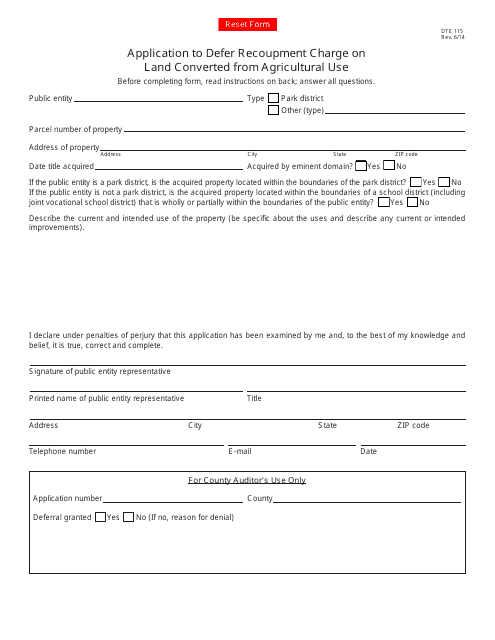

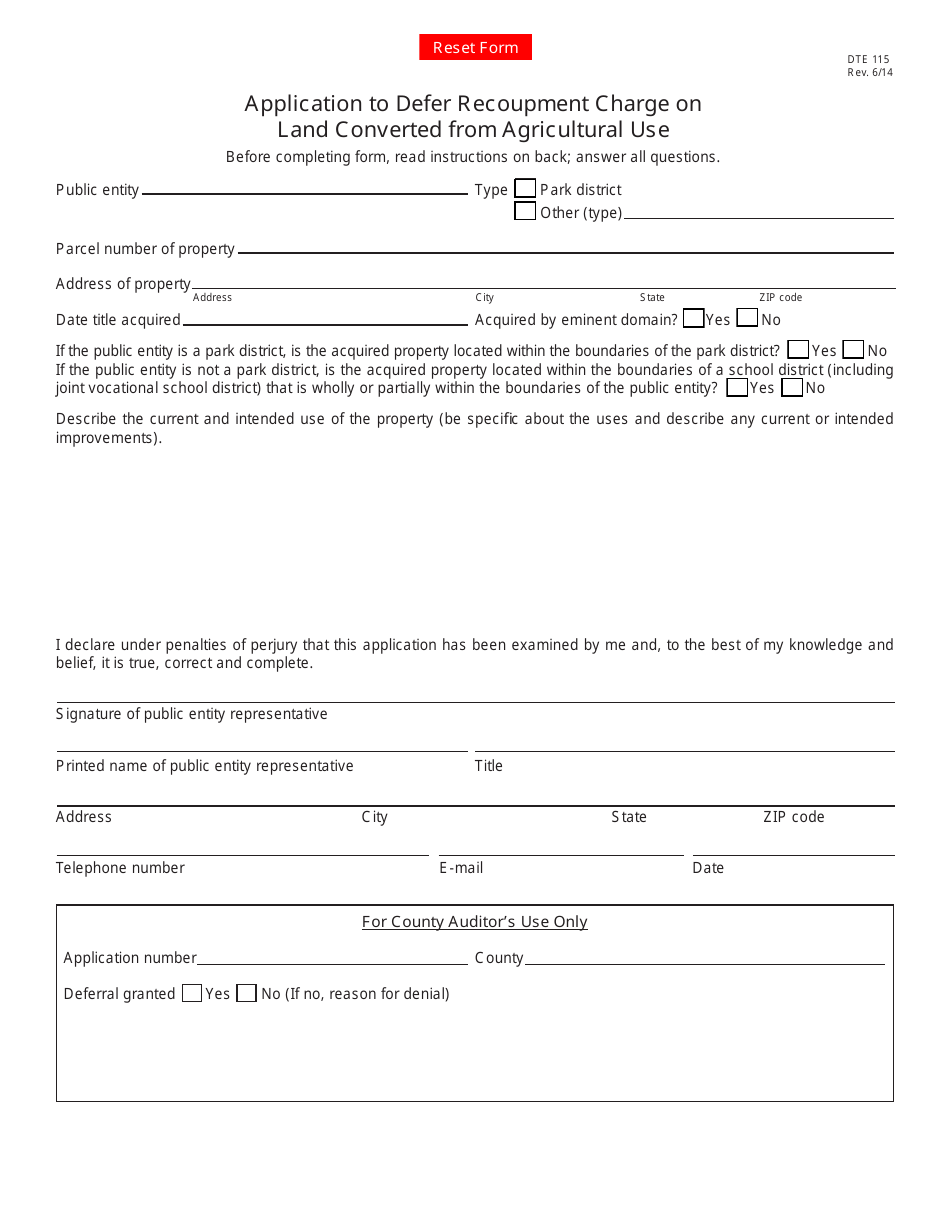

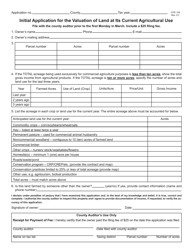

Form DTE115 Application to Defer Recoupment Charge on Land Converted From Agricultural Use - Ohio

What Is Form DTE115?

This is a legal form that was released by the Ohio Department of Taxation - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DTE115?

A: Form DTE115 is an application to defer recoupment charge on land converted from agricultural use in Ohio.

Q: Who can use Form DTE115?

A: Landowners in Ohio who have converted their land from agricultural use can use Form DTE115 to apply for the deferral of recoupment charges.

Q: What is a recoupment charge?

A: A recoupment charge is a fee imposed on landowners in Ohio who convert their agricultural land to a non-agricultural use.

Q: What is the purpose of deferring recoupment charges?

A: The purpose of deferring recoupment charges is to provide financial relief to landowners who have converted their agricultural land and may face financial difficulties in paying the charges immediately.

Q: Are there any eligibility requirements for the deferral of recoupment charges?

A: Yes, to be eligible for the deferral, the land must meet certain requirements and the landowner must meet specific criteria outlined in the application form.

Q: What is the deadline for submitting Form DTE115?

A: The deadline for submitting Form DTE115 varies and is based on the date the recoupment charge notice is issued. It is important to check the notice for specific deadlines.

Q: Can I appeal if my application for the deferral of recoupment charges is denied?

A: Yes, if your application is denied, you have the right to appeal the decision. It is recommended to consult with a tax professional or legal advisor for assistance with the appeals process.

Q: What happens if I do not pay the recoupment charges or my application for deferral is denied?

A: If you do not pay the recoupment charges or your application for deferral is denied, you may be subject to penalties and/or interest on the unpaid charges. It is important to comply with the requirements or seek professional advice.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Ohio Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DTE115 by clicking the link below or browse more documents and templates provided by the Ohio Department of Taxation.