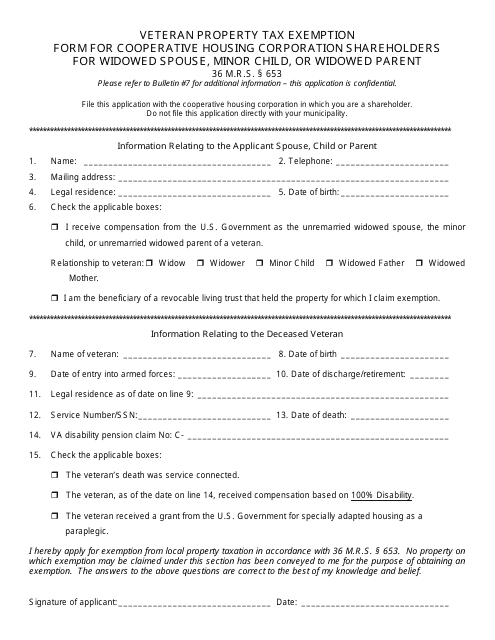

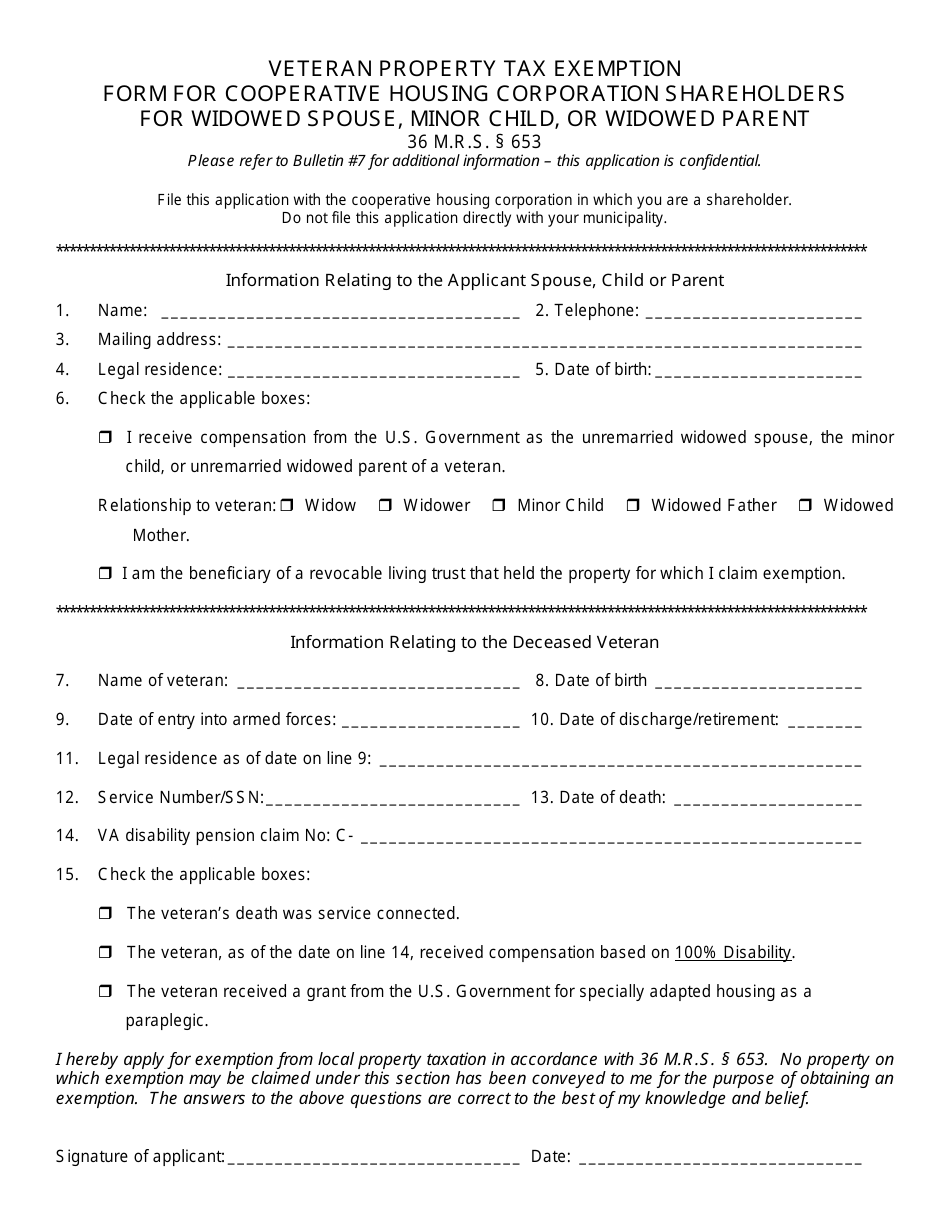

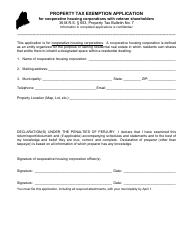

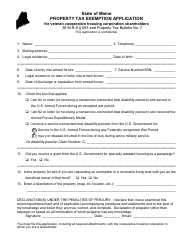

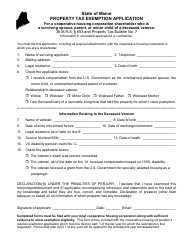

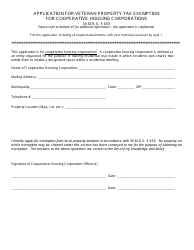

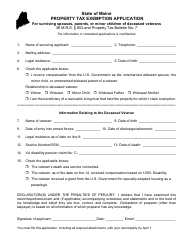

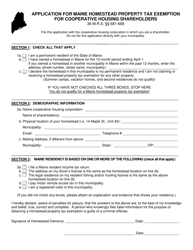

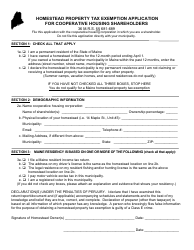

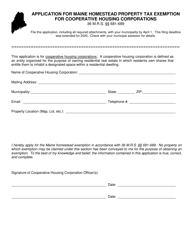

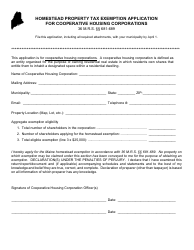

Form PTF-653-2B Veteran Property Tax Exemption Form for Cooperative Housing Corporation Shareholders for Widowed Spouse, Minor Child, or Widowed Parent - Maine

What Is Form PTF-653-2B?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PTF-653-2B?

A: Form PTF-653-2B is the Veteran Property Tax Exemption Form for Cooperative Housing Corporation Shareholders for Widowed Spouse, Minor Child, or Widowed Parent in Maine.

Q: Who is eligible to use Form PTF-653-2B?

A: Widowed spouses, minor children, or widowed parents of veterans who are shareholders in cooperative housing corporations in Maine can use Form PTF-653-2B.

Q: What is the purpose of Form PTF-653-2B?

A: The purpose of Form PTF-653-2B is to claim a property tax exemption for eligible individuals who are shareholders in cooperative housing corporations and are widowed spouses, minor children, or widowed parents of veterans in Maine.

Q: Are there any filing fees for Form PTF-653-2B?

A: No, there are no filing fees for Form PTF-653-2B.

Q: What documentation is required to accompany Form PTF-653-2B?

A: You will need to provide a copy of the veteran's death certificate and proof of ownership or ownership interest in the cooperative housing corporation.

