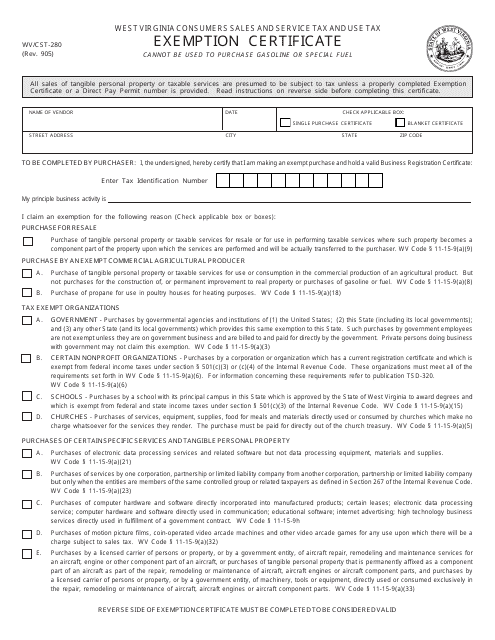

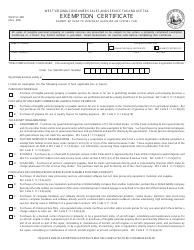

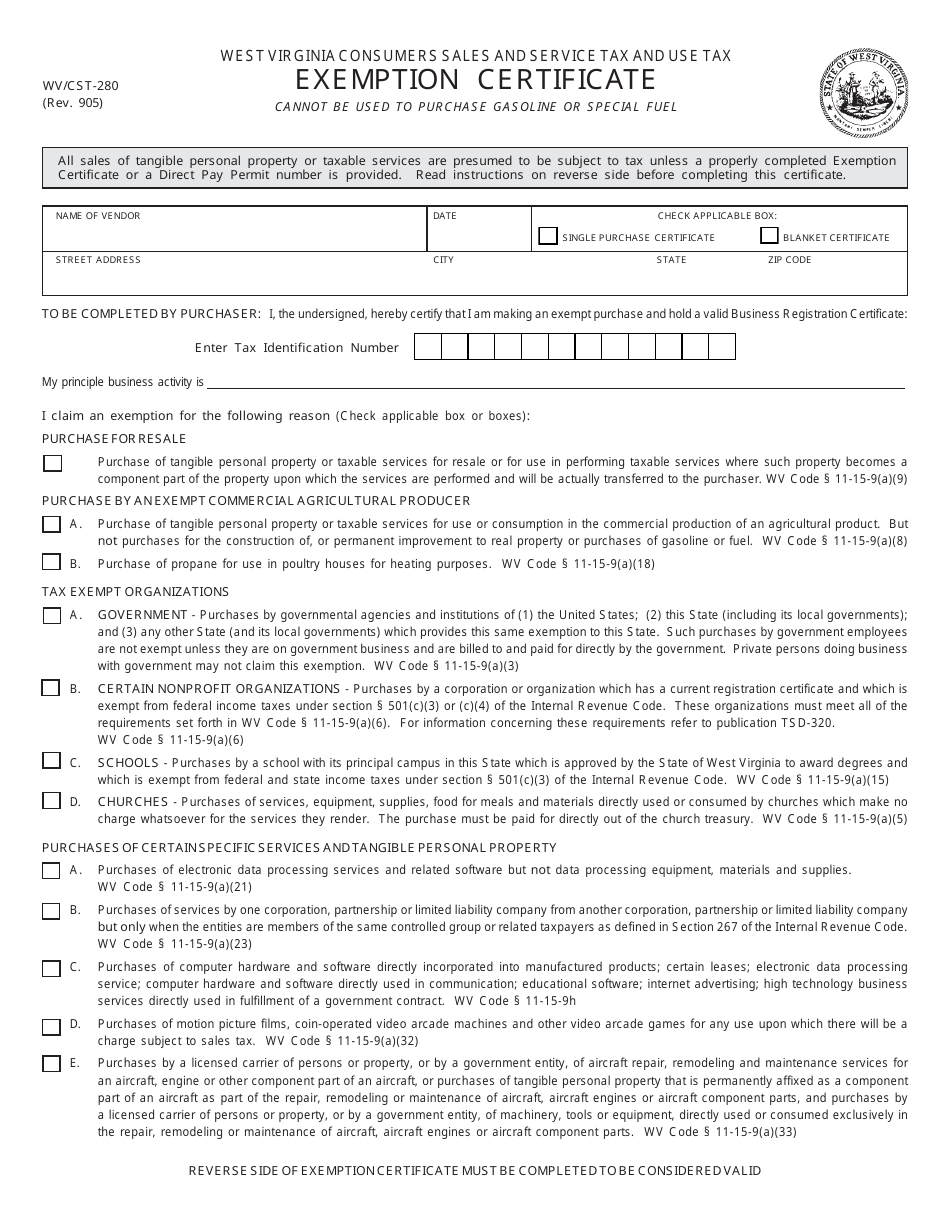

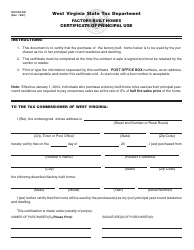

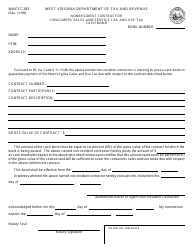

Form WV / CST-280 Exemption Certificate - West Virginia

What Is Form WV/CST-280?

Form WV/CST-280, Exemption Certificate , is used to claim exemption from paying sales tax on the purchase of tangible personal property or services which will be used for exempt purposes. These kinds of purchases are generally made by businesses that buy products for resale, by non-profit organizations. This form is only applicable to the state of West Virginia.

Alternate Name:

- West Virginia Tax Exemption Form.

