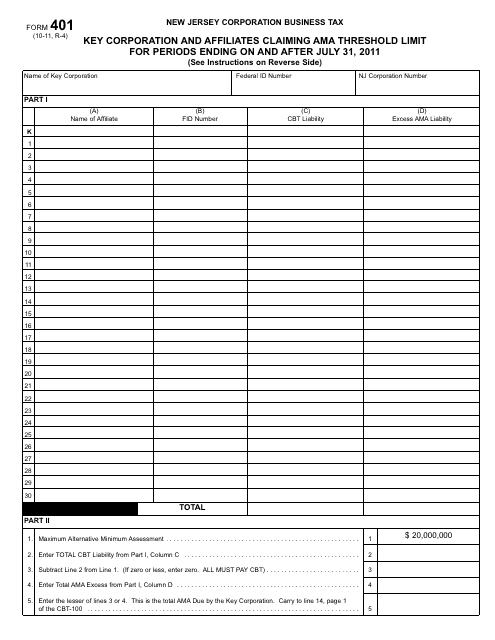

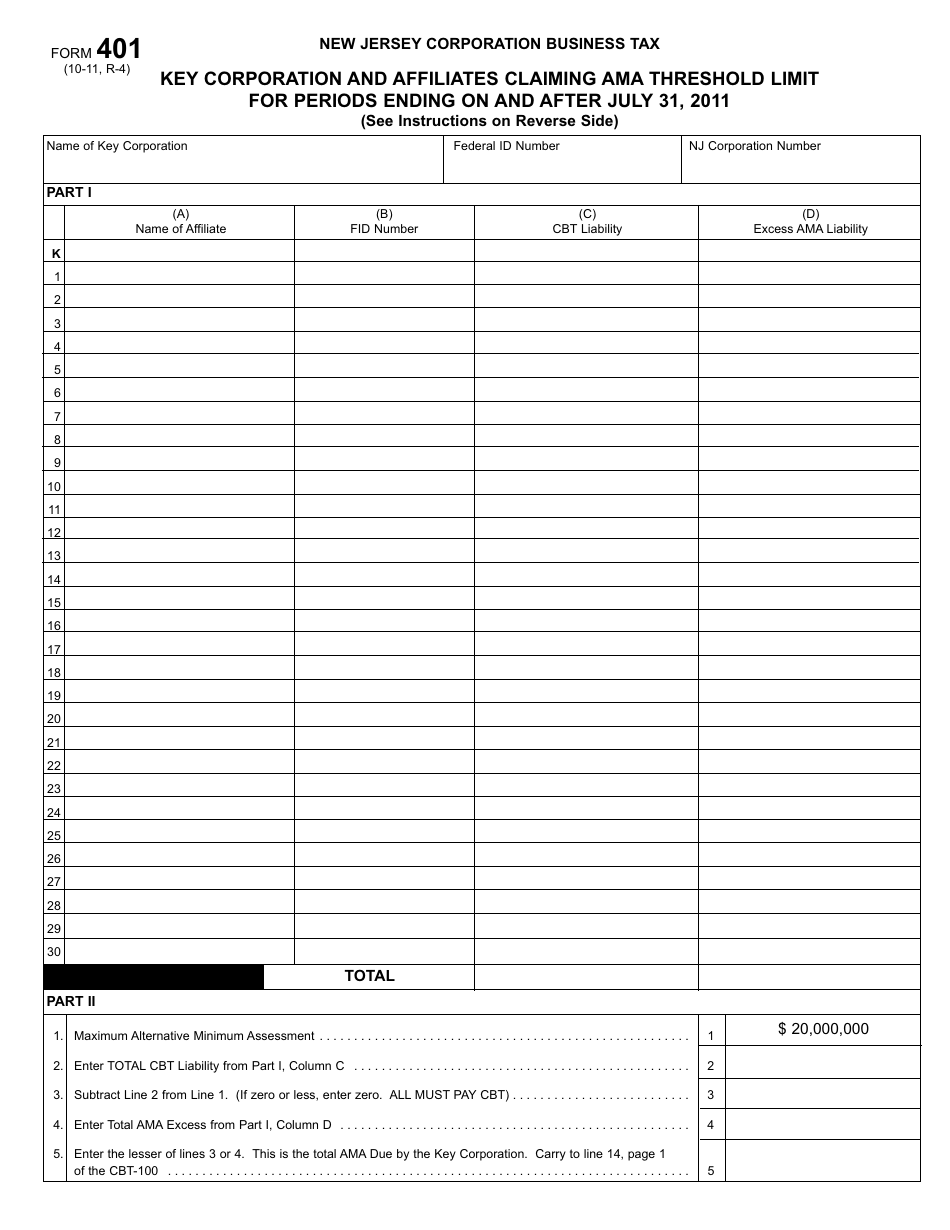

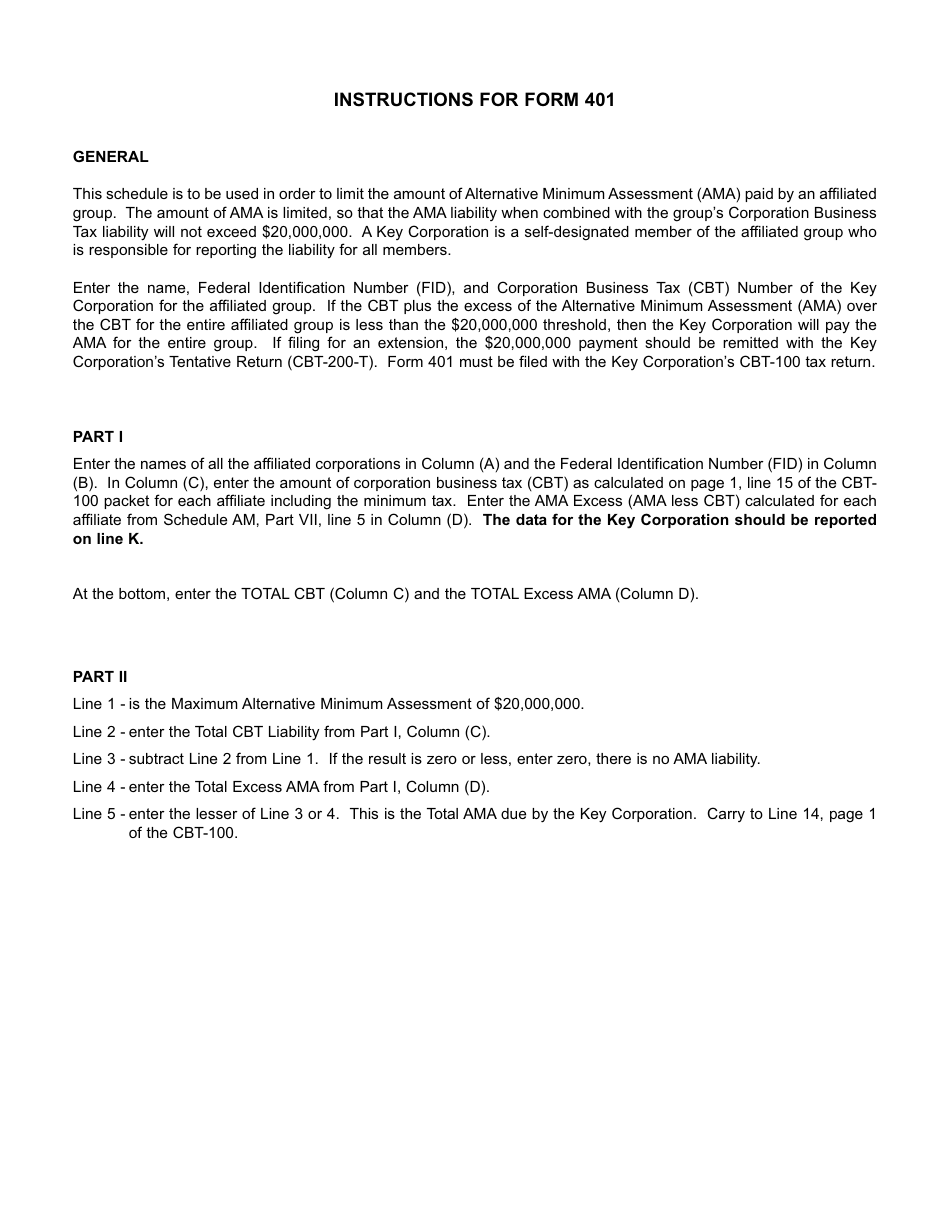

Form 401 Key Corporation and Affiliates Claiming Ama Threshold Limit for Periods Ending on and After July 31, 2011 - New Jersey

What Is Form 401?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 401?

A: Form 401 is a form used by Key Corporation and its affiliates to claim the Ama Threshold Limit for periods ending on and after July 31, 2011 in New Jersey.

Q: What is the Ama Threshold Limit?

A: The Ama Threshold Limit is a threshold set by the New Jersey government for claiming the Alternative Minimum Assessment (AMA).

Q: Who can use Form 401?

A: Key Corporation and its affiliates can use Form 401 to claim the Ama Threshold Limit.

Q: When can Form 401 be used?

A: Form 401 can be used for periods ending on and after July 31, 2011.

Q: What is the purpose of Form 401?

A: The purpose of Form 401 is to claim the Ama Threshold Limit for tax purposes in New Jersey.

Q: Is Form 401 specific to New Jersey?

A: Yes, Form 401 is specific to New Jersey and is used for state tax purposes.

Q: Are there any eligibility requirements to use Form 401?

A: To use Form 401, you must be Key Corporation or one of its affiliates.

Q: Can individuals use Form 401?

A: No, Form 401 is specifically for Key Corporation and its affiliates.

Q: What information is required on Form 401?

A: Form 401 requires information about the claiming entity, periods ending date, and calculation of the Ama Threshold Limit.

Form Details:

- Released on October 1, 2011;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 401 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.