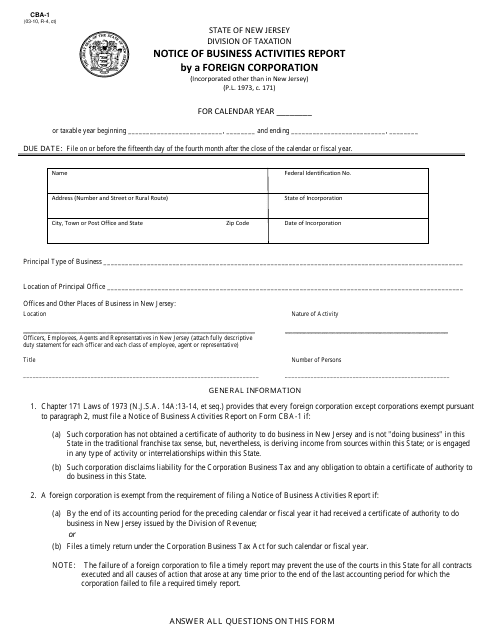

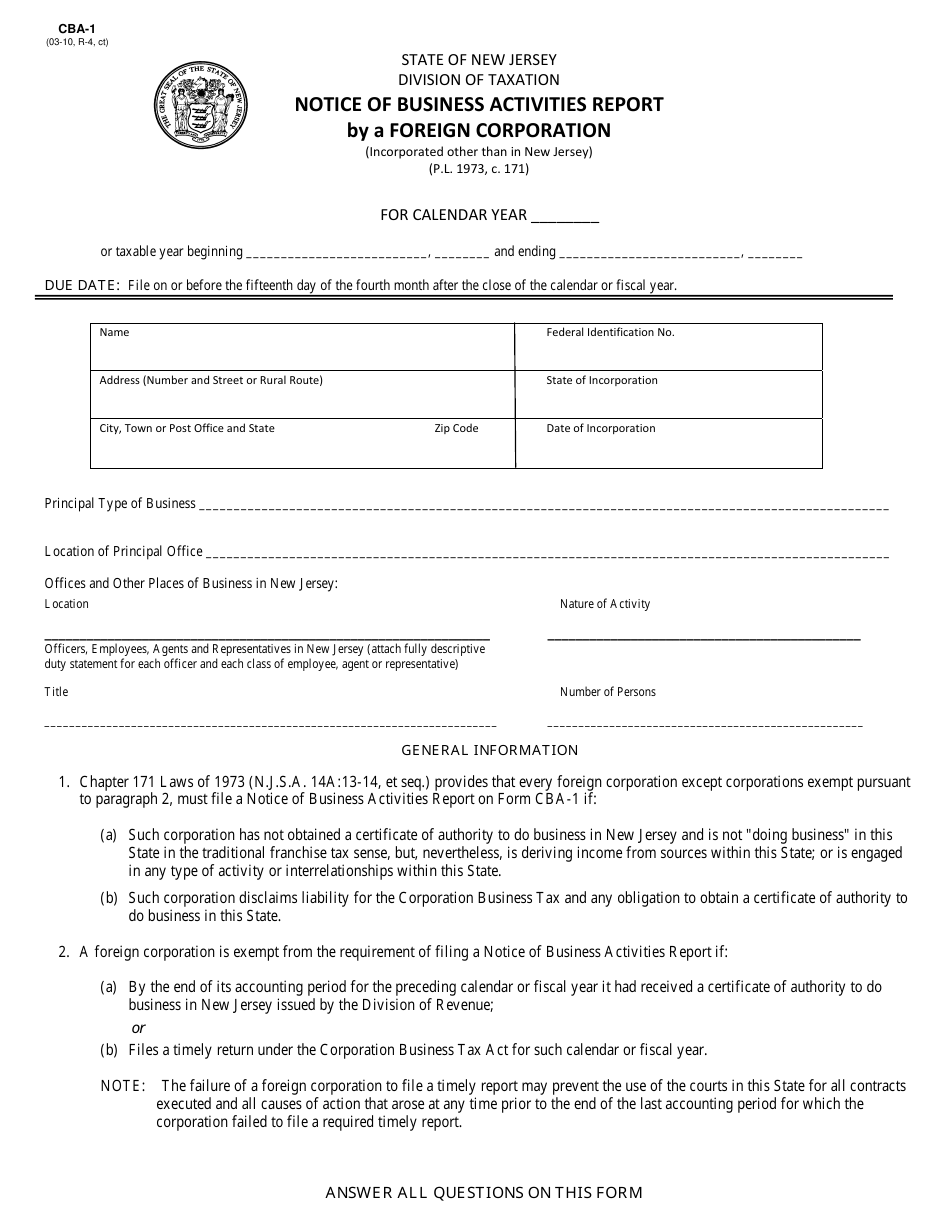

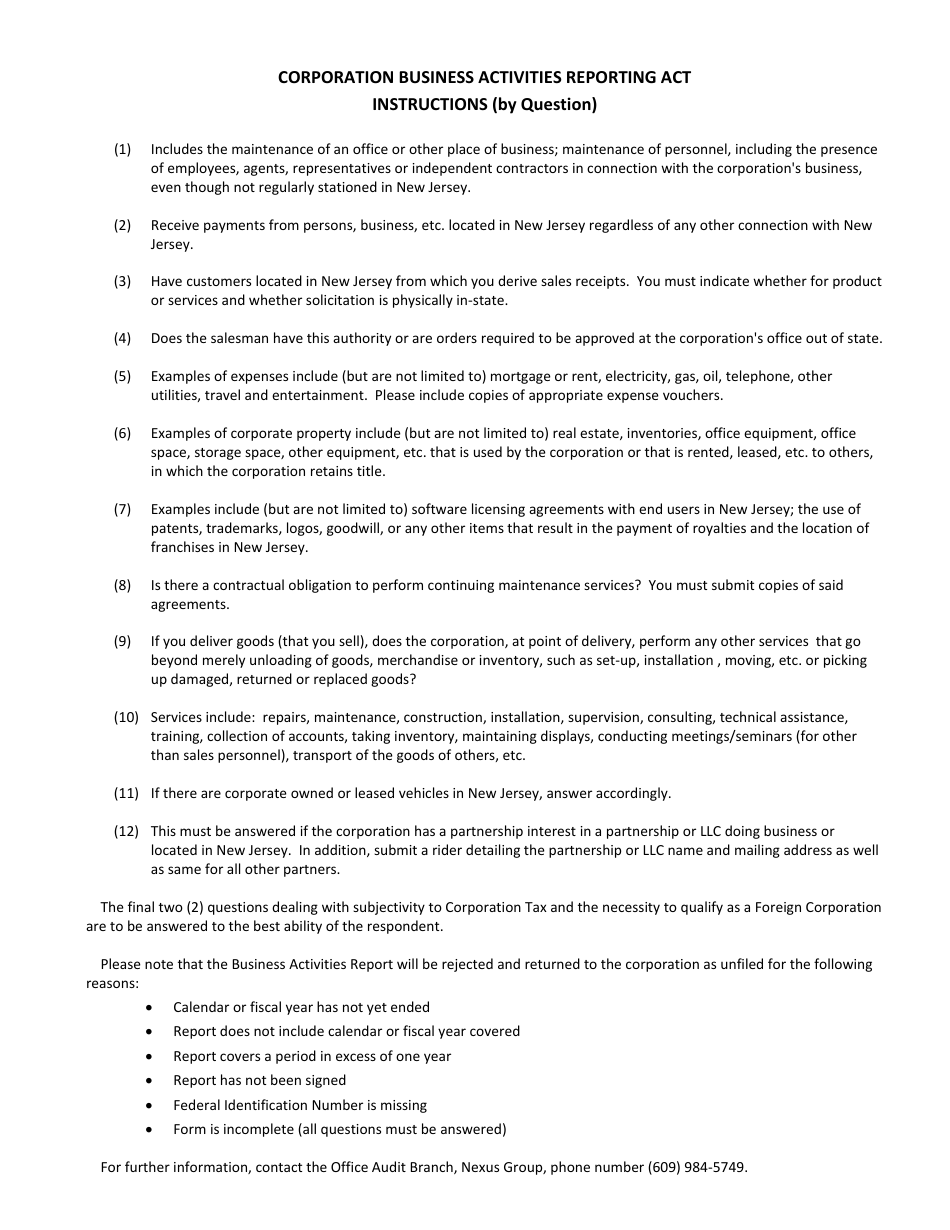

Form CBA-1 Notice of Business Activities Report by a Foreign Corporation - New Jersey

What Is Form CBA-1?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form CBA-1?

A: Form CBA-1 is a Notice of Business Activities Report.

Q: What is a Foreign Corporation?

A: A Foreign Corporation is a corporation that is incorporated in a different state or country.

