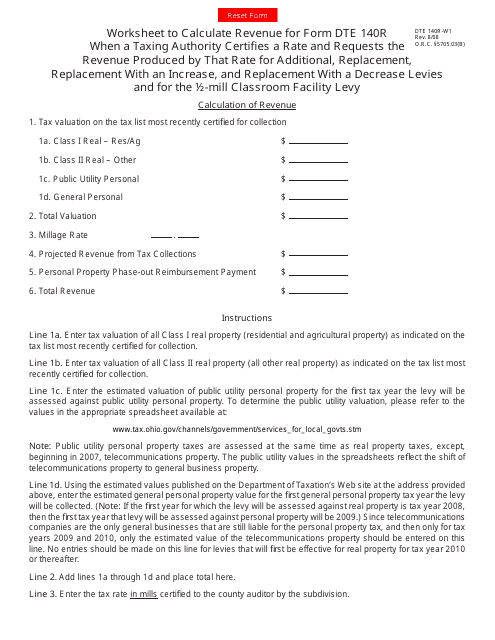

Form DTE140R-W1 140r Worksheet for Additional, Replacement, Replacement With an Increase and Replacement With a Decrease Levies and 1 / 2-mill Classroom Facility Levy - Ohio

What Is Form DTE140R-W1?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE140R-W1?

A: Form DTE140R-W1 is a worksheet for additional, replacement, replacement with an increase, and replacement with a decrease levies and 1/2-mill classroom facility levy in Ohio.

Q: What is the purpose of Form DTE140R-W1?

A: Form DTE140R-W1 is used to calculate and report levies and the 1/2-mill classroom facility levy.

Q: What types of levies are covered in Form DTE140R-W1?

A: Form DTE140R-W1 covers additional levies, replacement levies, replacement levies with an increase, and replacement levies with a decrease.

Q: What is the 1/2-mill classroom facility levy?

A: The 1/2-mill classroom facility levy is a specific type of levy for funding classroom facilities in Ohio.

Q: Who needs to use Form DTE140R-W1?

A: Anyone who is responsible for calculating and reporting levies and the 1/2-mill classroom facility levy in Ohio needs to use Form DTE140R-W1.

Q: Are there any specific instructions for completing Form DTE140R-W1?

