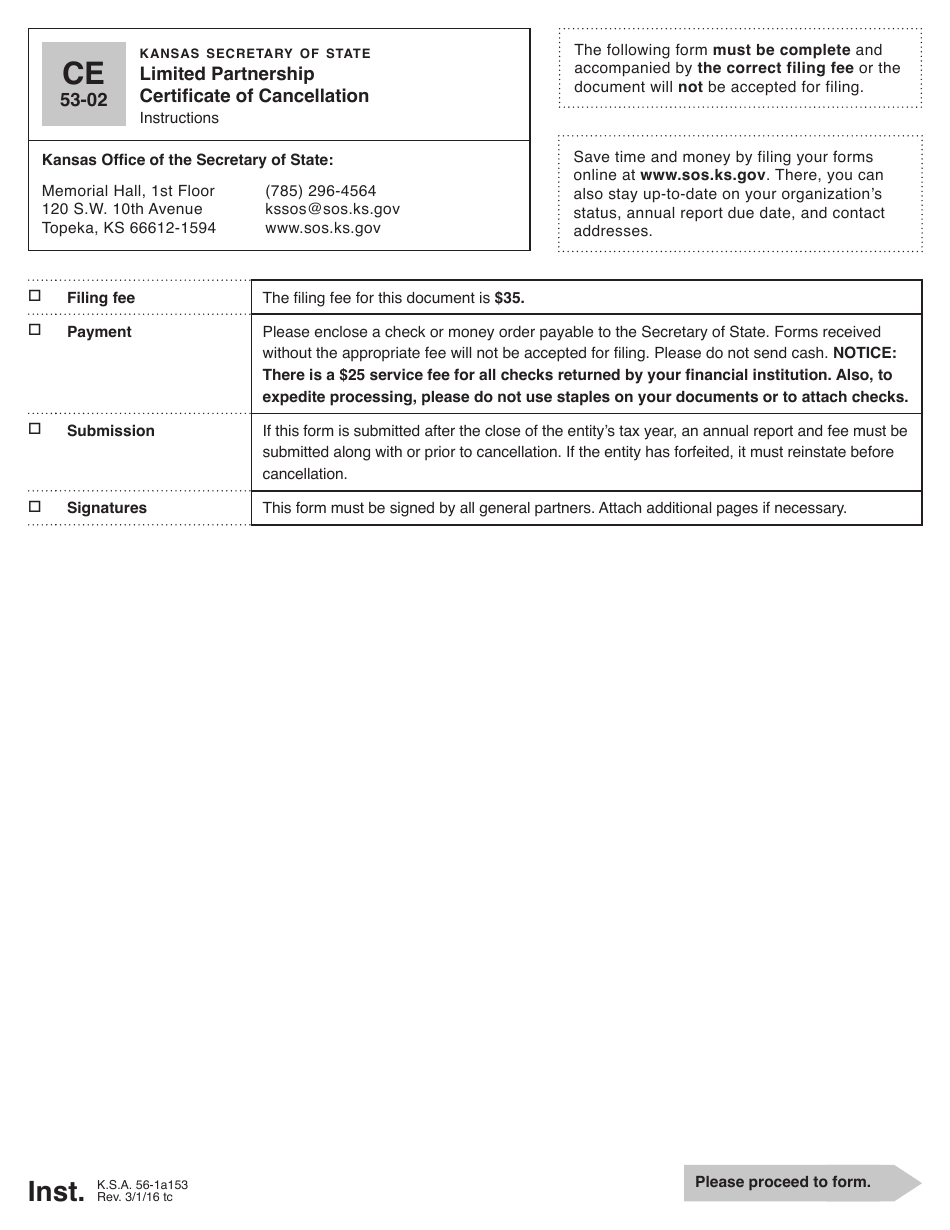

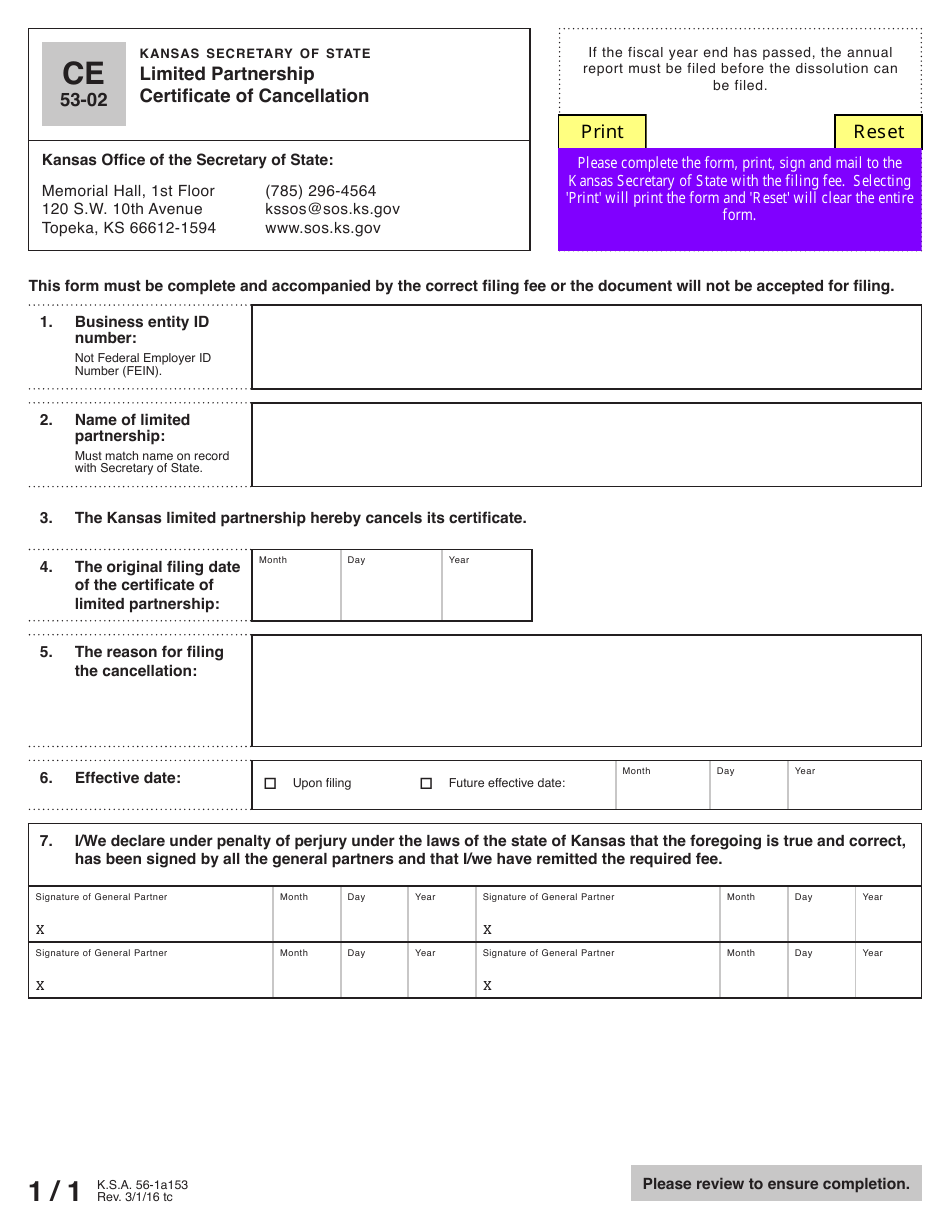

Form CE53-02 Limited Partnership Certificate of Cancellation - Kansas

What Is Form CE53-02?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CE53-02?

A: Form CE53-02 is the Limited Partnership Certificate of Cancellation specific to Kansas.

Q: What is a limited partnership?

A: A limited partnership is a type of business structure that has both general partners, who have unlimited liability, and limited partners, who have limited liability.

Q: When should I use Form CE53-02?

A: Form CE53-02 should be used when a limited partnership wants to cancel its registration in the state of Kansas.

Q: What information is required on Form CE53-02?

A: Form CE53-02 requires information such as the name of the limited partnership, the date of cancellation, and the reason for cancellation.

Q: What happens after I file Form CE53-02?

A: After filing Form CE53-02 and paying the required fee, the limited partnership's registration will be canceled and it will no longer be considered active in the state of Kansas.

Q: Do I need to notify any other agencies or entities after filing Form CE53-02?

A: It is recommended to notify other relevant agencies, such as the Internal Revenue Service (IRS) and the Kansas Department of Revenue, about the cancellation of the limited partnership.

Q: Can I reinstate a canceled limited partnership in Kansas?

A: Yes, a canceled limited partnership can be reinstated in Kansas by filing a different form and paying the necessary fees as outlined by the Kansas Secretary of State.

Form Details:

- Released on February 1, 2016;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CE53-02 by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.