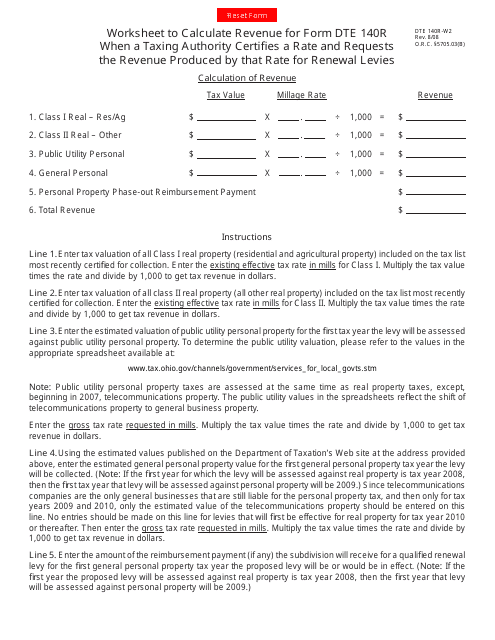

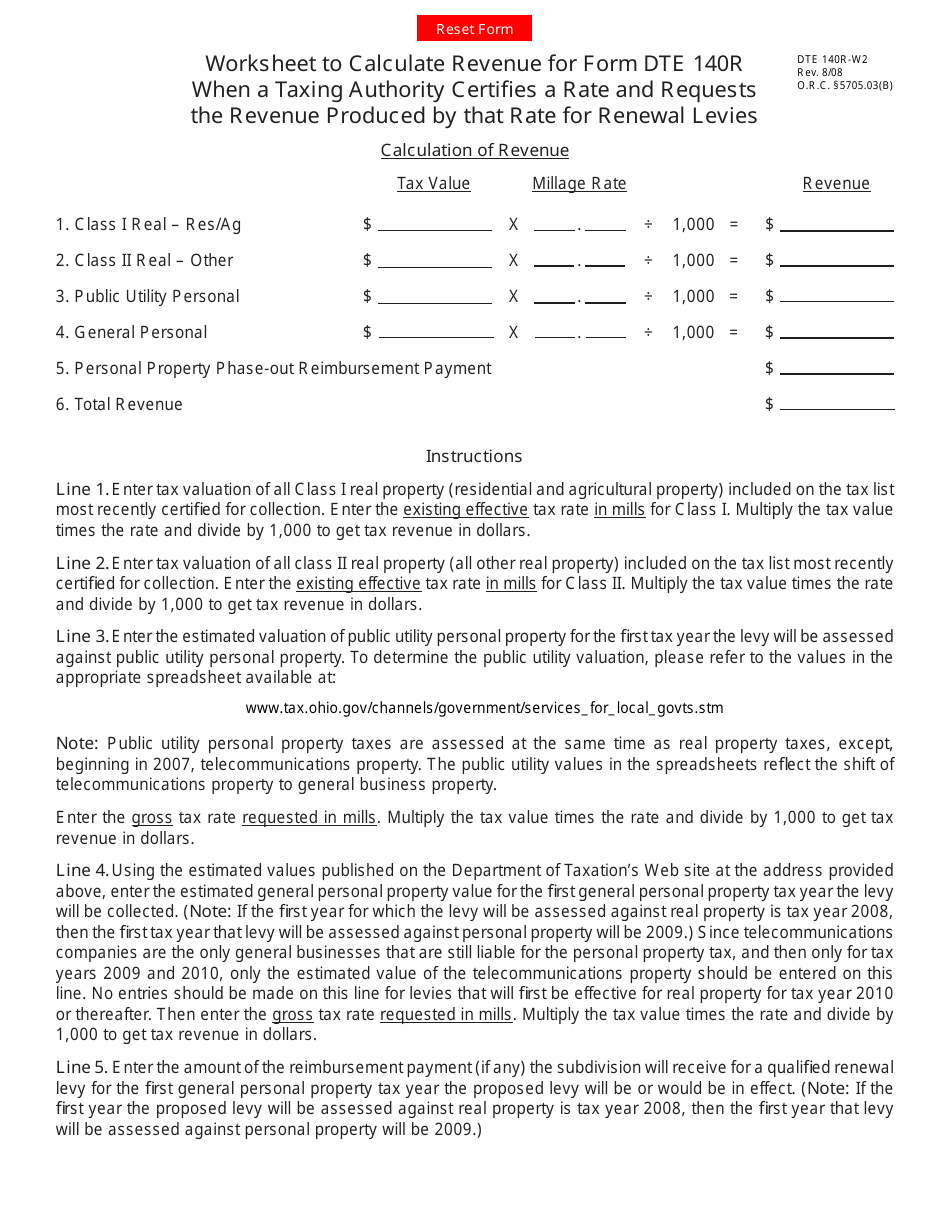

Form DTE140R-W2 140r Worksheet for Renewal Levies - Ohio

What Is Form DTE140R-W2?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the DTE140R-W2 form?

A: The DTE140R-W2 form is a worksheet for renewal levies in Ohio.

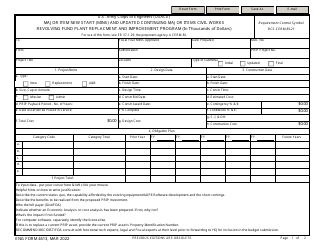

Q: What is the purpose of the DTE140R-W2 form?

A: The purpose of the DTE140R-W2 form is to calculate the amount of revenue that will be generated from a renewal levy.

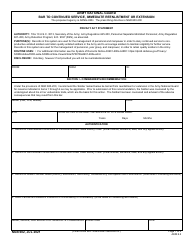

Q: Who needs to fill out the DTE140R-W2 form?

A: The DTE140R-W2 form needs to be filled out by the jurisdiction or taxing authority requesting the renewal levy.

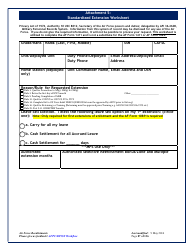

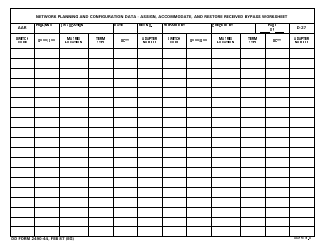

Q: What information is required on the DTE140R-W2 form?

A: The DTE140R-W2 form requires information such as the current millage rate, estimated assessed valuation, and likely exemptions.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140R-W2 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.