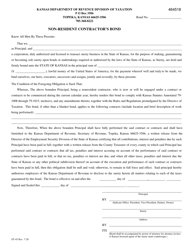

This version of the form is not currently in use and is provided for reference only. Download this version of

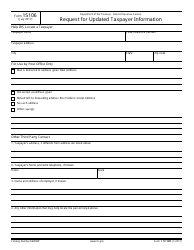

Form ST-44

for the current year.

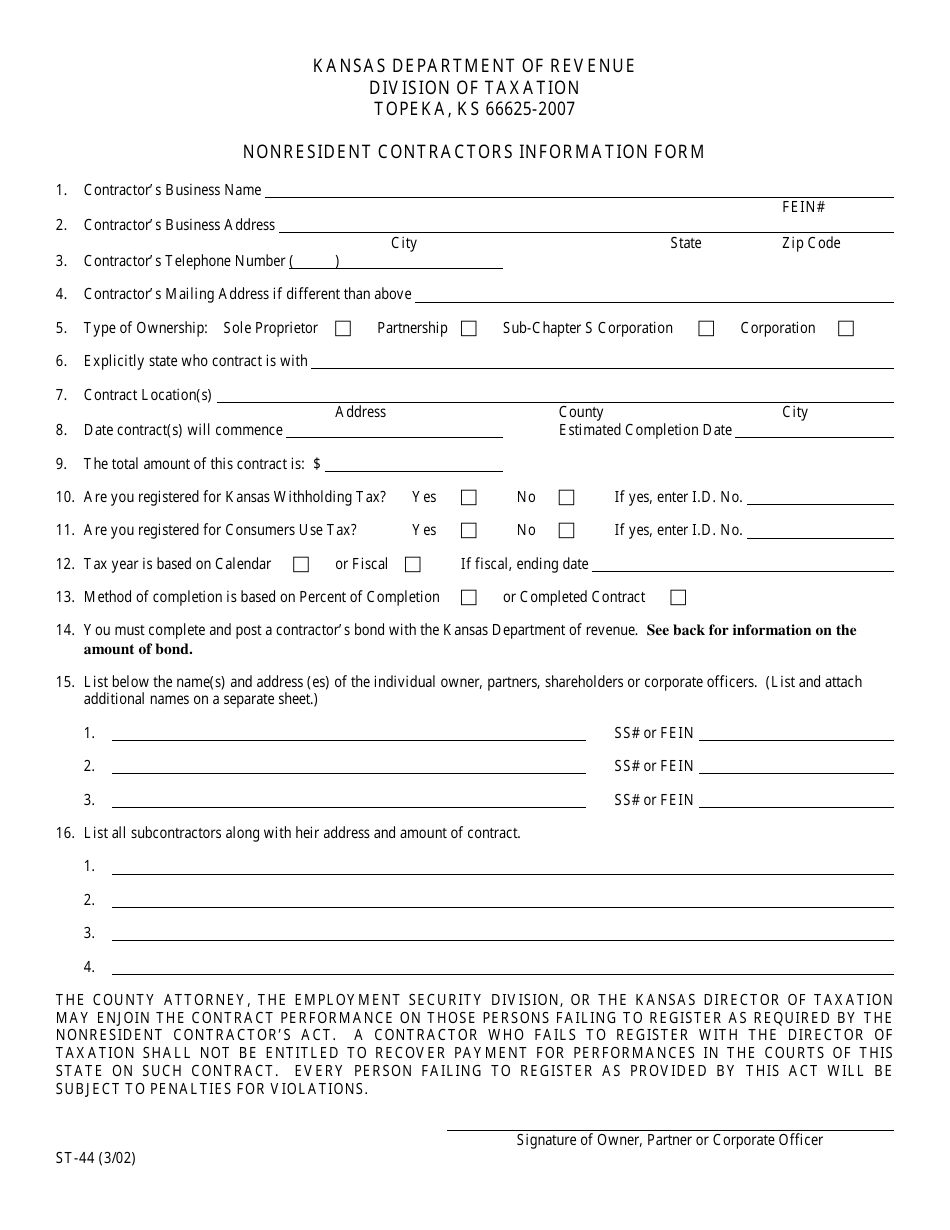

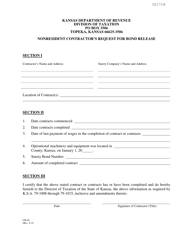

Form ST-44 Nonresident Contractors Information Form - Kansas

What Is Form ST-44?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-44?

A: Form ST-44 is the Nonresident Contractors Information Form in Kansas.

Q: Who needs to fill out Form ST-44?

