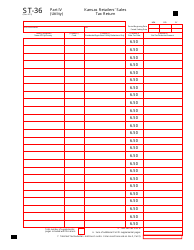

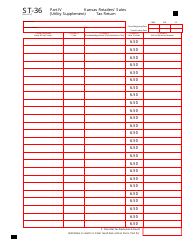

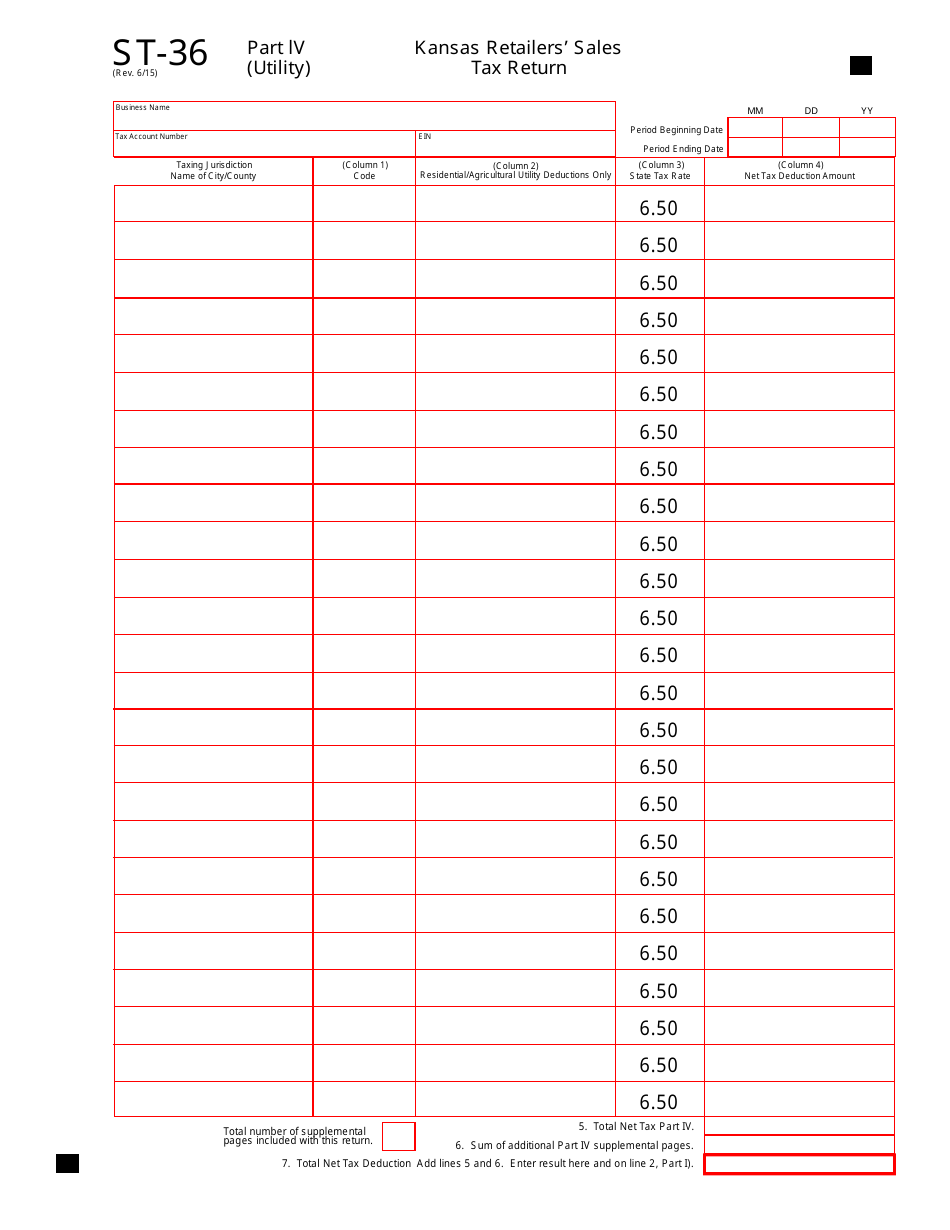

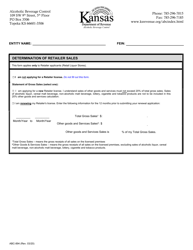

Form ST-36 Kansas Retailers' Sales Tax Return - Part IV - Utility Companies Supplement - Kansas

What Is Form ST-36?

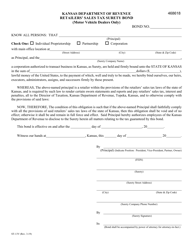

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-36?

A: Form ST-36 is the Kansas Retailers' Sales Tax Return.

