Form BR53-04 Business Trust Resolution of Withdrawal - Kansas

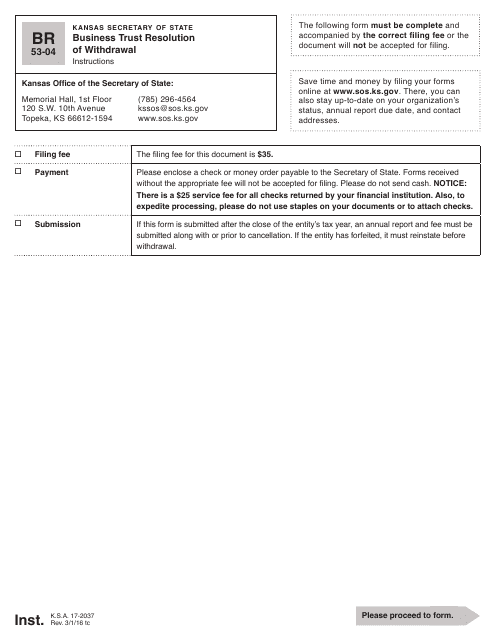

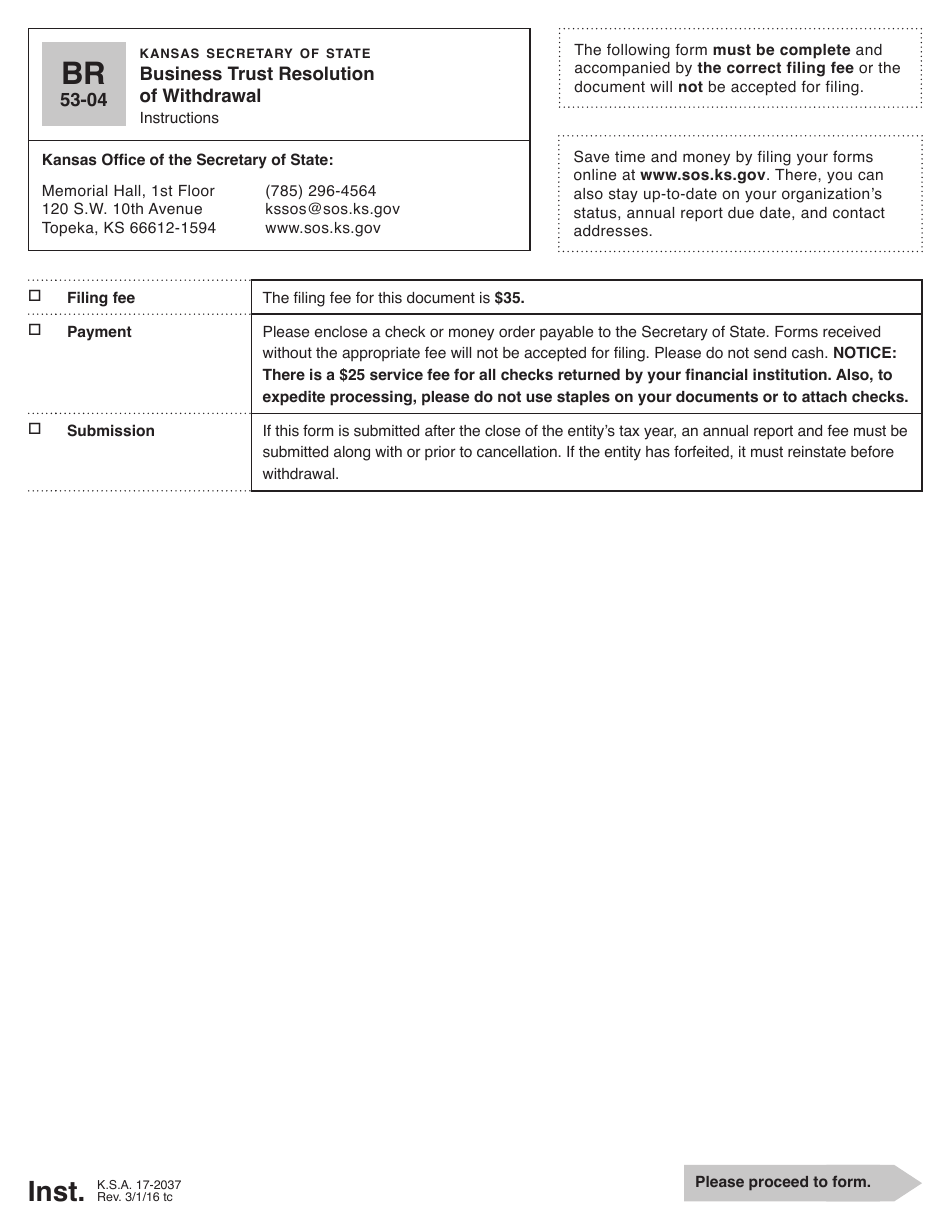

What Is Form BR53-04?

