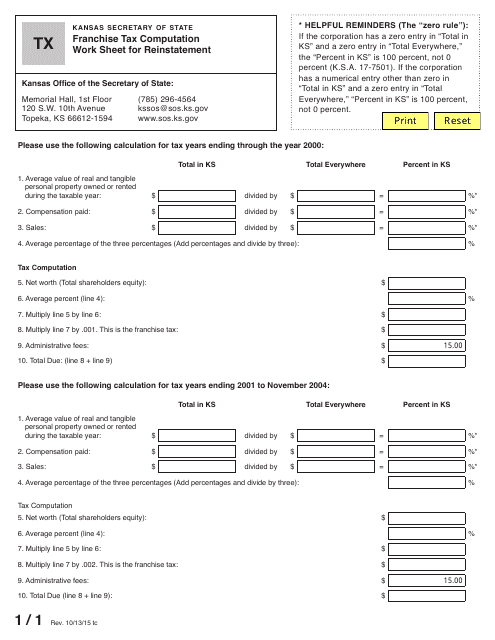

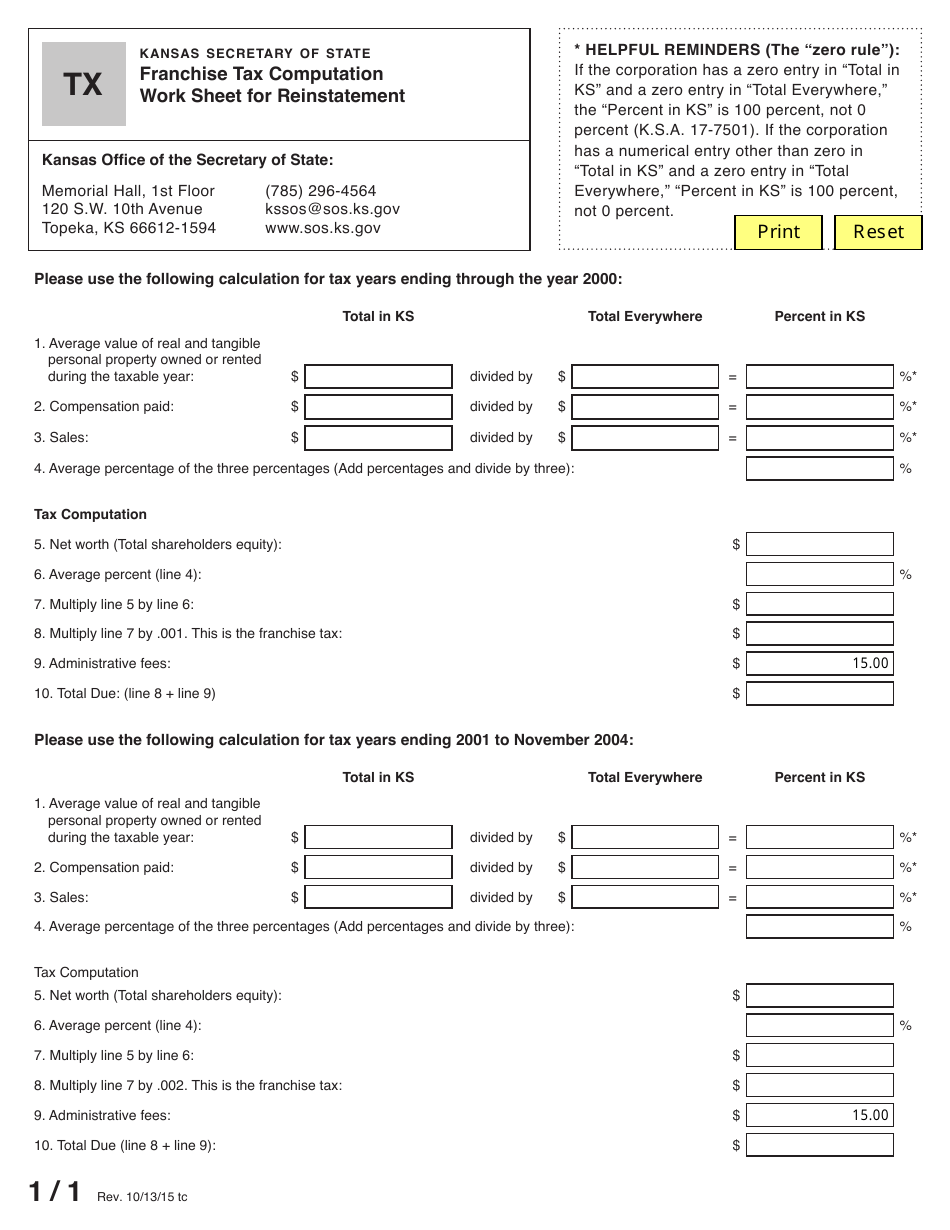

Form TX Franchise Tax Computation Work Sheet for Reinstatement - Kansas

What Is Form TX?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: The Form TX Franchise Tax Computation Work Sheet for Reinstatement is a document used in Kansas.

Q: What is the purpose of the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: The purpose of this form is to calculate the franchise tax due for reinstatement in Kansas.

Q: Who must complete the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: Any business or corporation that needs to reinstate its franchise tax in Kansas must complete this form.

Q: When is the deadline for filing the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: The deadline for filing this form varies depending on the specific circumstances. It is recommended to consult the Kansas Department of Revenue or a tax professional for accurate information.

Q: What happens if I don't file the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: Failure to file this form may result in penalties or other consequences as determined by the Kansas Department of Revenue.

Q: Are there any specific instructions for completing the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: Yes, the form comes with detailed instructions that should be followed carefully to ensure accurate completion.

Q: Can I seek professional assistance in completing the Form TX Franchise Tax Computation Work Sheet for Reinstatement?

A: Yes, it is recommended to seek the help of a tax professional or an accountant to ensure accurate completion of this form.

Form Details:

- Released on October 13, 2015;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form TX by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.