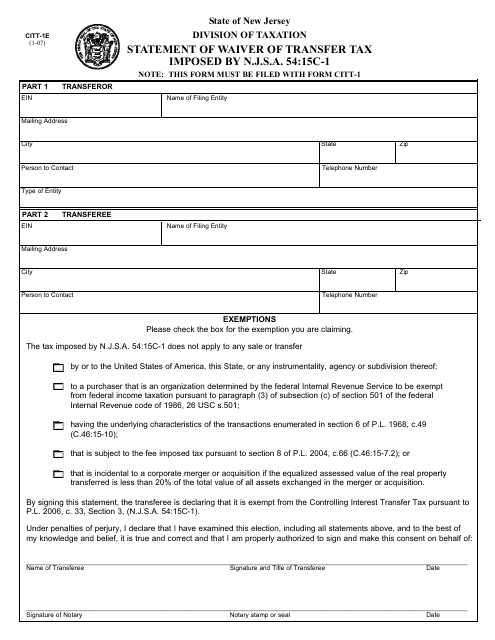

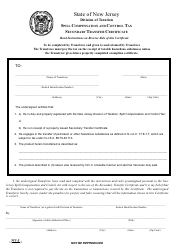

Form CITT-1E Statement of Waiver of Transfer Tax - New Jersey

What Is Form CITT-1E?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the CITT-1E form?

A: The CITT-1E form is the Statement of Waiver of Transfer Tax form in New Jersey.

Q: What is the purpose of the CITT-1E form?

A: The purpose of the CITT-1E form is to request a waiver of transfer tax for certain property transfers.

Q: Who needs to file the CITT-1E form?

A: The CITT-1E form needs to be filed by the seller or their authorized agent.

Q: When should I file the CITT-1E form?

A: The CITT-1E form should be filed at least 10 days before the property transfer.

Q: Is there a fee for filing the CITT-1E form?

A: Yes, there is a fee for filing the CITT-1E form. The fee amount can vary depending on the county.

Form Details:

- Released on January 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form CITT-1E by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.