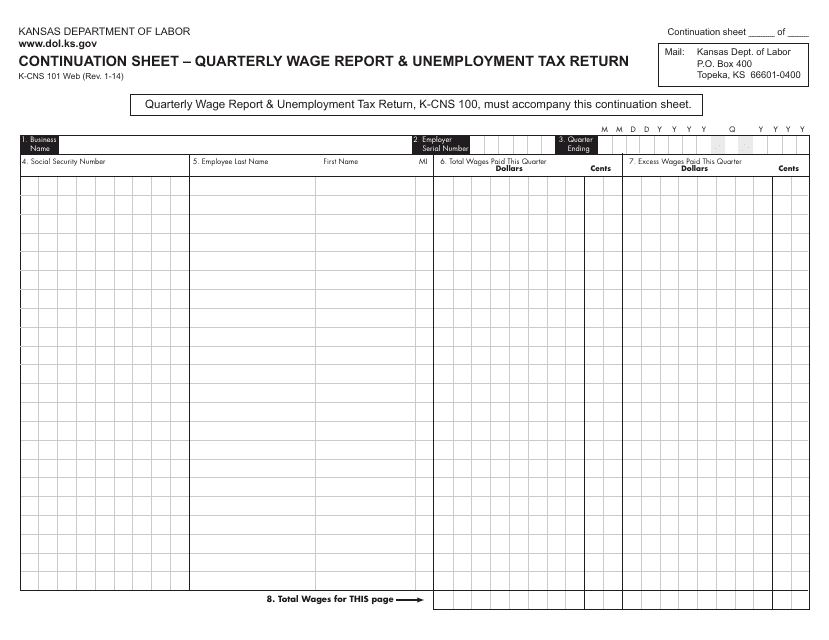

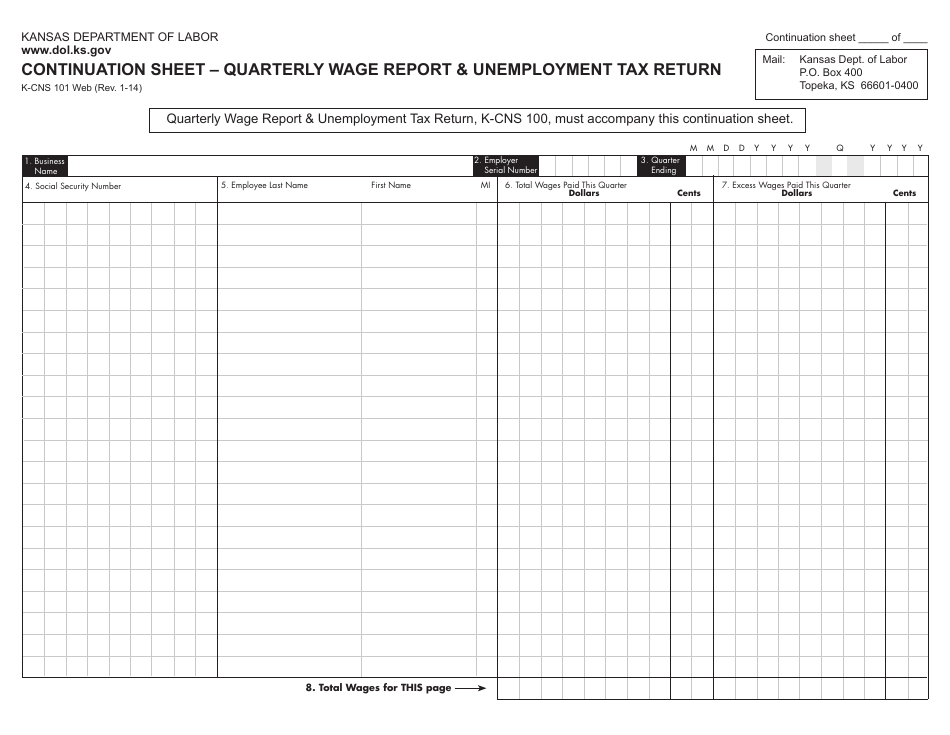

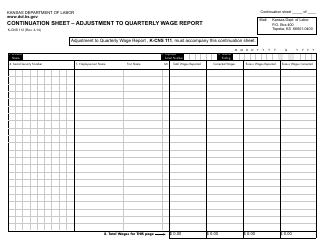

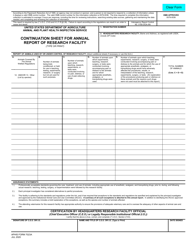

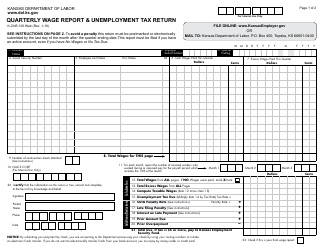

Form K-CNS101 Continuation Sheet - Quarterly Wage Report & Unemployment Tax Return - Kansas

What Is Form K-CNS101?

This is a legal form that was released by the Kansas Department of Labor - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-CNS101?

A: Form K-CNS101 is the Continuation Sheet for the Quarterly Wage Report & Unemployment Tax Return in Kansas.

Q: What is the purpose of Form K-CNS101?

A: Form K-CNS101 is used to provide additional wage and tax information when filing the Quarterly Wage Report & Unemployment Tax Return in Kansas.

Q: When should I file Form K-CNS101?

A: Form K-CNS101 should be filed along with the Quarterly Wage Report & Unemployment Tax Return in Kansas, which is due quarterly.

Q: Do I need to fill out Form K-CNS101?

A: You only need to fill out Form K-CNS101 if you have additional wage and tax information to provide.

Q: Are there any filing fees for Form K-CNS101?

A: There are no filing fees for Form K-CNS101.

Q: What if I make a mistake on Form K-CNS101?

A: If you make a mistake on Form K-CNS101, you should correct it as soon as possible and submit the corrected form to the Kansas Department of Labor.

Q: Who should I contact for more information about Form K-CNS101?

A: For more information about Form K-CNS101, you should contact the Kansas Department of Labor or your employer.

Form Details:

- Released on January 1, 2014;

- The latest edition provided by the Kansas Department of Labor;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-CNS101 by clicking the link below or browse more documents and templates provided by the Kansas Department of Labor.