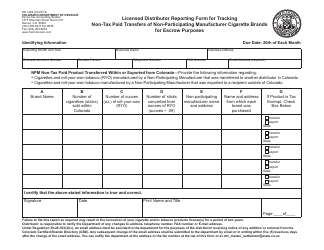

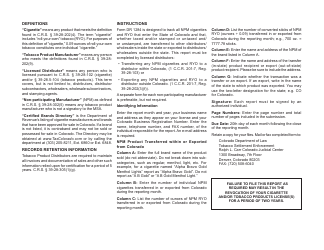

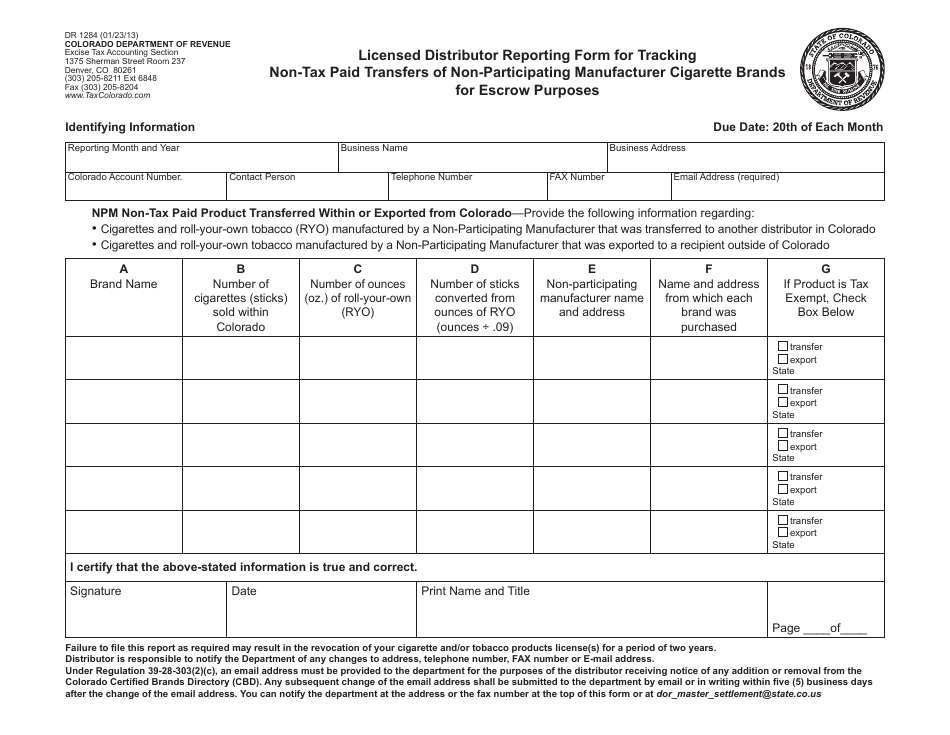

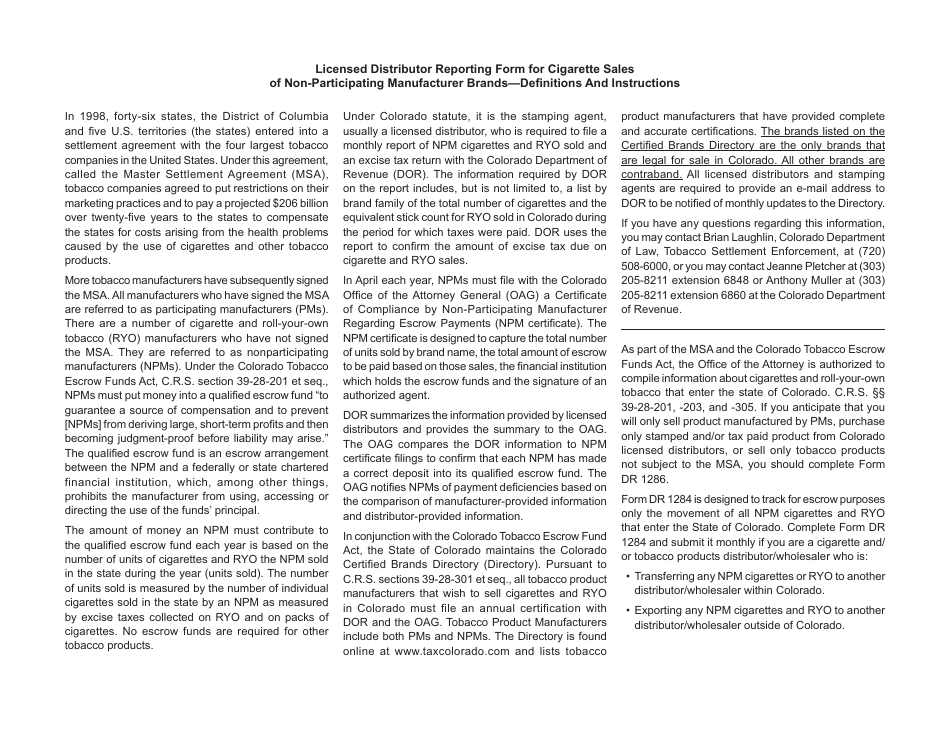

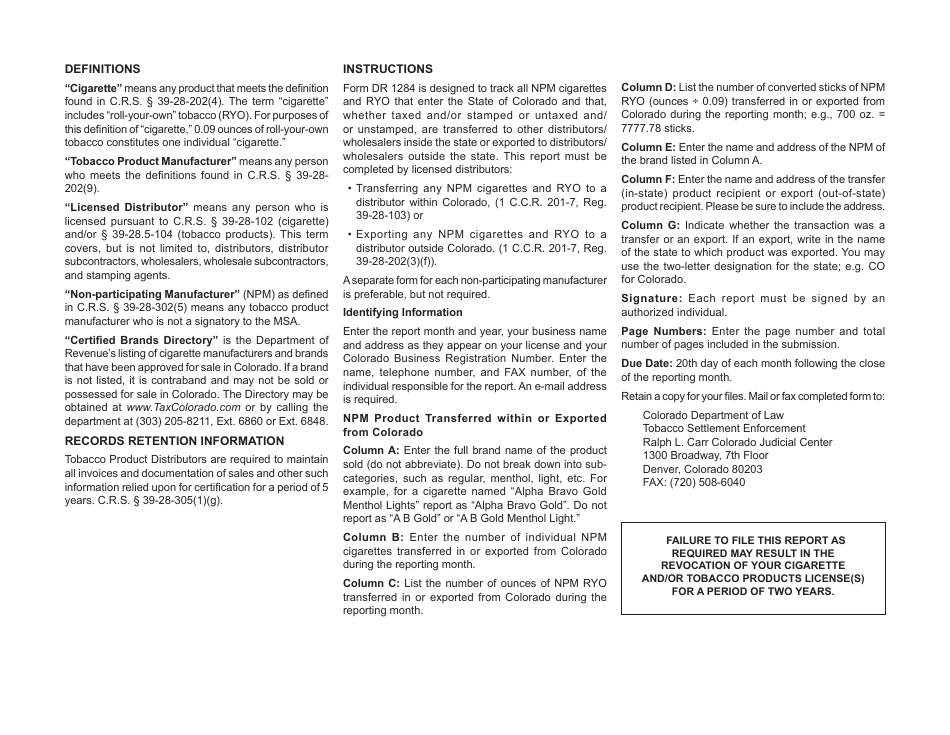

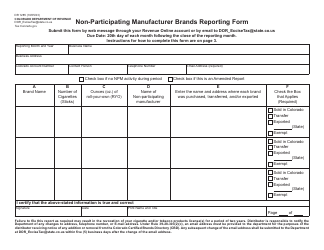

Form DR1284 Licensed Distributor Reporting Form for Tracking Non-tax Paid Transfers of Non-participating Manufacturer Cigarette Brands for Escrow Purposes - Colorado

What Is Form DR1284?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR1284?

A: Form DR1284 is a reporting form used in Colorado to track non-tax paid transfers of non-participating manufacturer cigarette brands for escrow purposes.

Q: Who is required to file Form DR1284?

A: Licensed distributors in Colorado are required to file Form DR1284.

Q: What is the purpose of Form DR1284?

A: The purpose of Form DR1284 is to track non-tax paid transfers of non-participating manufacturer cigarette brands for escrow purposes.

Q: What does 'non-tax paid transfers' mean?

A: 'Non-tax paid transfers' refer to the movement of cigarette brands that have not had taxes paid on them.

Q: What are non-participating manufacturer cigarette brands?

A: Non-participating manufacturer cigarette brands are brands that do not participate in the state's tobacco settlement agreement.

Form Details:

- Released on January 23, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DR1284 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.