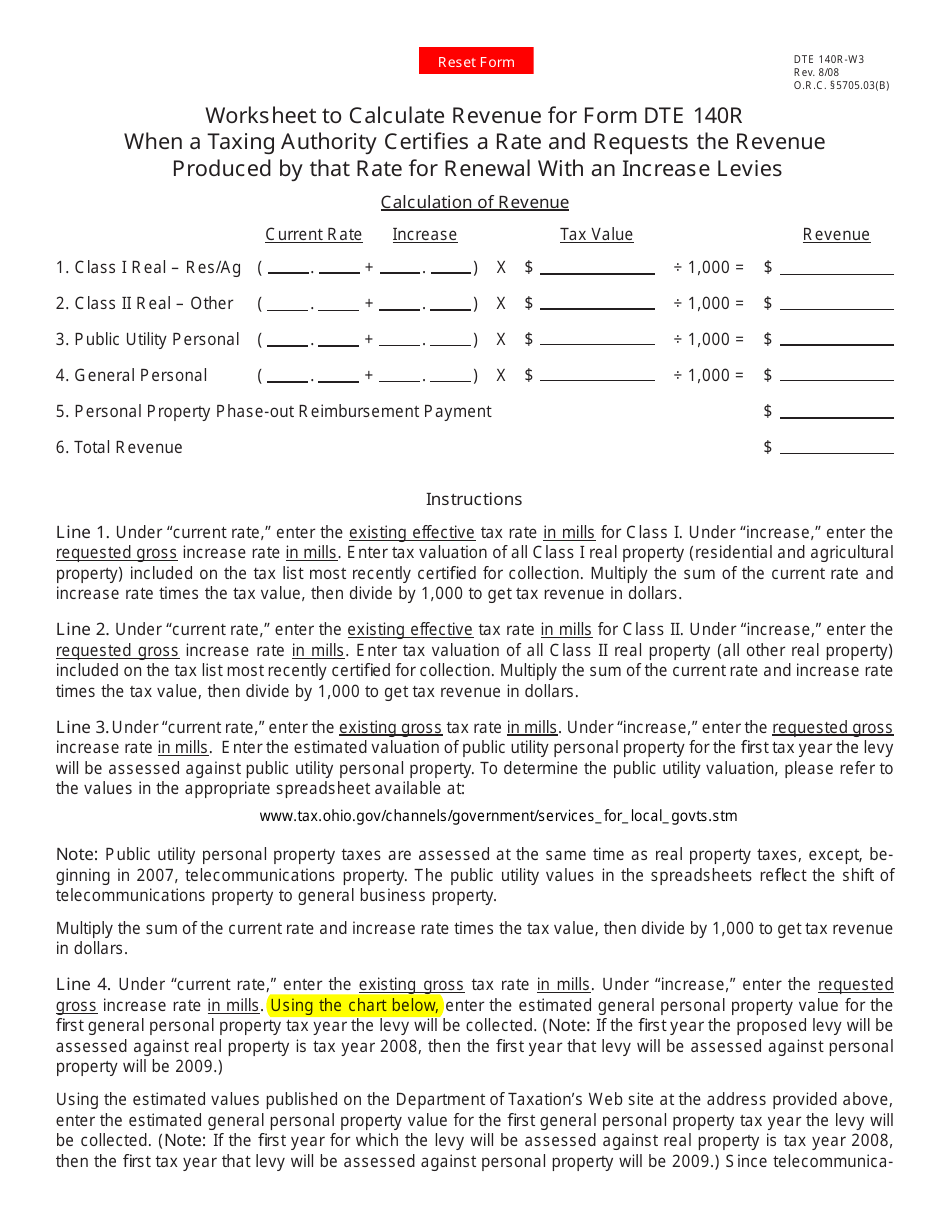

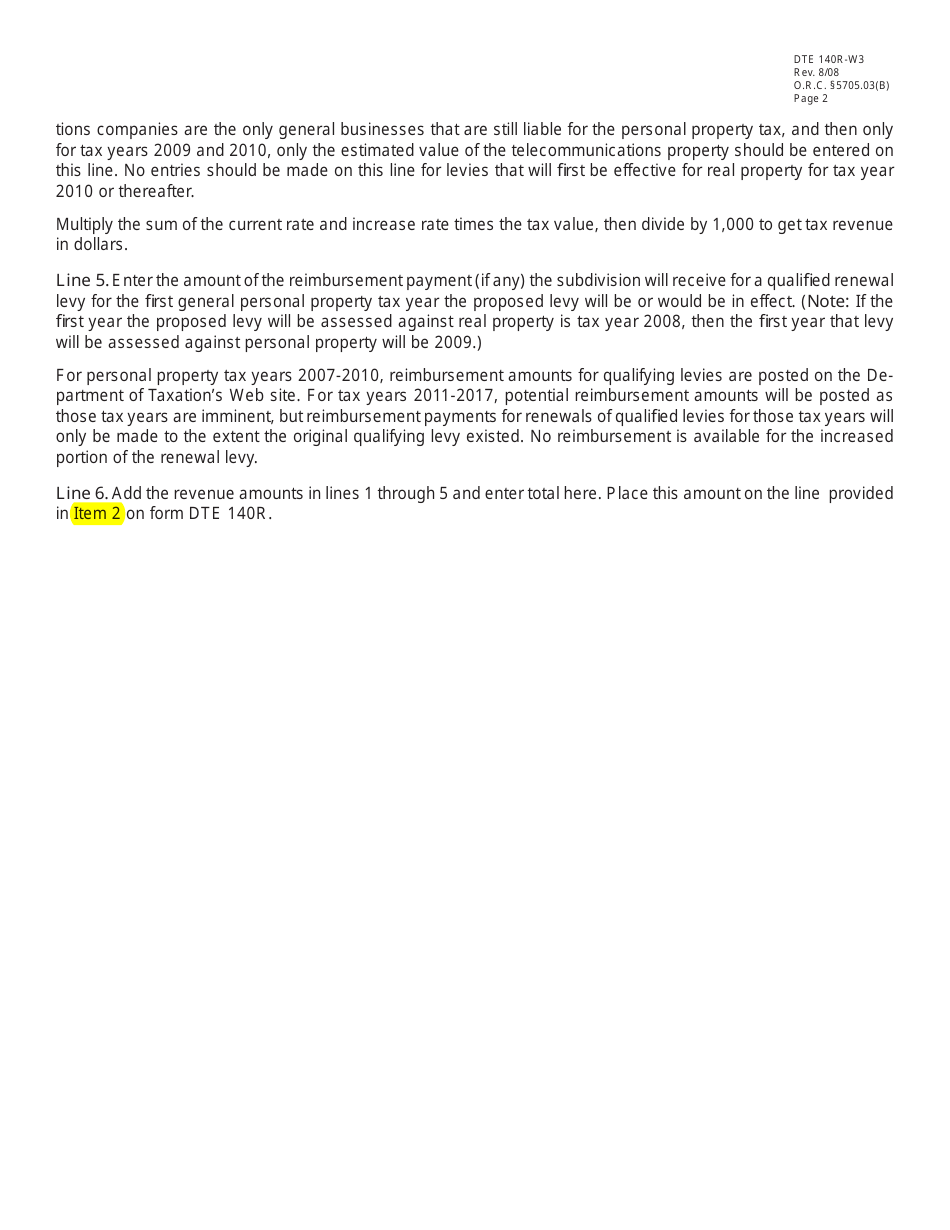

Q: What information is required on Form DTE140R-W3?

A: Form DTE140R-W3 requires information about the levy to be renewed and increased, such as the current year's revenue, the desired increase amount, and any anticipated changes in valuation or collections.

Q: Are there any deadlines for submitting Form DTE140R-W3?

A: Yes, there are specific deadlines for submitting Form DTE140R-W3. These deadlines can vary depending on the type of levy and the election cycle. It is recommended to consult the Ohio Department of Taxation or a tax professional for the specific deadlines.

Q: Is there any fee associated with submitting Form DTE140R-W3?

A: There is no fee associated with submitting Form DTE140R-W3.

Q: What should I do after filling out Form DTE140R-W3?

A: After filling out Form DTE140R-W3, you should submit it to the appropriate tax office in Ohio for review and processing.

Q: Who can I contact for more information about Form DTE140R-W3?

A: For more information about Form DTE140R-W3, you can contact the Ohio Department of Taxation or consult a tax professional.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140R-W3 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.