This version of the form is not currently in use and is provided for reference only. Download this version of

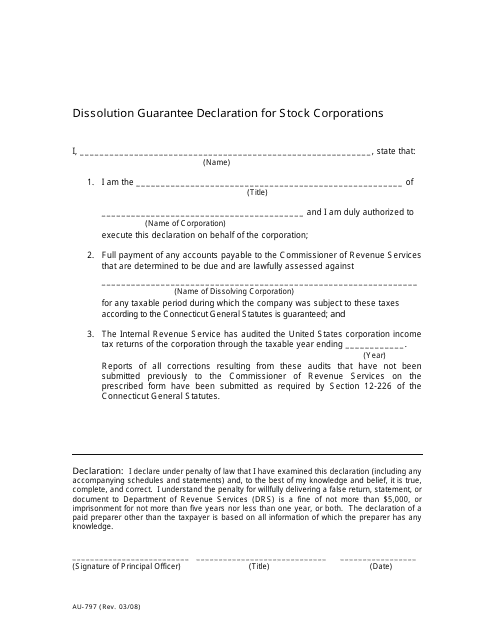

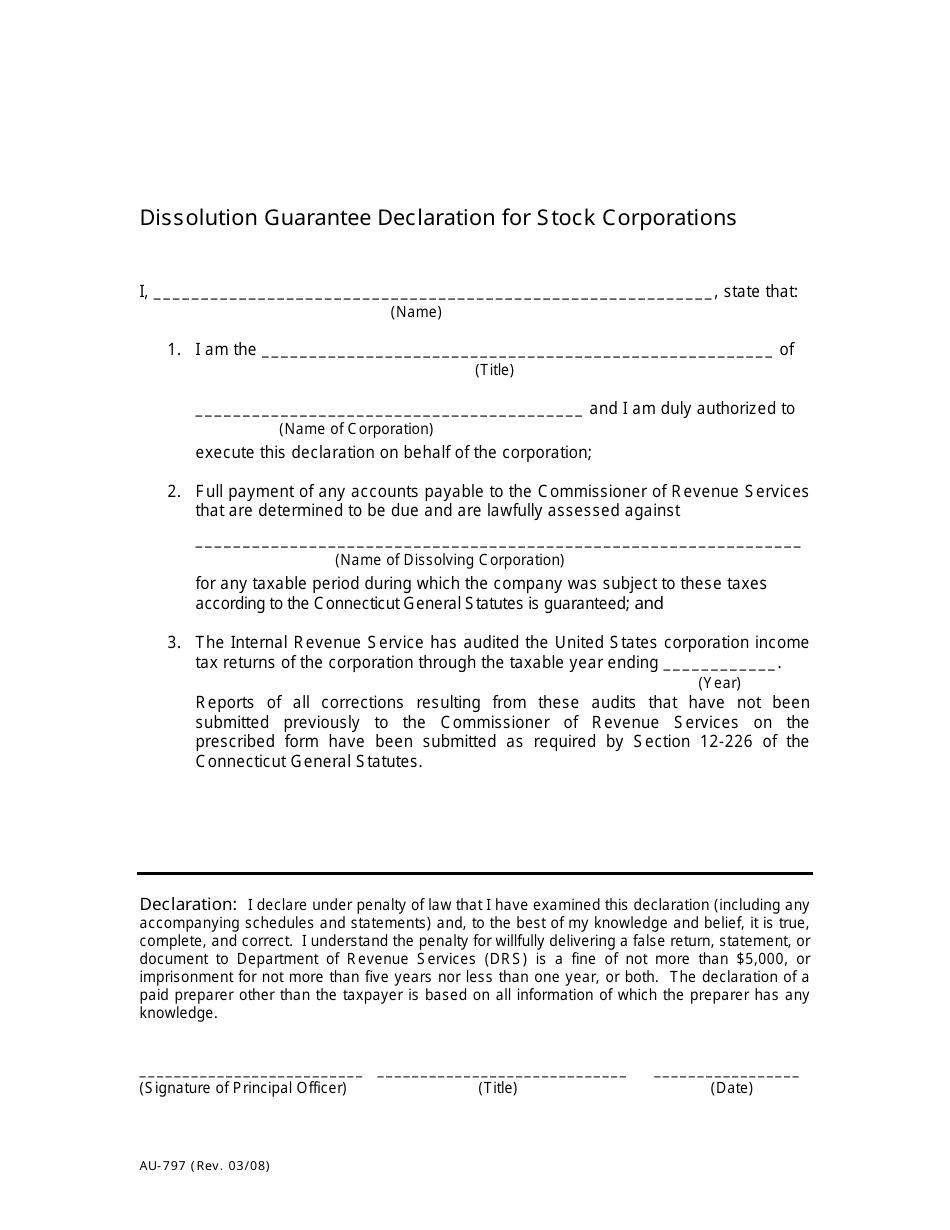

Form AU-797

for the current year.

Form AU-797 Dissolution Guarantee Declaration for Stock Corporations - Connecticut

What Is Form AU-797?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form AU-797?

A: Form AU-797 is the Dissolution Guarantee Declaration for Stock Corporations in Connecticut.

Q: Who needs to complete form AU-797?

A: Stock corporations that are seeking to dissolve in Connecticut need to complete form AU-797.

Q: What is the purpose of form AU-797?

A: Form AU-797 is used to declare that all the debts and liabilities of the stock corporation have been paid or adequately provided for before dissolving.

Q: Are there any fees associated with filing form AU-797?

A: Yes, there is a $50 filing fee.

Q: What information is required on form AU-797?

A: Form AU-797 requires information such as the name of the stock corporation, the date of dissolution, and the address where any process against the corporation may be served.

Q: What happens after submitting form AU-797?

A: After submitting form AU-797, the stock corporation will receive a Certificate of Dissolution from the Connecticut Secretary of State.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form AU-797 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.