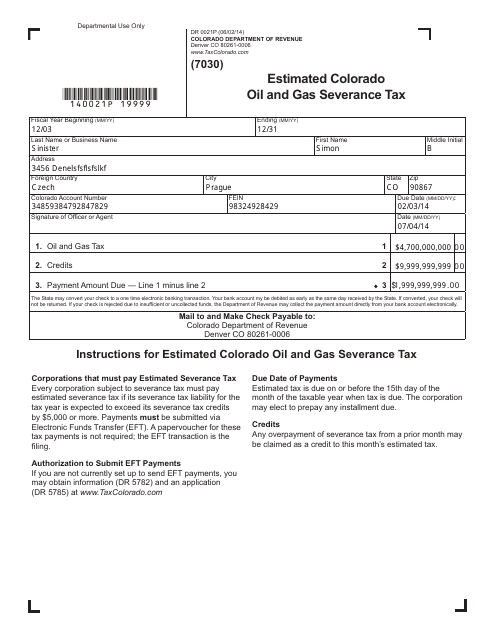

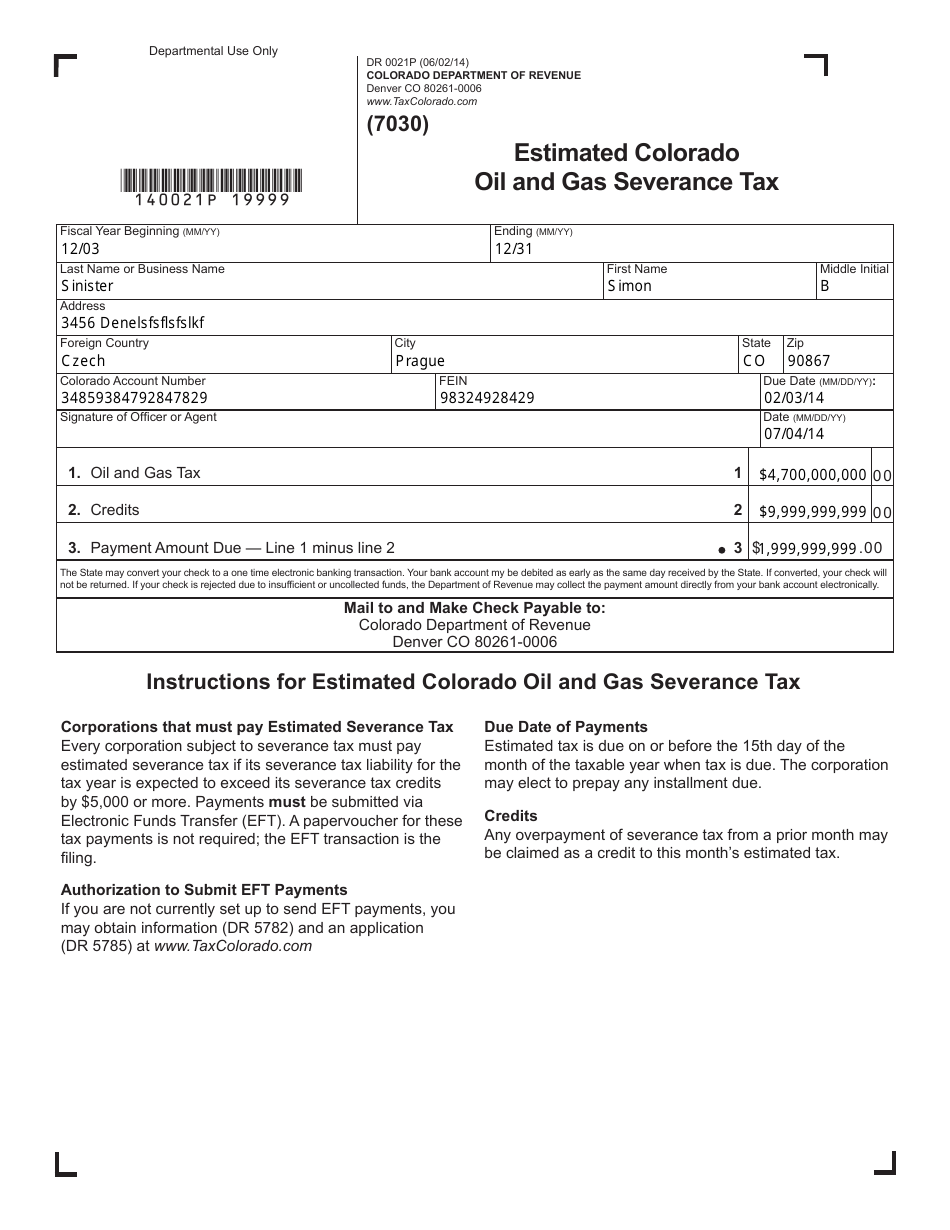

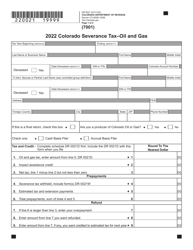

Form DR0021P Estimated Colorado Oil and Gas Severance Tax - Colorado

What Is Form DR0021P?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0021P?

A: Form DR0021P is the Estimated Colorado Oil and Gas Severance Tax form for the state of Colorado.

Q: What is the purpose of Form DR0021P?

A: The purpose of Form DR0021P is to estimate and report the Colorado Oil and Gas Severance Tax owed by oil and gas producers in Colorado.

Q: Who needs to file Form DR0021P?

A: Oil and gas producers in Colorado are required to file Form DR0021P to estimate and report their severance tax owed.

Q: How often do you need to file Form DR0021P?

A: Form DR0021P needs to be filed on a monthly basis.

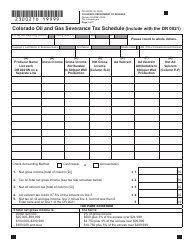

Q: What information do you need to complete Form DR0021P?

A: You will need to provide information about your oil and gas production, including the total volume and value of the produced oil and gas, as well as any applicable exemptions.

Q: When is the deadline to file Form DR0021P?

A: Form DR0021P must be filed and the tax paid by the 15th day of the month following the production month.

Form Details:

- Released on June 2, 2014;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0021P by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.