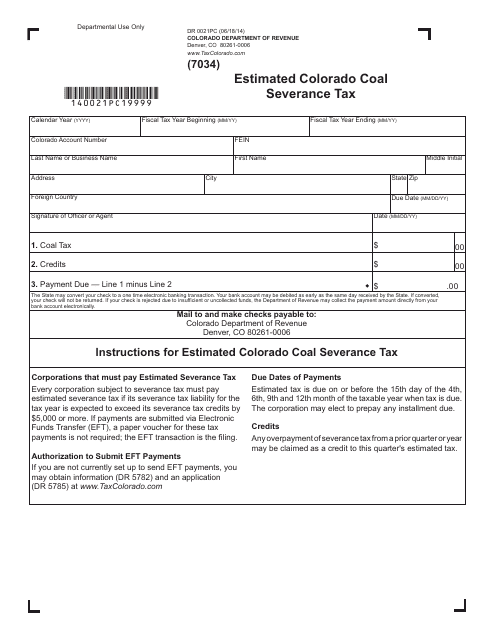

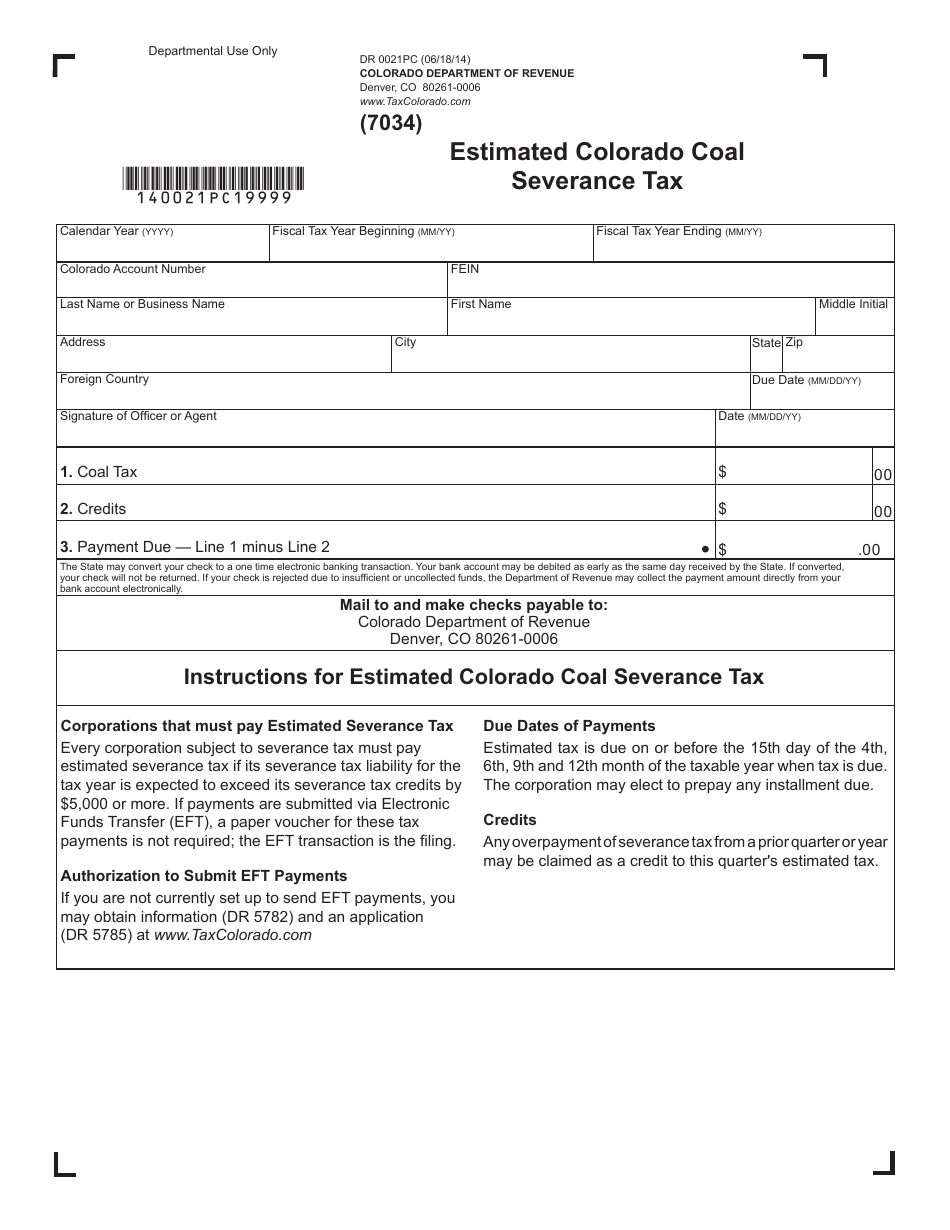

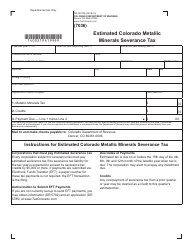

Form DR0021PC Estimated Colorado Coal Severance Tax - Colorado

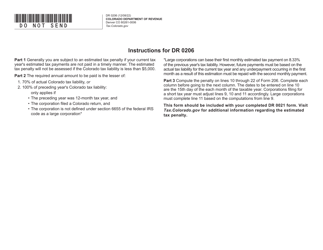

What Is Form DR0021PC?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0021PC?

A: Form DR0021PC is the form used to estimate the Colorado Coal Severance Tax.

Q: What is the Colorado Coal Severance Tax?

A: The Colorado Coal Severance Tax is a tax on the extraction of coal in the state of Colorado.

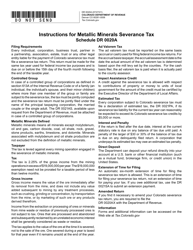

Q: Who needs to file Form DR0021PC?

A: Anyone who is engaged in the extraction of coal in Colorado and meets the threshold for the tax is required to file Form DR0021PC.

Q: How often is Form DR0021PC filed?

A: Form DR0021PC is filed on a monthly basis.

Q: How is the Colorado Coal Severance Tax calculated?

A: The Colorado Coal Severance Tax is based on the weight of the coal extracted and the current tax rate set by the state.

Form Details:

- Released on June 18, 2014;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR0021PC by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.