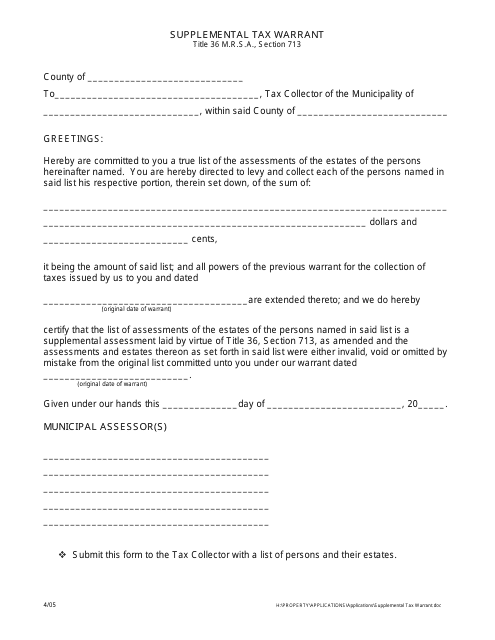

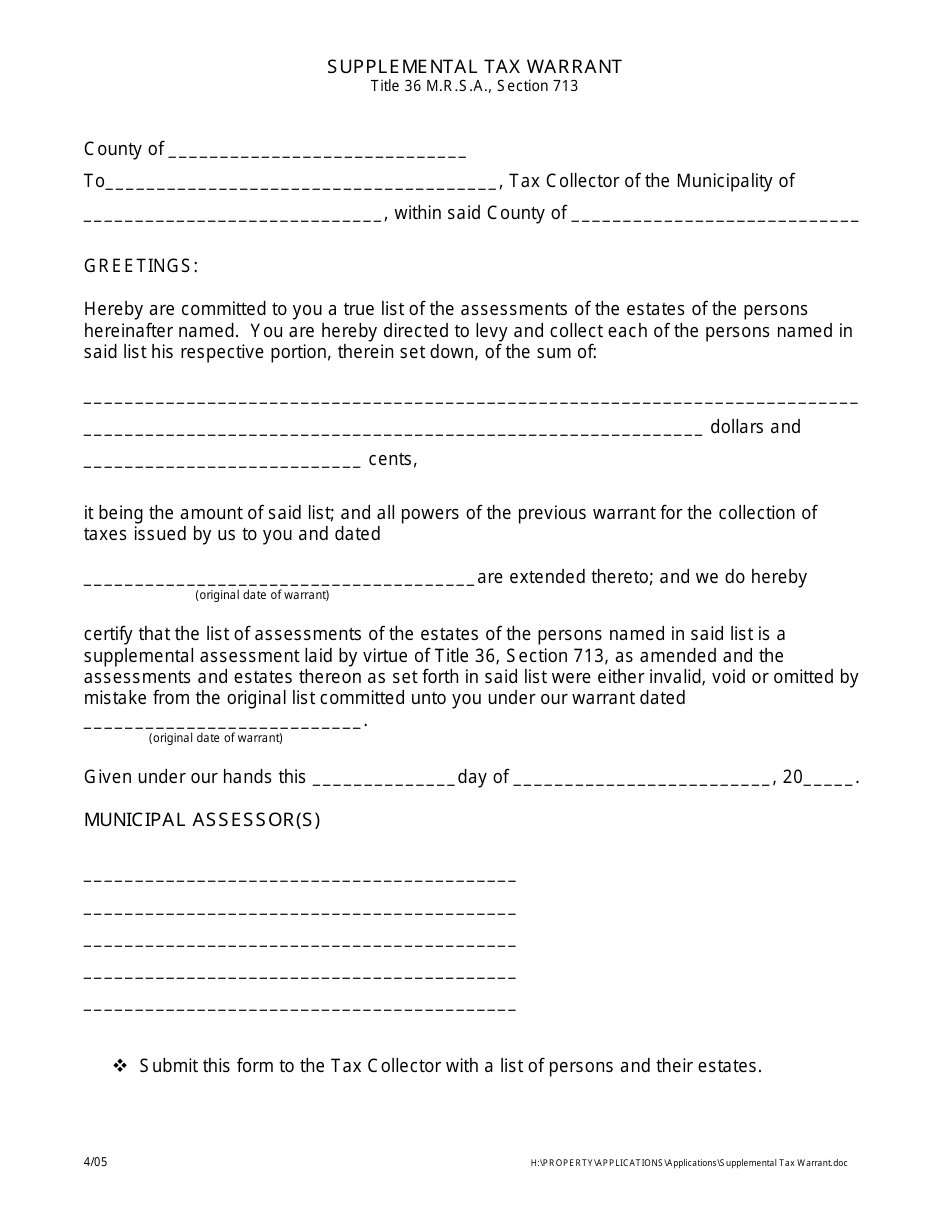

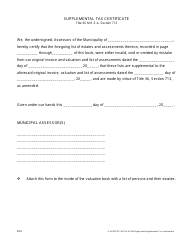

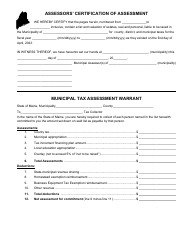

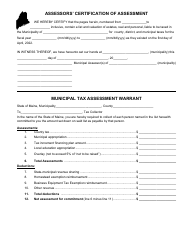

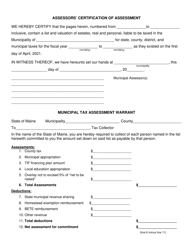

Supplemental Tax Warrant - Maine

Supplemental Tax Warrant is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is a supplemental tax warrant in Maine?

A: A supplemental tax warrant in Maine is a legal document issued by the local tax assessor when additional taxes are owed on a property.

Q: Why would a property owner receive a supplemental tax warrant in Maine?

A: A property owner may receive a supplemental tax warrant if there has been a change in the property assessment resulting in an increase in taxes owed.

Q: How does a supplemental tax warrant affect property owners in Maine?

A: A supplemental tax warrant means that the property owner is required to pay the additional taxes owed or face potential penalties, such as interest or a tax lien on the property.

Q: How can property owners in Maine resolve a supplemental tax warrant?

A: Property owners can resolve a supplemental tax warrant by paying the additional taxes owed in full or by reaching out to the local tax assessor's office to discuss possible payment arrangements.

Q: Can a supplemental tax warrant be disputed in Maine?

A: Yes, property owners have the right to dispute a supplemental tax warrant if they believe there is a mistake in the property assessment or if they have valid reasons for a reassessment. They should contact the local tax assessor's office for more information on the dispute process.

Form Details:

- Released on April 1, 2005;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.