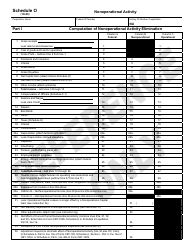

Nonoperational Activity Packet for Taxable Years Ending on or After July 31, 2007 - New Jersey

Nonoperational Activity Packet for Taxable Years Ending on or After July 31, 2007 is a legal document that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.

FAQ

Q: What is the Nonoperational Activity Packet?

A: The Nonoperational Activity Packet is a document for taxable years ending on or after July 31, 2007 in New Jersey.

Q: Who is required to complete the Nonoperational Activity Packet?

A: Taxpayers in New Jersey with nonoperational activity in their taxable year ending on or after July 31, 2007 are required to complete the packet.

Q: What is considered nonoperational activity?

A: Nonoperational activity includes activities such as holding investment assets, leasing or renting property, and other passive activities.

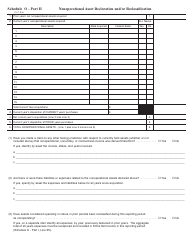

Q: What information is required to be included in the Nonoperational Activity Packet?

A: The packet requires taxpayers to provide information on any nonoperational activity conducted in New Jersey, including details on the activity, income, and expenses.

Q: When is the deadline for filing the Nonoperational Activity Packet?

A: The deadline for filing the Nonoperational Activity Packet in New Jersey is the same as the due date for the taxpayer's income tax return.

Form Details:

- Released on July 1, 2007;

- The latest edition currently provided by the New Jersey Department of the Treasury;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.