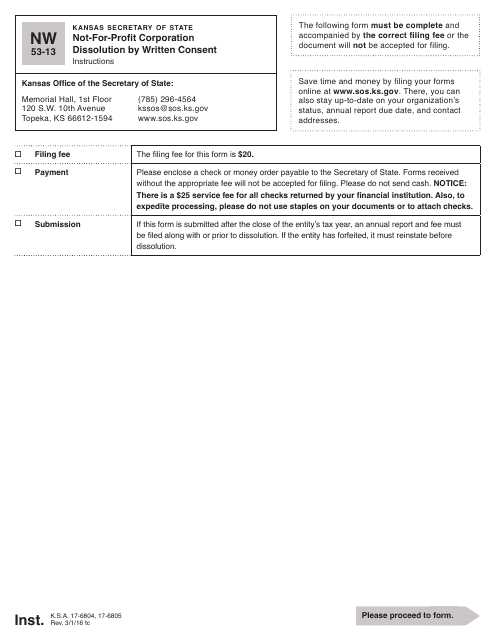

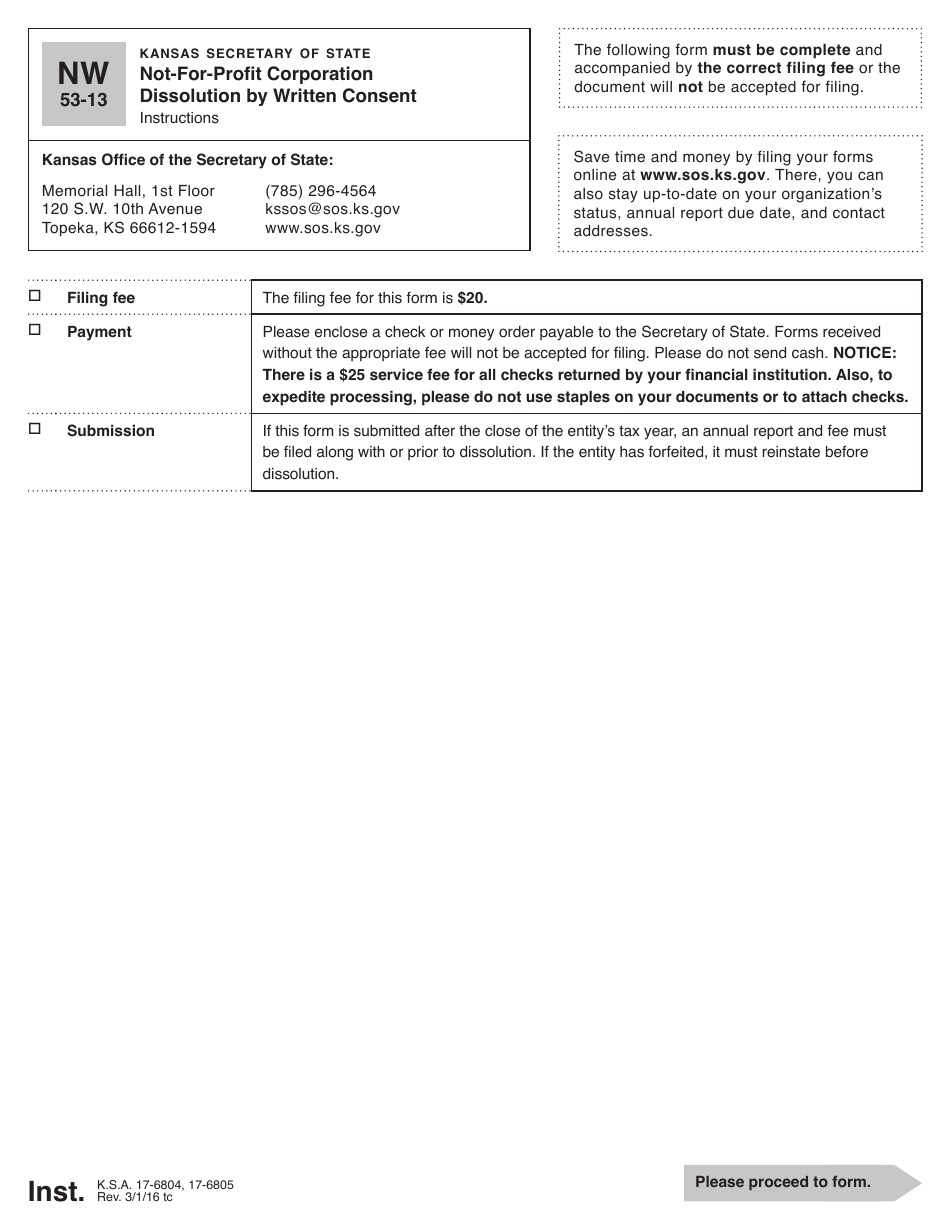

Form NW53-13 Not-For-Profit Corporation Dissolution by Written Consent - Kansas

What Is Form NW53-13?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NW53-13?