This is a legal form that was released by the Kansas Secretary of State - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

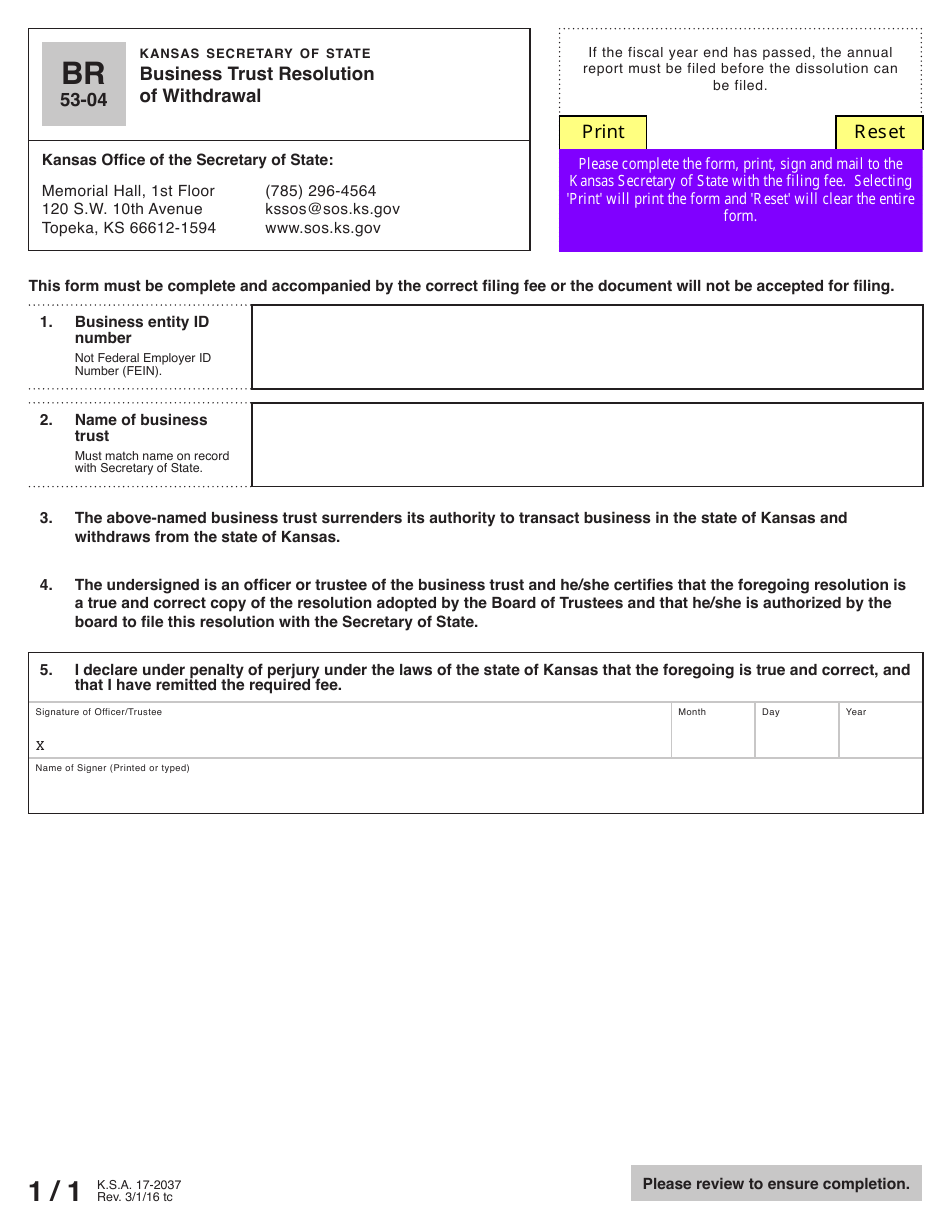

Q: What is BR53-04 Business Trust Resolution of Withdrawal in Kansas?

A: BR53-04 Business Trust Resolution of Withdrawal is a form used in Kansas to officially withdraw a business trust from the state.

Q: Who needs to file BR53-04 Business Trust Resolution of Withdrawal in Kansas?

A: Any business trust that wants to withdraw from Kansas needs to file BR53-04.

Q: What information is required to complete the BR53-04 form?

A: The form requires information such as the name of the business trust, its business address, and the effective date of the withdrawal.

Q: Is there a fee to file BR53-04 Business Trust Resolution of Withdrawal in Kansas?

A: Yes, there is a fee for filing the BR53-04 form. The fee amount may vary, so it's best to check with the Kansas Secretary of State for the current fee schedule.

Q: What happens after I file the BR53-04 Business Trust Resolution of Withdrawal form?

A: Once the form is filed and the fee is paid, the business trust will be officially withdrawn from Kansas.

Q: Can I withdraw my business trust from Kansas without filing the BR53-04 form?

A: No, filing the BR53-04 form is necessary to officially withdraw a business trust from Kansas.

Q: Are there any additional requirements for withdrawing a business trust from Kansas?

A: In addition to filing the BR53-04 form, it's important to fulfill any other obligations or requirements set by the Kansas Secretary of State's office.

Q: Is there a deadline for filing the BR53-04 Business Trust Resolution of Withdrawal form?

A: There is no specific deadline for filing the form, but it is recommended to do so as soon as the business trust decides to withdraw from Kansas.

Q: Can I get a refund of the filing fee if my withdrawal request is denied?

A: Refunds of filing fees are generally not provided, even if the withdrawal request is denied.

Q: Can I still file the BR53-04 form if my business trust has outstanding obligations in Kansas?

A: Yes, you can still file the form, but it's important to fulfill any outstanding obligations before or during the withdrawal process.

Q: How long does it take for the withdrawal to be processed after filing the BR53-04 form?

A: The processing time can vary, but it usually takes a few business days to process the withdrawal request.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the Kansas Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form BR53-04 by clicking the link below or browse more documents and templates provided by the Kansas Secretary of State.