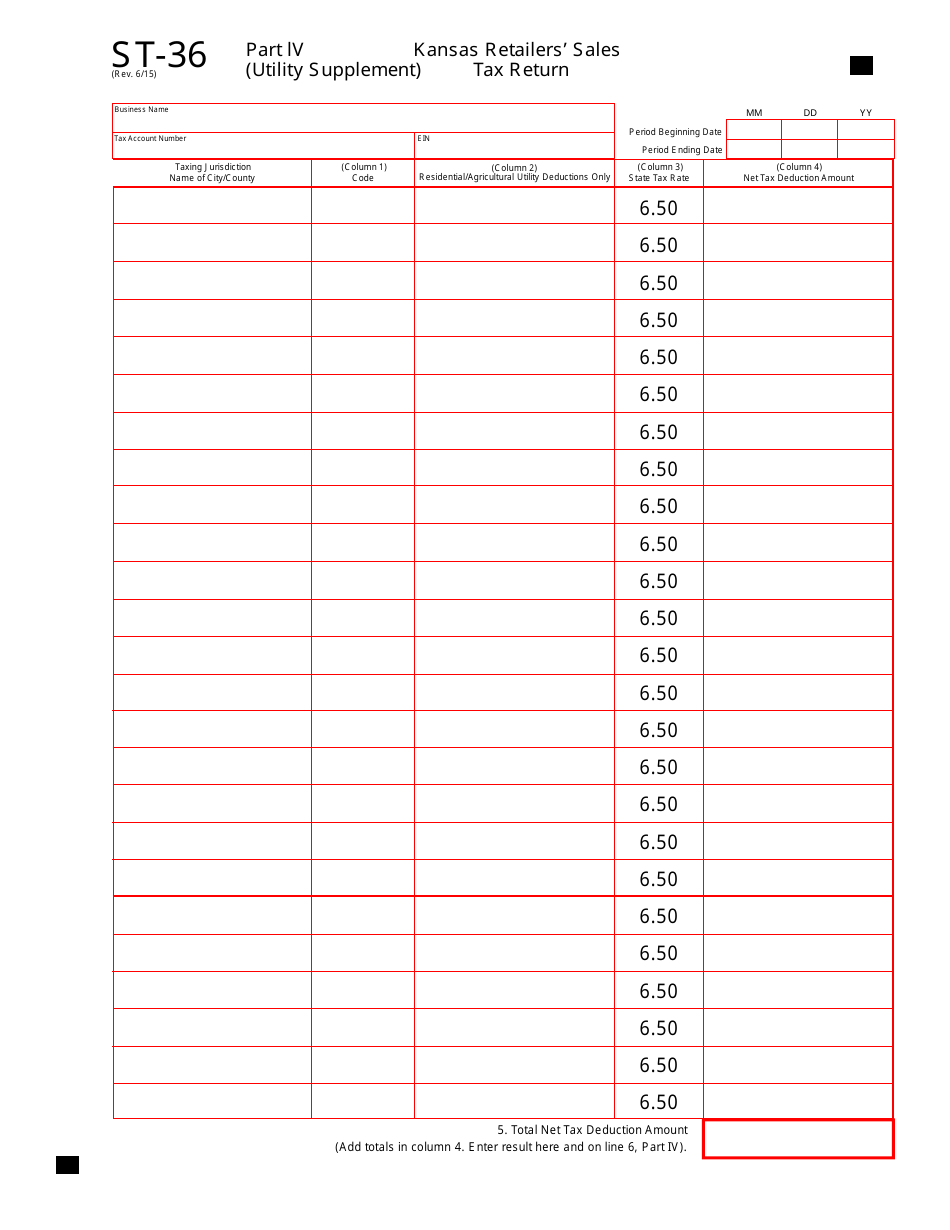

Q: What is the purpose of Part IV of Form ST-36?

A: Part IV of Form ST-36 is the Utility Companies Supplement, which is specific to utility companies in Kansas.

Q: Who needs to complete Part IV of Form ST-36?

A: Utility companies in Kansas need to complete Part IV of Form ST-36.

Q: What information is required in Part IV of Form ST-36?

A: Part IV of Form ST-36 requires utility companies to provide specific details related to their sales tax liabilities.

Q: Why is the Utility Companies Supplement necessary?

A: The Utility Companies Supplement is necessary to accurately calculate and report sales tax liabilities for utility companies in Kansas.

Form Details:

- Released on June 1, 2015;

- The latest edition provided by the Kansas Department of Revenue;

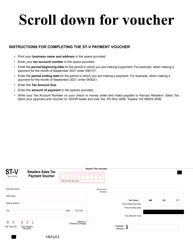

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-36 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.