A: Form NW53-13 is a document used for the dissolution of a not-for-profit corporation by written consent in the state of Kansas.

Q: What is the purpose of Form NW53-13?

A: The purpose of Form NW53-13 is to officially dissolve a not-for-profit corporation in Kansas.

Q: Who needs to file Form NW53-13?

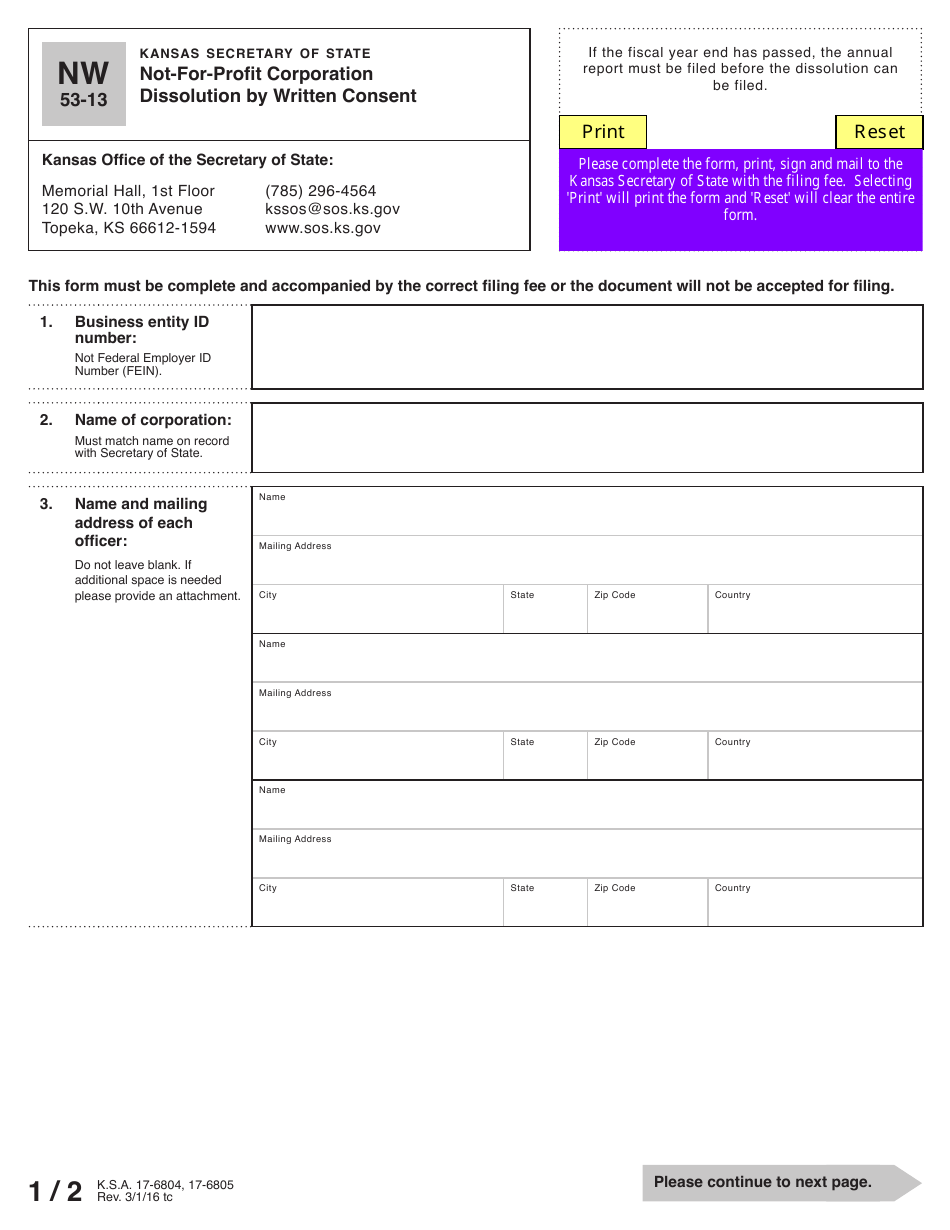

A: The board of directors or governing body of a not-for-profit corporation in Kansas need to file Form NW53-13 to dissolve the corporation.