Q: Who needs to file a Form CBA-1 in New Jersey?

A: Foreign Corporations conducting business in New Jersey need to file a Form CBA-1.

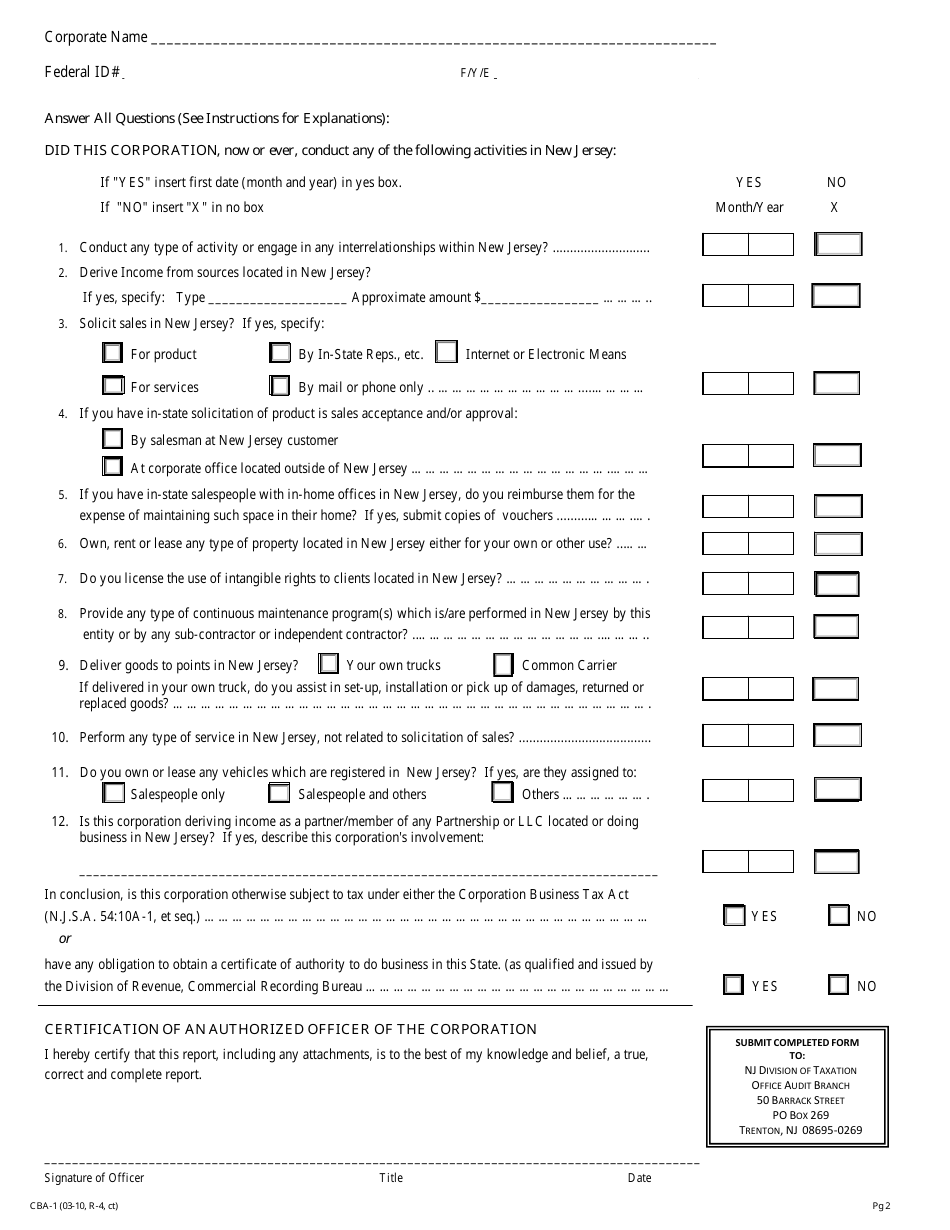

Q: What information is required on the Form CBA-1?

A: The form will require information such as the corporation's name, address, registered agent, and a description of its business activities in New Jersey.

Q: When is the deadline to file Form CBA-1 in New Jersey?

A: The deadline to file Form CBA-1 in New Jersey is the last day of the third month following the end of the corporation's fiscal year.

Q: Is there a fee for filing Form CBA-1?

A: Yes, there is a filing fee associated with Form CBA-1. The fee amount may vary.

Form Details:

- Released on March 1, 2010;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CBA-1 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.