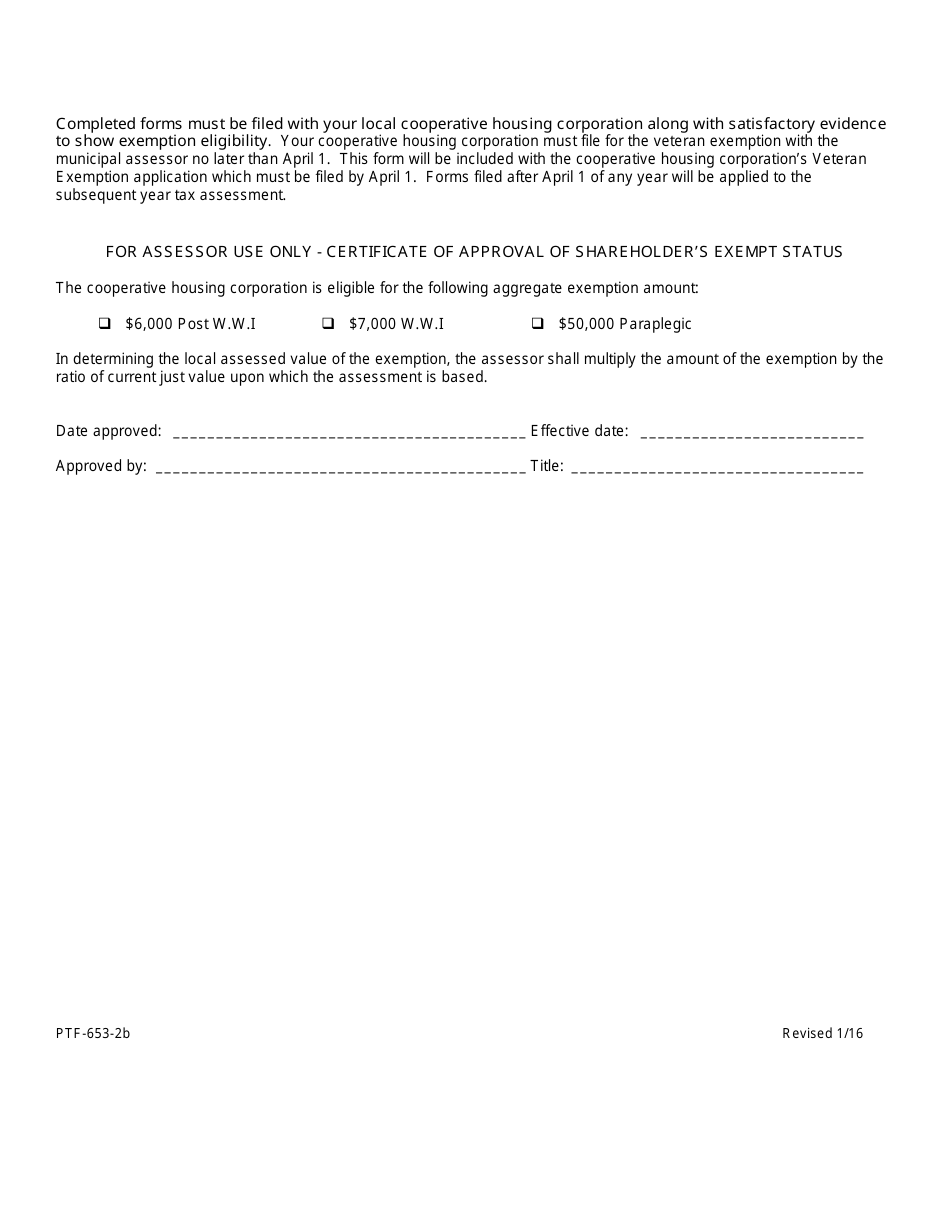

Q: When is the deadline to file Form PTF-653-2B?

A: The deadline to file Form PTF-653-2B is April 1st of each year.

Q: How often do I need to file Form PTF-653-2B?

A: Once you have been approved for the property tax exemption, you do not need to file Form PTF-653-2B annually unless there is a change in your eligibility status.

Q: Who should I contact for more information about Form PTF-653-2B?

A: For more information about Form PTF-653-2B, you can contact the Maine Revenue Services or your local tax assessor's office in Maine.

Form Details:

- Released on January 1, 2016;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PTF-653-2B by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.