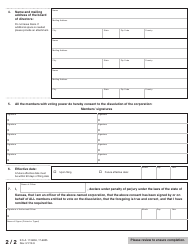

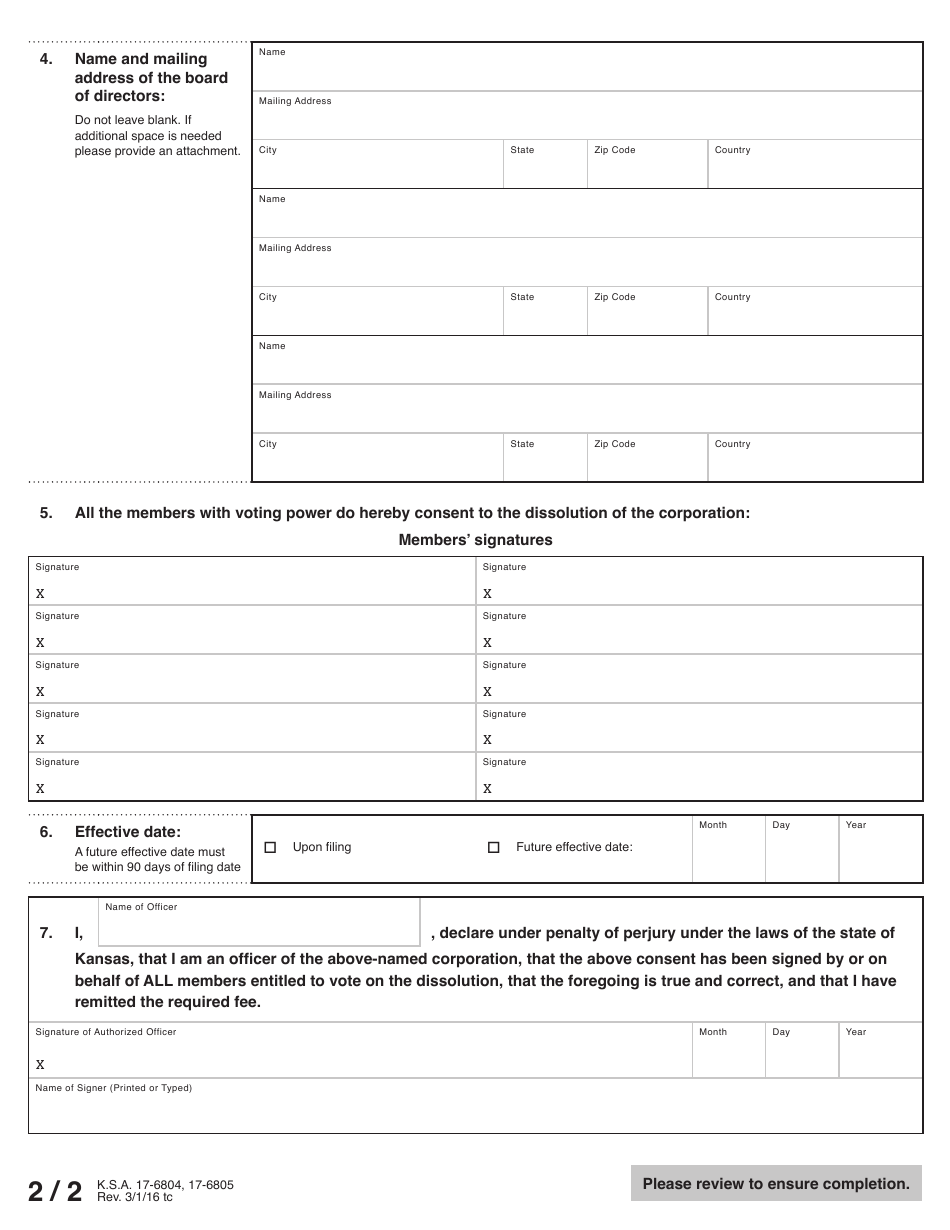

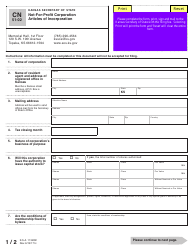

Q: What information is required in Form NW53-13?

A: Form NW53-13 requires information such as the name and address of the corporation, the date of the written consent, and the signatures of the directors or governing body.

Q: What happens after filing Form NW53-13?

A: After filing Form NW53-13 and paying the required fee, the not-for-profit corporation will be officially dissolved in Kansas.

Q: Are there any additional requirements to dissolve a not-for-profit corporation?

A: In addition to filing Form NW53-13, a not-for-profit corporation may need to fulfill any outstanding obligations, such as filing tax returns or closing bank accounts.

Q: Can I reinstate a dissolved not-for-profit corporation?

A: Yes, under certain circumstances, a dissolved not-for-profit corporation can be reinstated by filing the appropriate forms and paying any necessary fees.

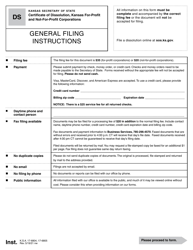

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NW53-13 by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.