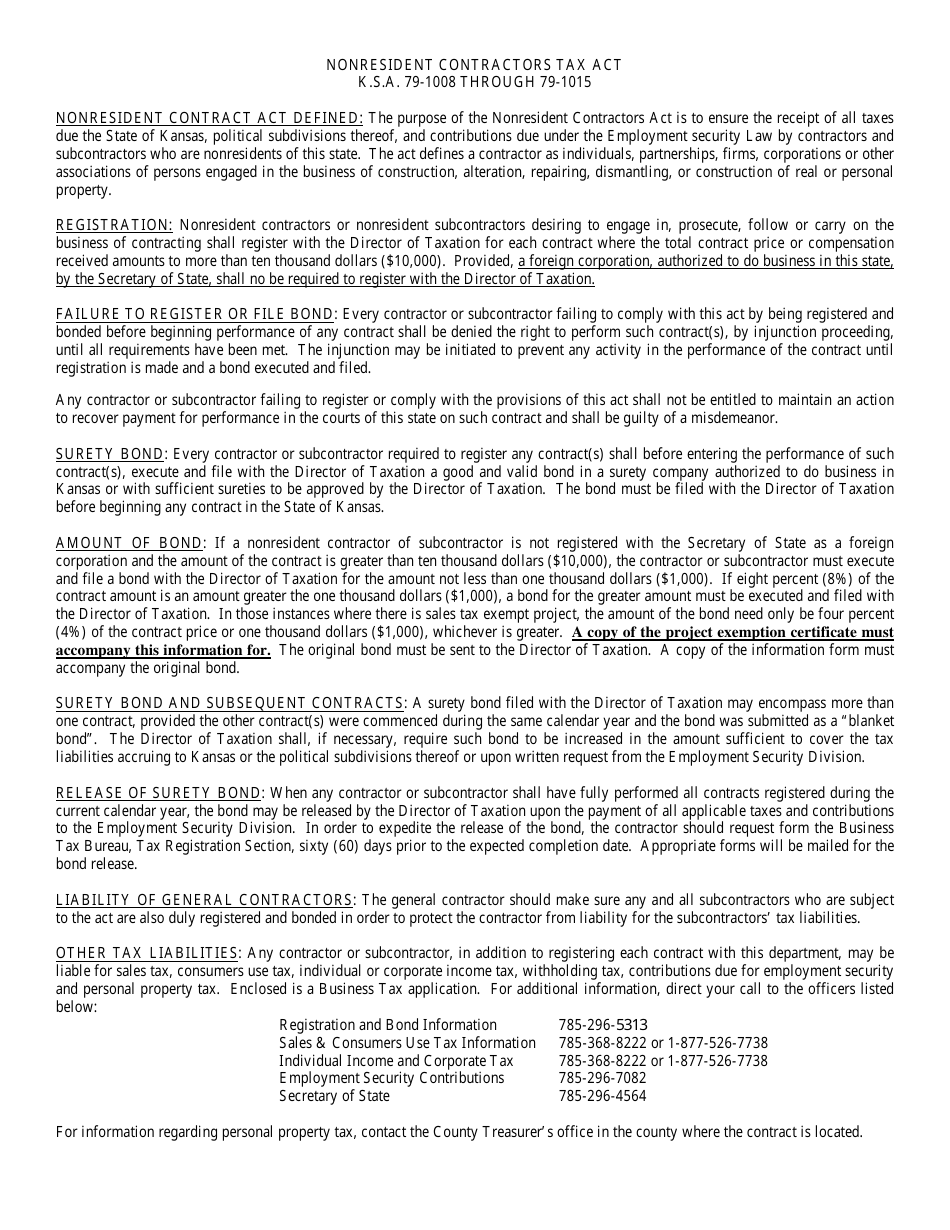

A: Nonresident contractors who perform services in Kansas need to fill out Form ST-44.

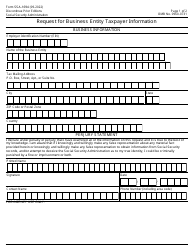

Q: What information is required on Form ST-44?

A: Form ST-44 requires information about the nonresident contractor, the services performed in Kansas, and the amount of income earned in Kansas.

Q: When is Form ST-44 due?

A: Form ST-44 is due on or before the last day of the fourth month following the close of the contractor's fiscal year.

Q: What happens if I don't file Form ST-44?

A: Failure to file Form ST-44 or filing an incorrect or incomplete form may result in penalties or other enforcement actions by the Kansas Department of Revenue.

Form Details:

- Released on March 1, 2002;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-44 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.