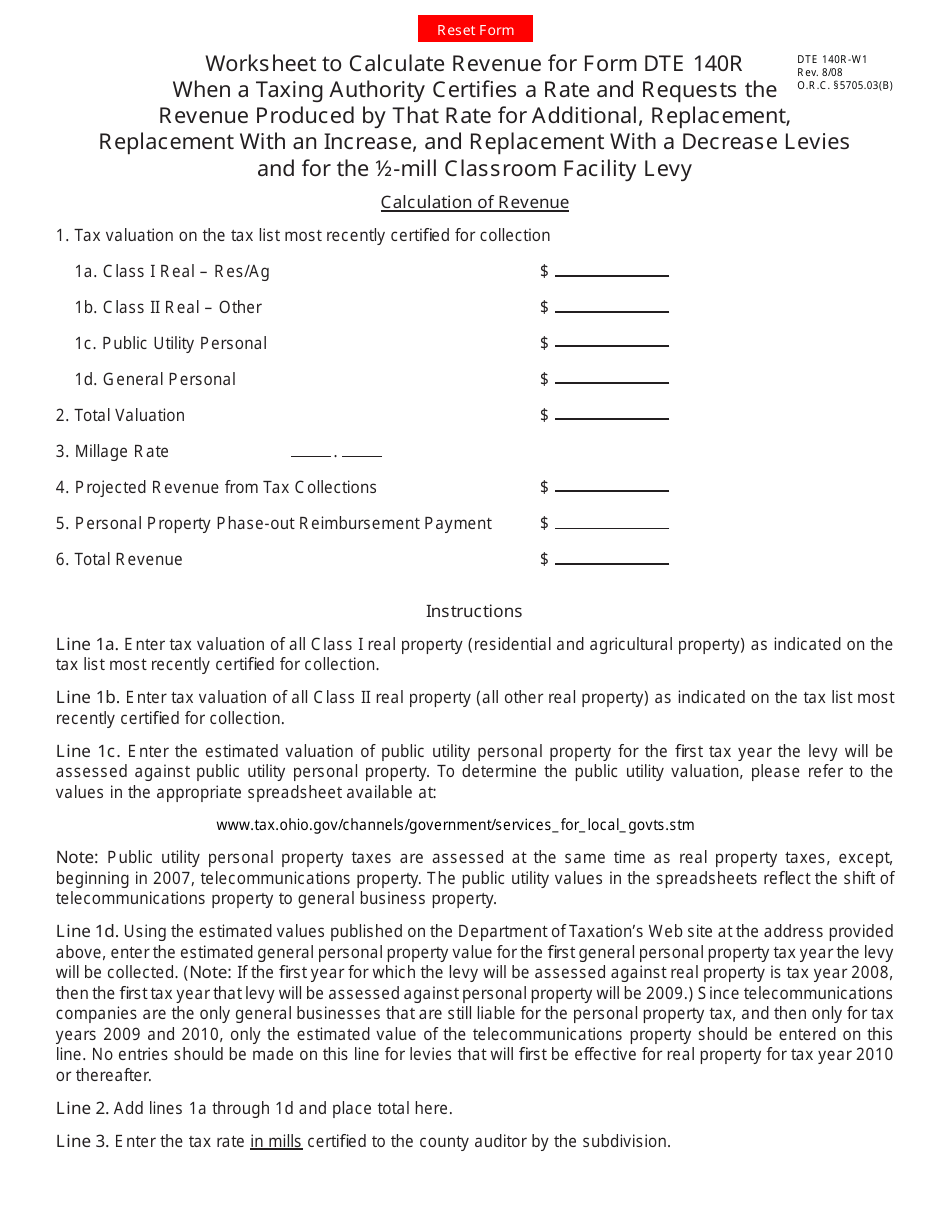

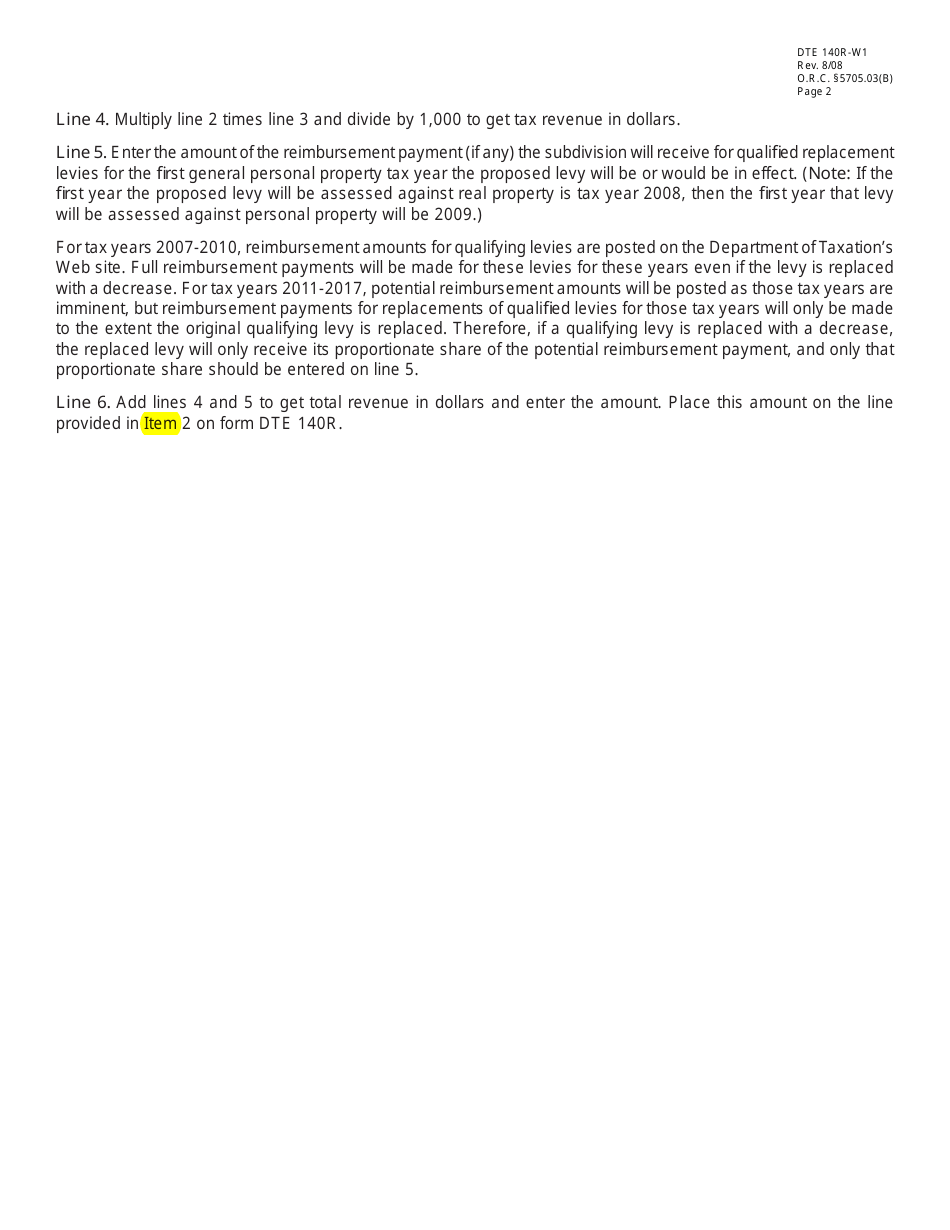

A: Yes, detailed instructions for completing Form DTE140R-W1 can be found on the form itself or in the accompanying documentation provided by the Ohio Department of Taxation.

Form Details:

- Released on August 1, 2008;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE140R-W1 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.