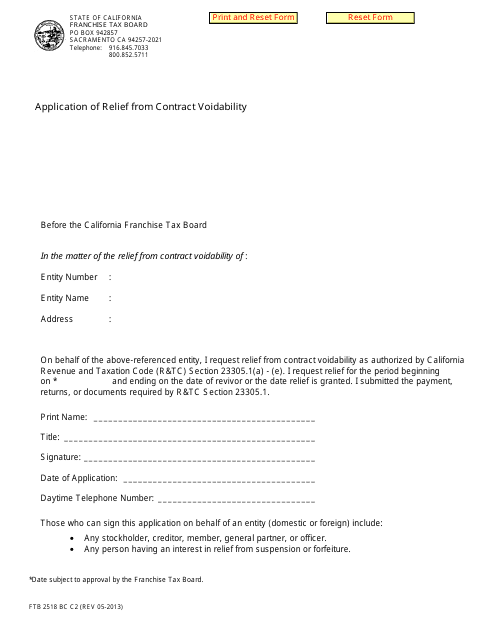

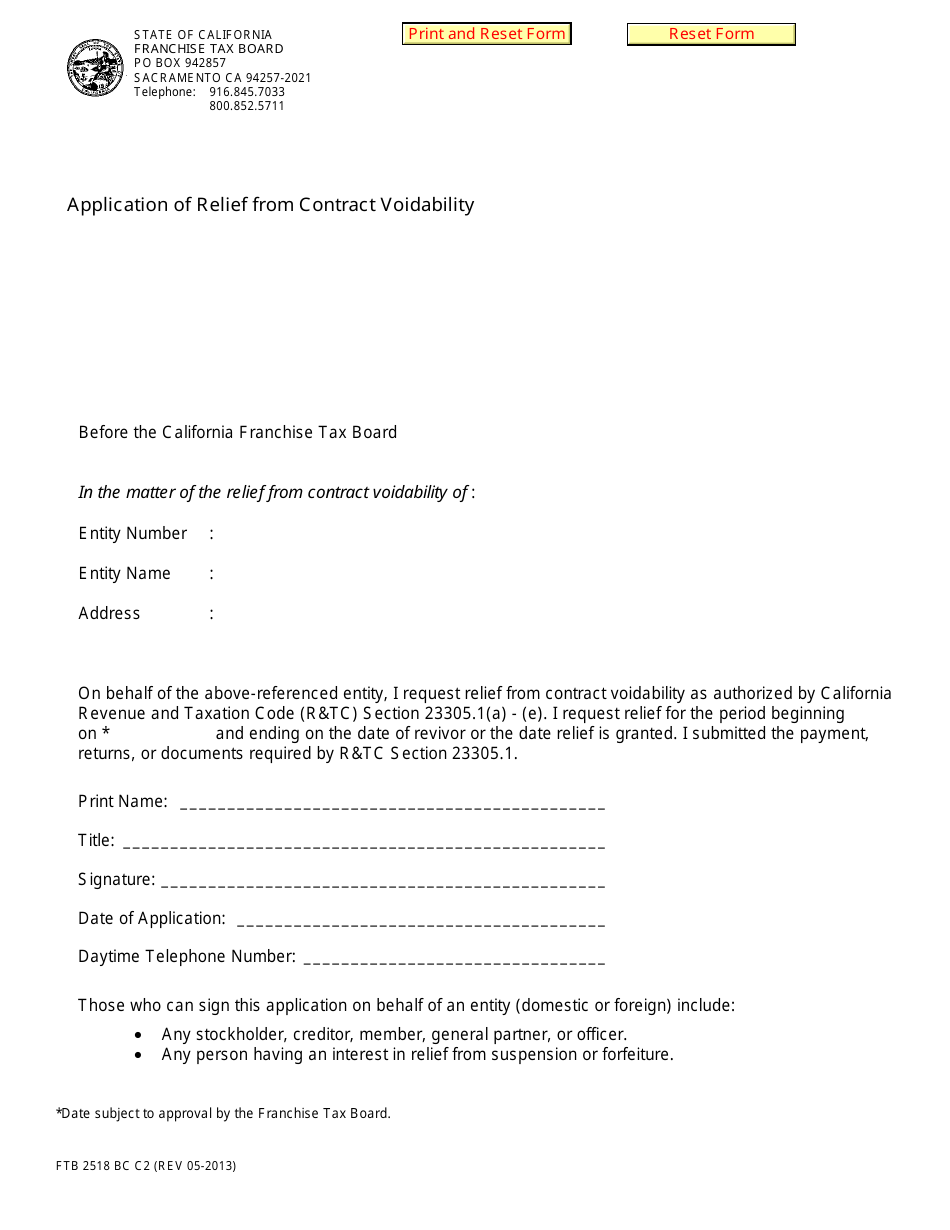

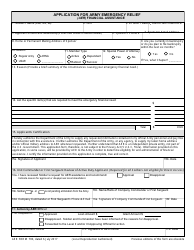

Form FTB2518 BC Application of Relief From Contract Voidability - California

What Is Form FTB2518 BC?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB2518 BC?

A: Form FTB2518 BC is the Application of Relief From Contract Voidability in California.

Q: What is the purpose of Form FTB2518 BC?

A: The purpose of Form FTB2518 BC is to apply for relief from the voidability of a contract in California.

Q: Who can use Form FTB2518 BC?

A: Any individual or business who wants to apply for relief from the voidability of a contract in California can use Form FTB2518 BC.

Q: Is there a fee to file Form FTB2518 BC?

A: Yes, there is a fee to file Form FTB2518 BC. The current fee is $35.

Q: What information do I need to complete Form FTB2518 BC?

A: To complete Form FTB2518 BC, you will need to provide information about the contract, the reasons for requesting relief, and any supporting documents.

Q: How long does it take to process Form FTB2518 BC?

A: The processing time for Form FTB2518 BC can vary, but it generally takes around 4-6 weeks.

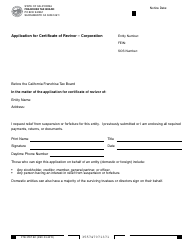

Q: What happens after I submit Form FTB2518 BC?

A: After you submit Form FTB2518 BC, the California Franchise Tax Board (FTB) will review your application and notify you of their decision.

Q: Can I appeal if my application is denied?

A: Yes, if your application for relief from contract voidability is denied, you can appeal the decision to the California Board of Equalization (BOE).

Form Details:

- Released on May 1, 2013;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB2518 BC by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.

![Document preview: DLSE Form 538 Application for Relief From Order, Decision or Award of the Labor Commissioner by Want of Notice [labor Code Section 98(F)] - California](https://data.templateroller.com/pdf_docs_html/1765/17654/1765434/dlse-form-538-application-relief-from-order-decision-or-award-the-labor-commissioner-by-want-notice-labor-code-section-98-f-california.png)