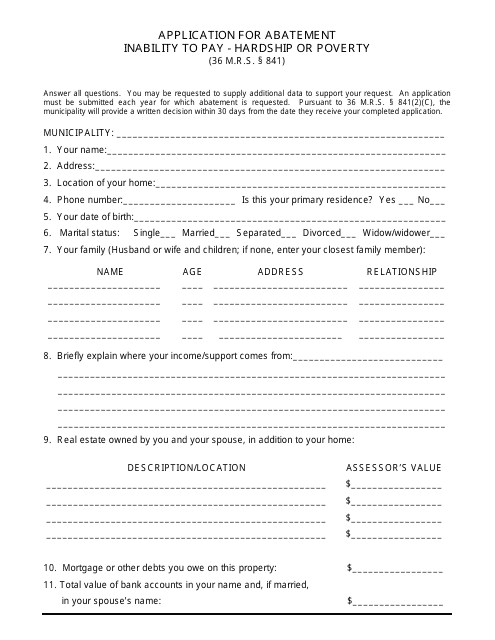

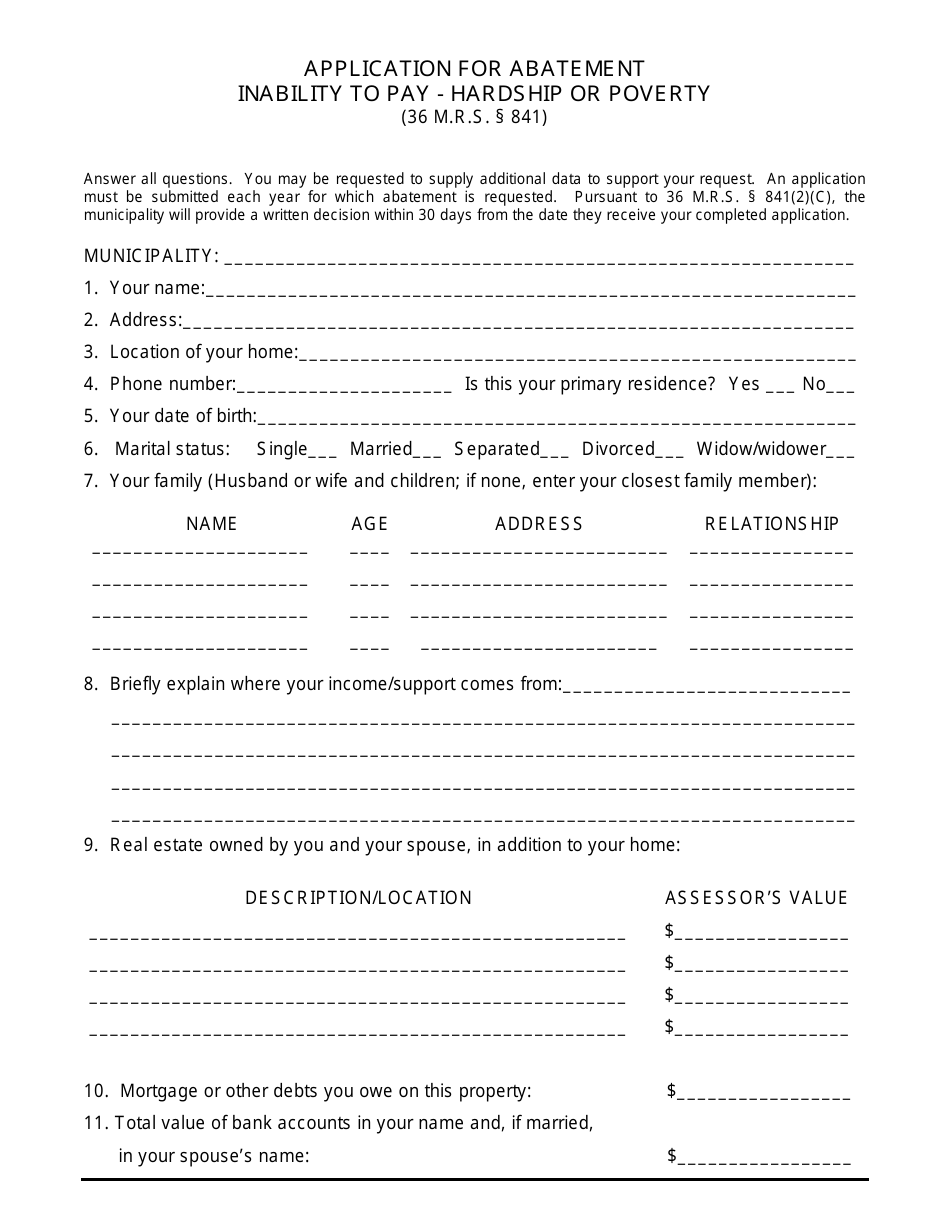

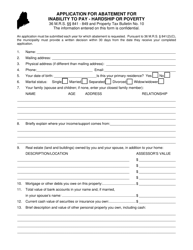

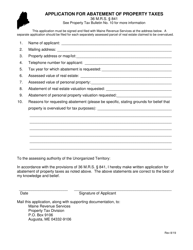

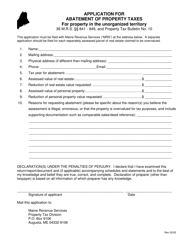

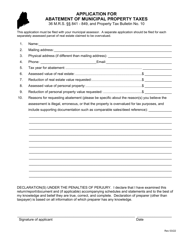

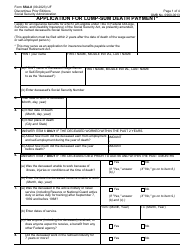

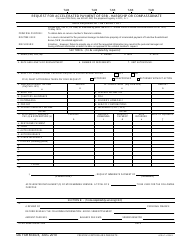

Application for Abatement Inability to Pay - Hardship or Poverty - Maine

Application for Abatement Inability to Pay - Hardship or Poverty is a legal document that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine.

FAQ

Q: What is an Application for Abatement Inability to Pay?

A: An Application for Abatement Inability to Pay is a request to reduce or eliminate tax liabilities due to financial hardship.

Q: What is meant by 'hardship or poverty' in this context?

A: 'Hardship or poverty' refers to a situation where an individual or household is unable to pay their tax liabilities due to financial struggles.

Q: Who can apply for an Application for Abatement Inability to Pay based on hardship or poverty in Maine?

A: Individuals or households in Maine who are experiencing financial hardship or poverty can apply for an Application for Abatement Inability to Pay.

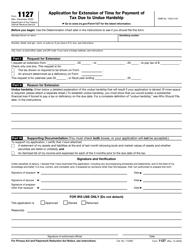

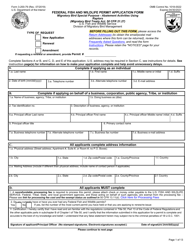

Q: How can I apply for an Application for Abatement Inability to Pay based on hardship or poverty in Maine?

A: To apply, you need to fill out the necessary forms provided by the Maine tax authorities and submit them along with relevant financial documentation.

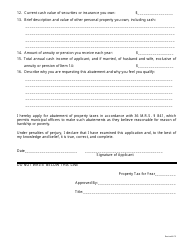

Q: What happens after I submit my Application for Abatement Inability to Pay based on hardship or poverty?

A: The tax authorities will review your application and the supporting documentation to assess your financial situation. They will then determine if you qualify for a reduction or elimination of your tax liabilities.

Q: Are there any specific eligibility criteria for this application?

A: Yes, there are specific eligibility criteria related to income, assets, and other factors. The Maine tax authorities will consider these criteria when evaluating your application.

Q: Will the information I provide on my Application for Abatement Inability to Pay be confidential?

A: Yes, generally the information you provide will be treated as confidential and will only be used for the purpose of assessing your eligibility for abatement based on hardship or poverty.

Q: Is there a deadline for submitting the application?

A: Yes, there is usually a deadline for submitting the Application for Abatement Inability to Pay. It is important to submit your application within the specified timeframe.

Q: What should I do if my application is approved?

A: If your application is approved, you may be granted a reduction or elimination of your tax liabilities based on your financial situation.

Q: What should I do if my application is denied?

A: If your application is denied, you may have options to appeal the decision or explore other avenues to address your tax liabilities.

Form Details:

- Released on April 1, 2015;

- The latest edition currently provided by the Maine Department of Administrative and Financial Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.