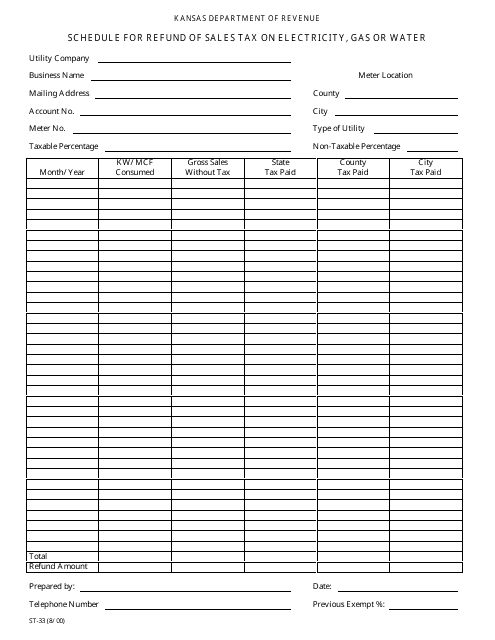

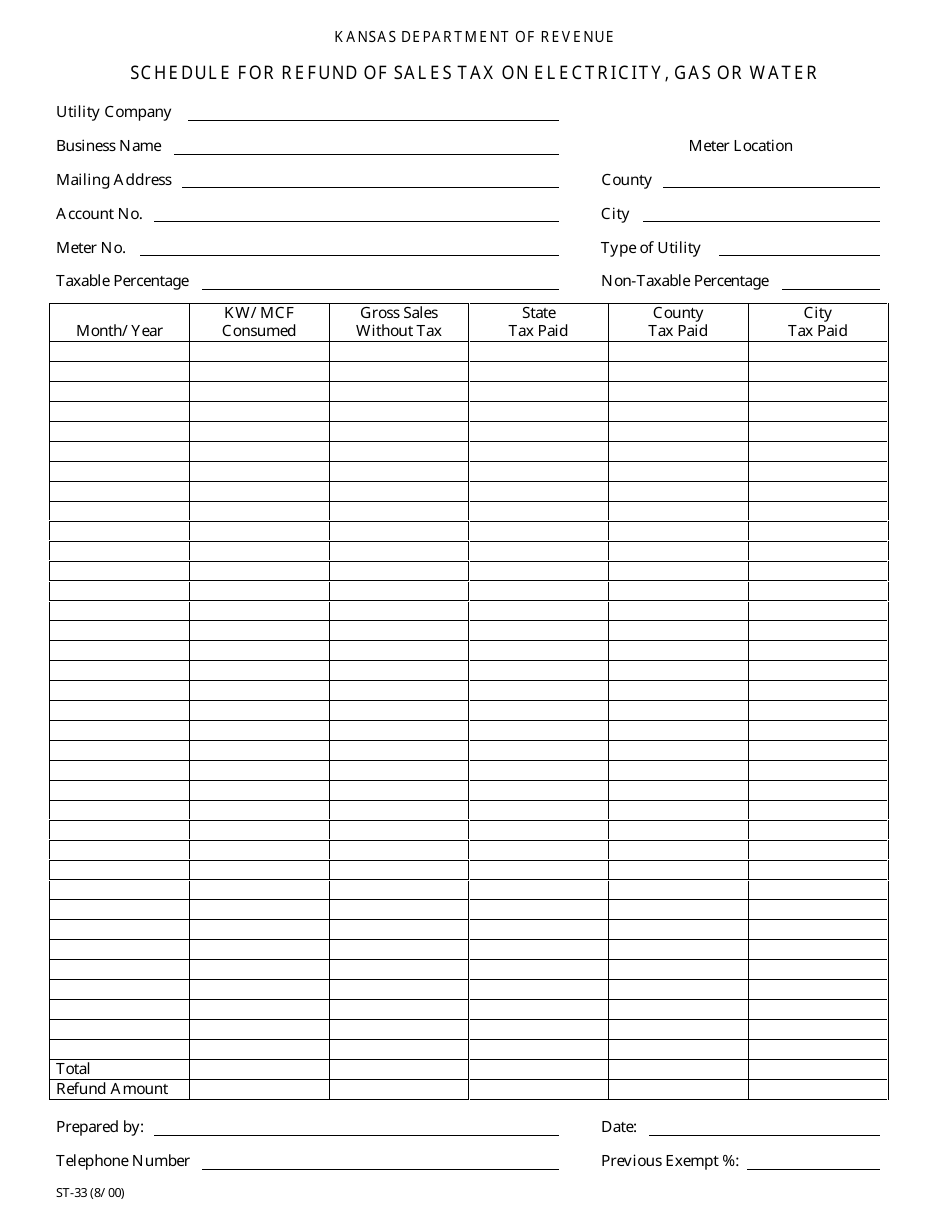

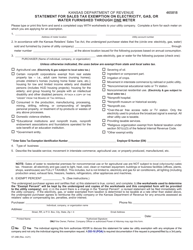

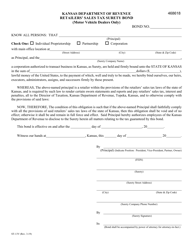

Form ST-33 Schedule for Refund of Sales Tax on Electricity, Gas or Water - Kansas

What Is Form ST-33?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-33 Schedule for Refund of Sales Tax on Electricity, Gas or Water?

A: Form ST-33 Schedule is a form used in Kansas to claim a refund for sales tax paid on electricity, gas, or water.

Q: Who can use Form ST-33 Schedule?

A: Any individual, business, or organization in Kansas that has paid sales tax on electricity, gas, or water can use Form ST-33 Schedule.

Q: What is the purpose of Form ST-33 Schedule?

A: The purpose of Form ST-33 Schedule is to request a refund for sales tax paid on electricity, gas, or water in Kansas.

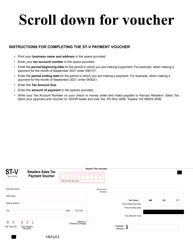

Q: What information do I need to complete Form ST-33 Schedule?

A: To complete Form ST-33 Schedule, you will need information about the amount of sales tax paid, the account number, and the period for which the refund is being claimed.

Q: Is there a deadline for submitting Form ST-33 Schedule?

A: Yes, Form ST-33 Schedule must be submitted within three years from the date of payment of the sales tax.

Q: Are there any fees associated with filing Form ST-33 Schedule?

A: No, there are no fees associated with filing Form ST-33 Schedule for refund of sales tax on electricity, gas, or water.

Q: How long does it take to receive a refund after submitting Form ST-33 Schedule?

A: The processing time for refunds requested through Form ST-33 Schedule may vary, but the Kansas Department of Revenue strives to process refunds as quickly as possible.

Q: Can I amend Form ST-33 Schedule if I made a mistake?

A: Yes, if you made a mistake on Form ST-33 Schedule after it has been filed, you can file an amended form to correct the error.

Form Details:

- Released on August 1, 2000;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-33 by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.