This form was released by the West Virginia State Tax Department and the latest version was issued on . A WV Tax Exempt Form CST-280 fillable version is available for download below.

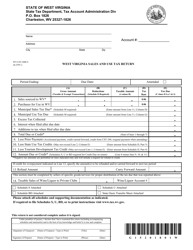

WV Tax Exempt Form Instructions

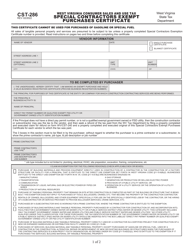

The instructions for filling in a WV Tax Exempt Form CST-280 are the following:

-

Fill out the name of the vendor and the date;

-

Choose the type of certificate requested. It can be a Single Purchase Certificate or a Blanket Certificate. A Single Certificate is used for one-time purchases and Blanket Certificates are used for a regular series of purchases;

-

Enter the address of the vendor;

-

The purchaser should fill out their tax identification number and indicate their principal business activity;

-

The purchaser should choose the reason for claiming an exemption:

-

Purchase for resale. There is only one option in this section, so check this box if it is applicable;

-

Purchase by an exempt commercial agricultural producer. There are two options to choose from in this section. Choose "A" if it is a purchase of tangible personal property for use in the commercial production of an agricultural product. Choose "B" if you buy propane and are going to use it in a poultry house for heating purposes.

-

Tax-exempt organizations. If the purchaser is a nonprofit organization, they should indicate its -type. It can be a government body, qualified nonprofit organization, school, or church;

-

Purchases of certain specific services and tangible personal property. Check the boxes from "A" to "E" depending on the type of products or services purchased:

- "A" if you buy electronic data processing services;

- "B" if it is a purchase of services by one corporation from another;

- "C" if you buy a certain type of computer software, internet advertising;

- "D" if it is a purchase of motion picture films;

- "E" if it is a purchase connected with aircraft.

-

-

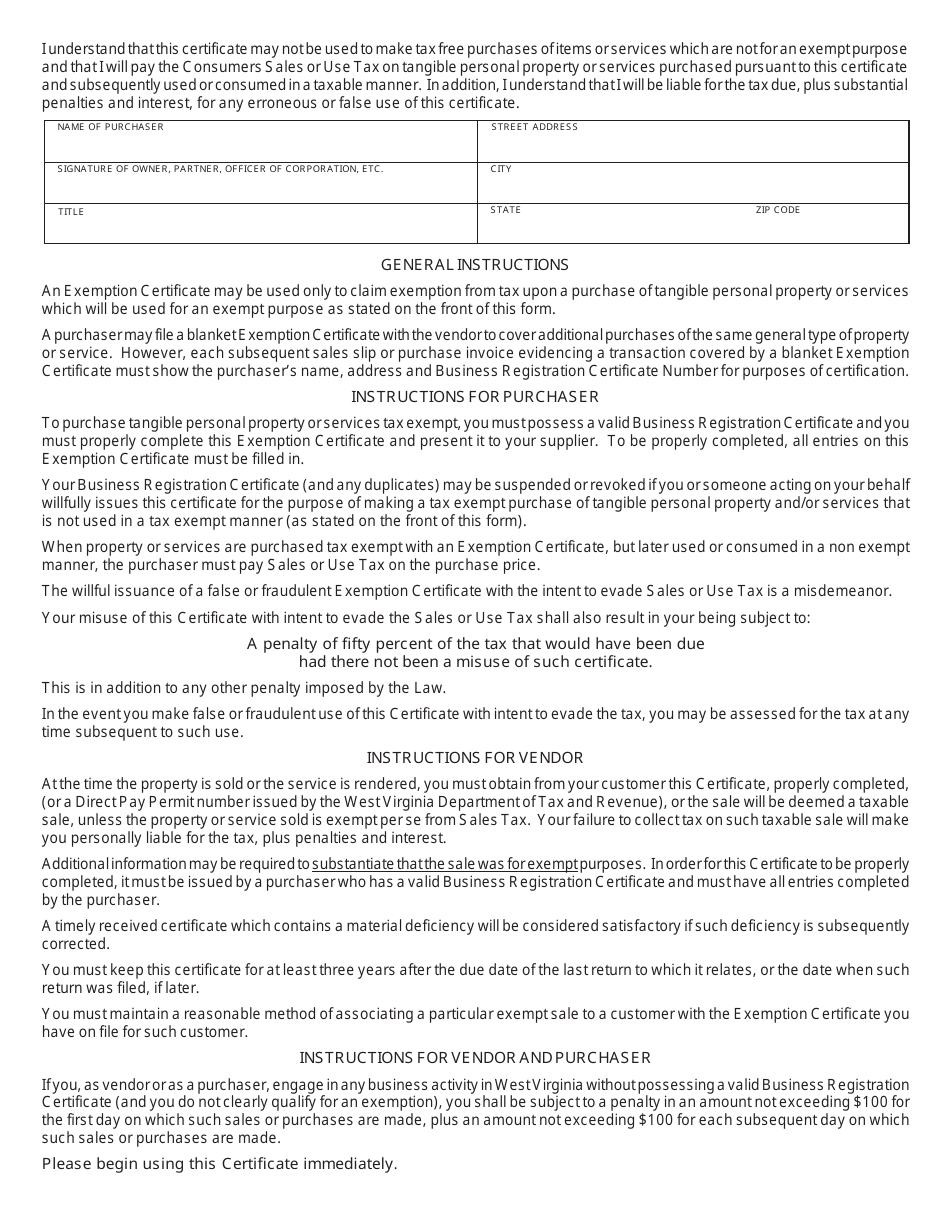

Enter the name of the purchaser and their address;

-

Signature of the owner or partner of the corporation.