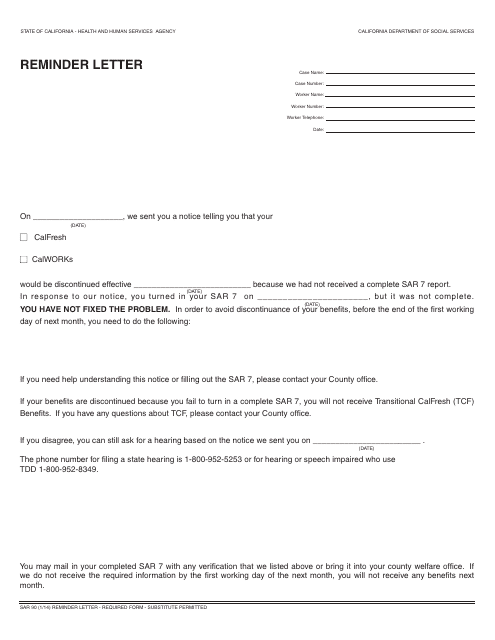

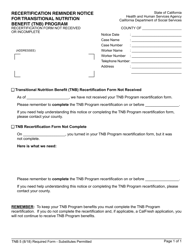

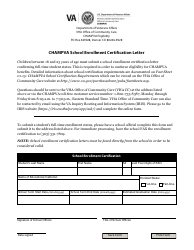

Form SAR90 Reminder Letter - California

What Is Form SAR90?

This is a legal form that was released by the California Department of Social Services - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

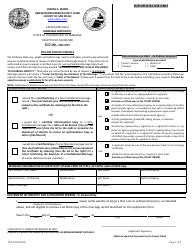

Q: What is a SAR90 Reminder Letter?

A: A SAR90 Reminder Letter is a notification sent by the State of California to remind employers to file their quarterly wage and tax reports (SAR90) on time.

Q: Who receives a SAR90 Reminder Letter?

A: Employers in California who are required to file quarterly wage and tax reports receive a SAR90 Reminder Letter.

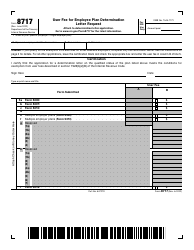

Q: Why is it important to file SAR90 reports?

A: Filing SAR90 reports is important because it enables the State of California to accurately track and administer unemployment insurance, disability insurance, and employment training tax programs.

Q: When should SAR90 reports be filed?

A: SAR90 reports should be filed quarterly, by the last day of the month following the end of each calendar quarter.

Q: What happens if SAR90 reports are not filed on time?

A: If SAR90 reports are not filed on time, employers may be subject to penalties and interest charges.

Q: Is there a fee for filing SAR90 reports?

A: No, there is no fee for filing SAR90 reports.

Q: What should employers do if they did not receive a SAR90 Reminder Letter?

A: If employers did not receive a SAR90 Reminder Letter, they should still file their SAR90 reports on time and contact the EDD for assistance if needed.

Form Details:

- Released on January 1, 2015;

- The latest edition provided by the California Department of Social Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SAR90 by clicking the link below or browse more documents and templates provided by the California Department of Social Services.