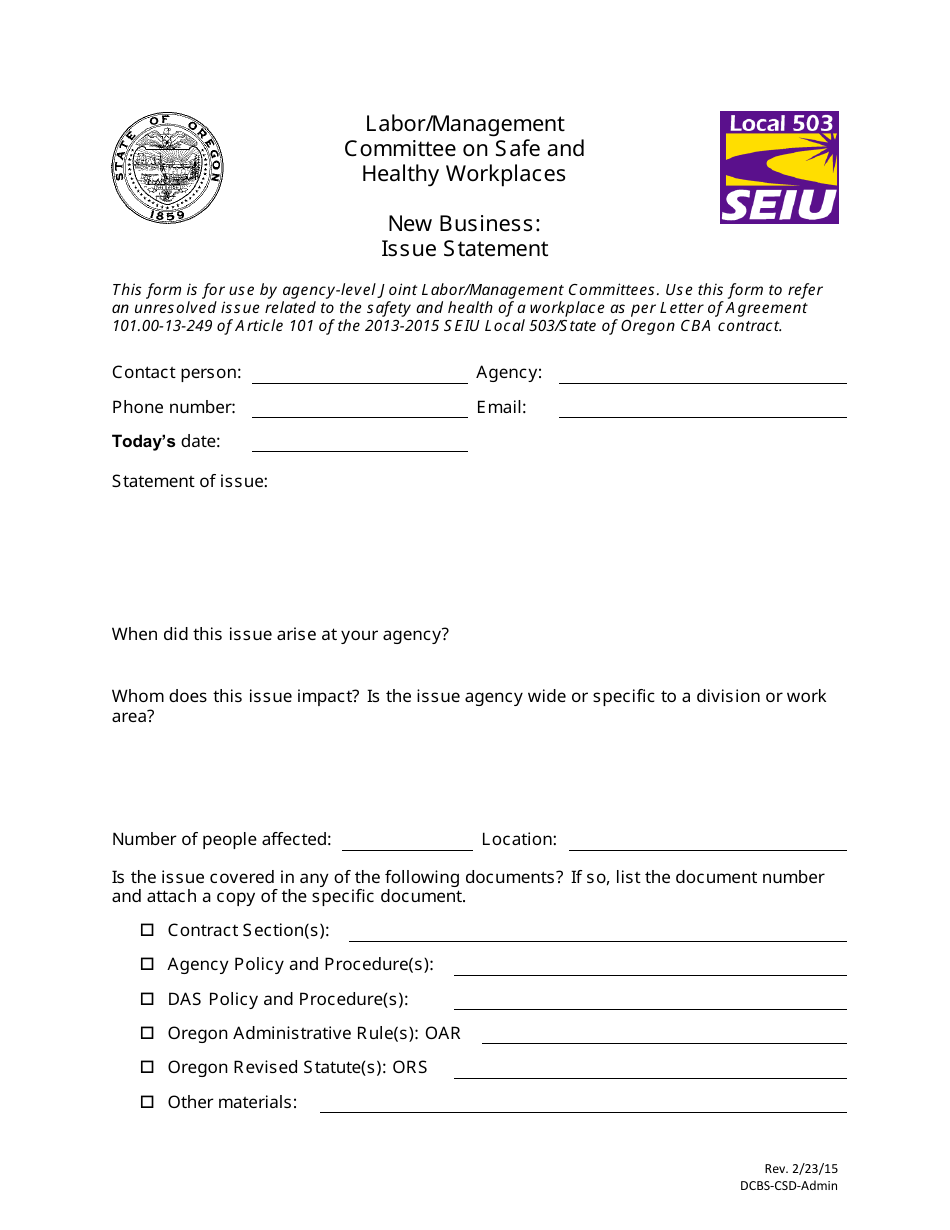

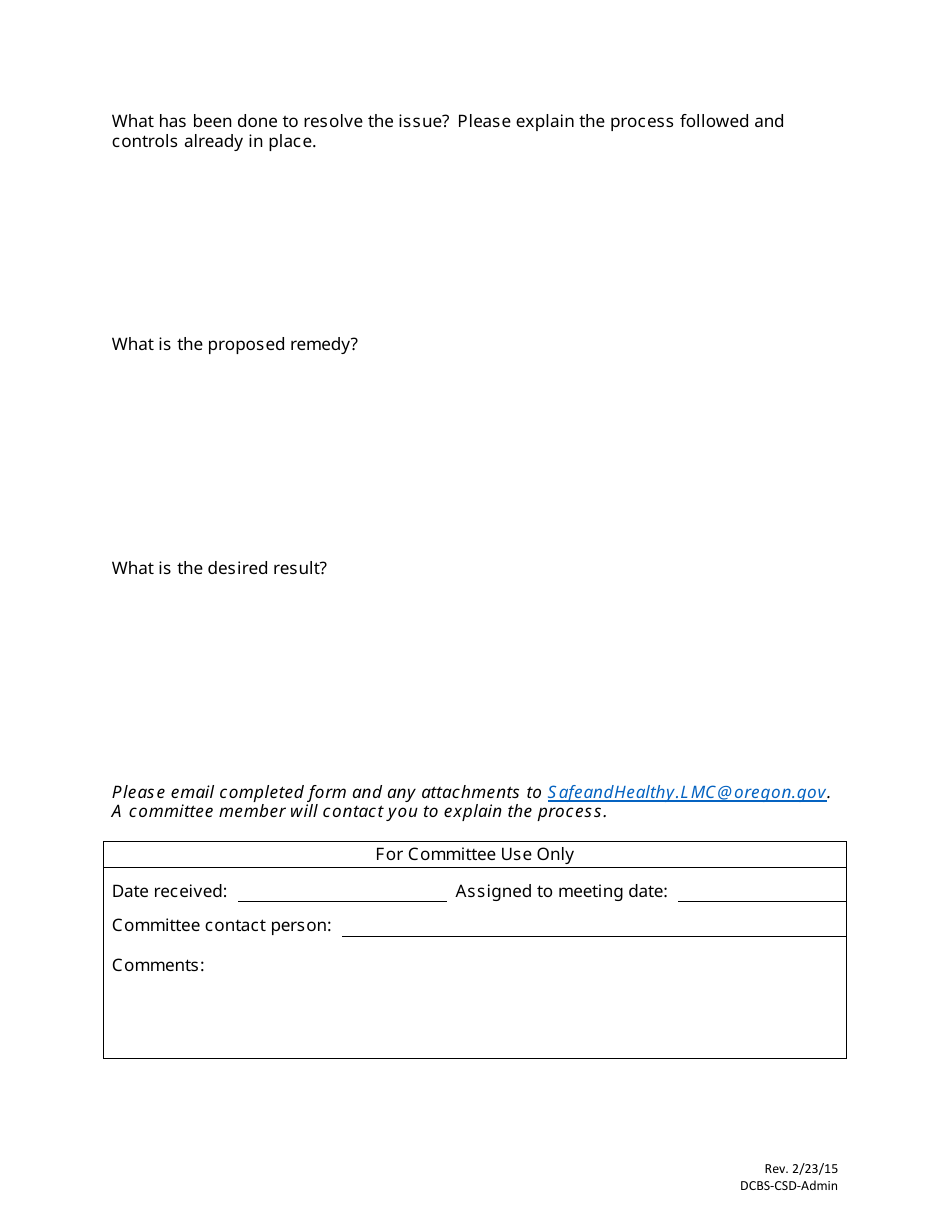

Issue Statement Form - New Business - Oregon

Issue Statement Form - New Business is a legal document that was released by the Oregon Department of Administrative Services - a government authority operating within Oregon.

FAQ

Q: How do I register my business in Oregon?

A: To register your business in Oregon, you need to file registration documents with the Oregon Secretary of State's office.

Q: What is the cost of registering a business in Oregon?

A: The cost of registering a business in Oregon varies based on the type of entity you are forming. The fees can range from $50 to $275.

Q: What types of business entities can I form in Oregon?

A: In Oregon, you can form various types of business entities, including sole proprietorships, partnerships, limited liability companies (LLCs), and corporations.

Q: Do I need a business license to operate in Oregon?

A: Depending on the type of business you have, you may need to obtain a state or local business license in Oregon. It's recommended to check with the relevant authorities or consult with a professional.

Q: Are there any specific regulations or permits required for certain types of businesses in Oregon?

A: Yes, certain types of businesses in Oregon may require specific regulations or permits. Examples include liquor licenses for establishments serving alcohol or permits for certain healthcare-related businesses. It's important to research and comply with the specific requirements for your industry.

Q: What are the tax obligations for businesses in Oregon?

A: Oregon has a corporate income tax and a state-wide transit tax. Additionally, businesses may be subject to other taxes such as payroll taxes, sales taxes, or property taxes. It's advisable to consult with a tax professional to understand your specific tax obligations.

Form Details:

- Released on February 23, 2015;

- The latest edition currently provided by the Oregon Department of Administrative Services;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of the form by clicking the link below or browse more documents and templates provided by the Oregon Department of Administrative Services.