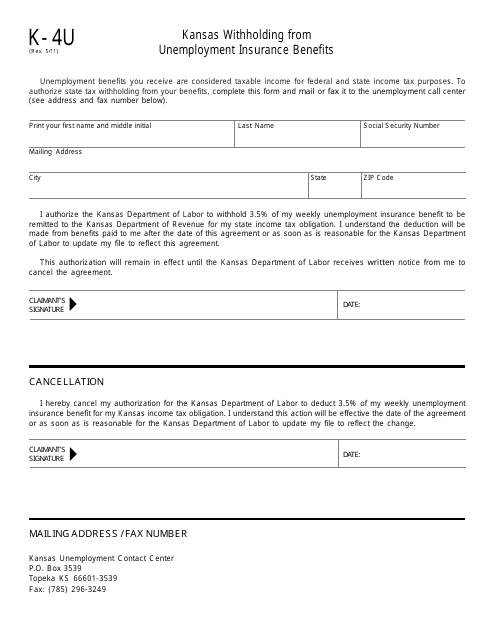

Form K-4U Kansas Withholding Allowance From Unemployment Benefits - Kansas

What Is Form K-4U?

This is a legal form that was released by the Kansas Department of Revenue - a government authority operating within Kansas. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form K-4U?

A: Form K-4U is the Kansas Withholding Allowance From Unemployment Benefits form.

Q: Who needs to complete Form K-4U?

A: Individuals who are receiving unemployment benefits in Kansas need to complete Form K-4U.

Q: What is the purpose of Form K-4U?

A: The purpose of Form K-4U is to determine the amount of Kansas state income tax to withhold from unemployment benefits.

Q: Do I have to complete Form K-4U every year?

A: No, you only need to complete Form K-4U once, unless there are changes to your withholding allowances or you stop receiving unemployment benefits.

Q: Are there any instructions for completing Form K-4U?

A: Yes, instructions for completing Form K-4U are provided on the form itself.

Q: Can I make changes to my withholding allowances after submitting Form K-4U?

A: Yes, you can make changes to your withholding allowances by submitting a new Form K-4U.

Q: What happens if I don't submit Form K-4U?

A: If you don't submit Form K-4U, the default withholding rate of 5% will be applied to your unemployment benefits.

Form Details:

- Released on May 1, 2011;

- The latest edition provided by the Kansas Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form K-4U by clicking the link below or browse more documents and templates provided by the Kansas Department of Revenue.