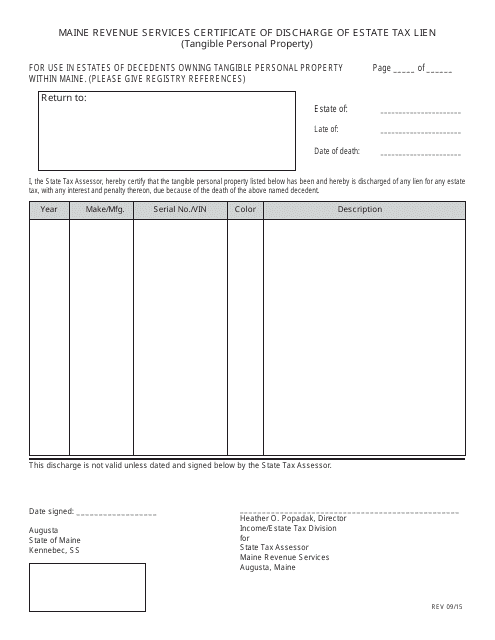

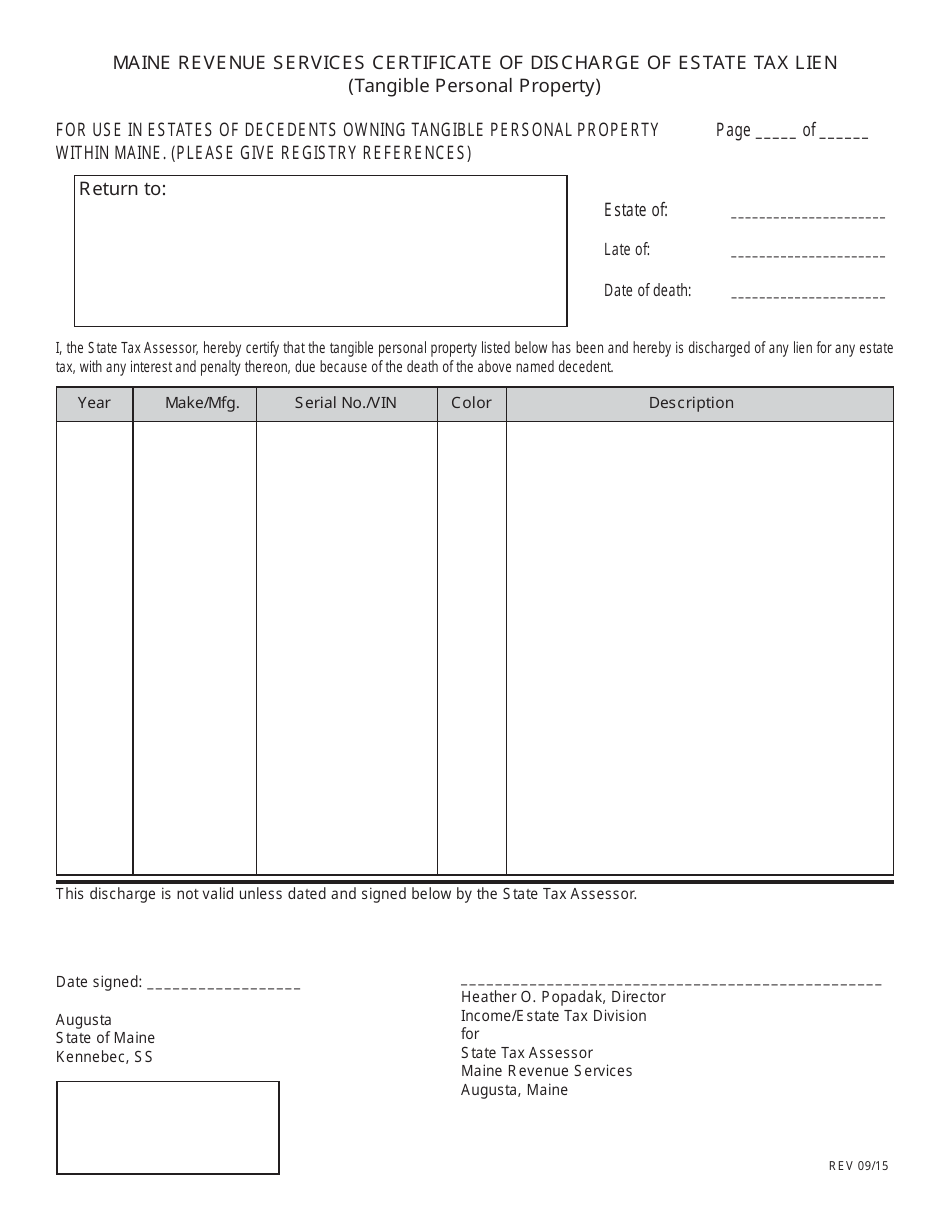

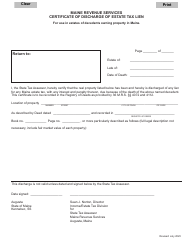

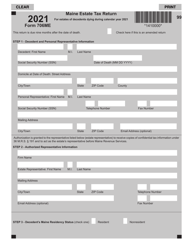

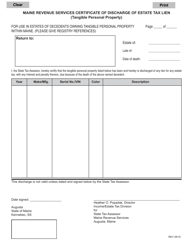

Certificate of Discharge of Estate Tax Lien (Tangible Personal Property) - Maine

Certificate of Discharge of Estate Tax Lien (Tangible Personal Property) is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

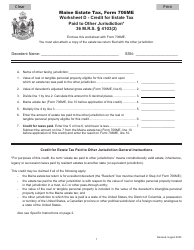

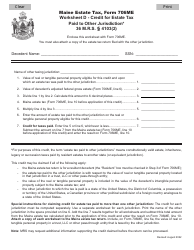

Q: What is a Certificate of Discharge of Estate Tax Lien?

A: A Certificate of Discharge of Estate Tax Lien is a document that releases a lien on tangible personal property imposed by the estate tax law.

Q: Who issues the Certificate of Discharge of Estate Tax Lien?

A: The Certificate of Discharge of Estate Tax Lien is issued by the state of Maine.

Q: What does the Certificate of Discharge of Estate Tax Lien do?

A: The Certificate of Discharge of Estate Tax Lien releases the lien on tangible personal property and clears the title of the property.

Q: What is tangible personal property?

A: Tangible personal property refers to physical items like furniture, jewelry, cars, and artwork.

Q: When is a Certificate of Discharge of Estate Tax Lien necessary?

A: A Certificate of Discharge of Estate Tax Lien is necessary when the estate tax law imposes a lien on tangible personal property and the lien needs to be released.

Q: How can I obtain a Certificate of Discharge of Estate Tax Lien in Maine?

A: To obtain a Certificate of Discharge of Estate Tax Lien in Maine, you need to follow the procedures and requirements set by the state's taxation authorities. Contact the Maine Department of Revenue Services for more information.

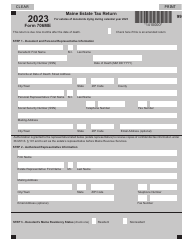

Form Details:

- Released on September 1, 2015;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.