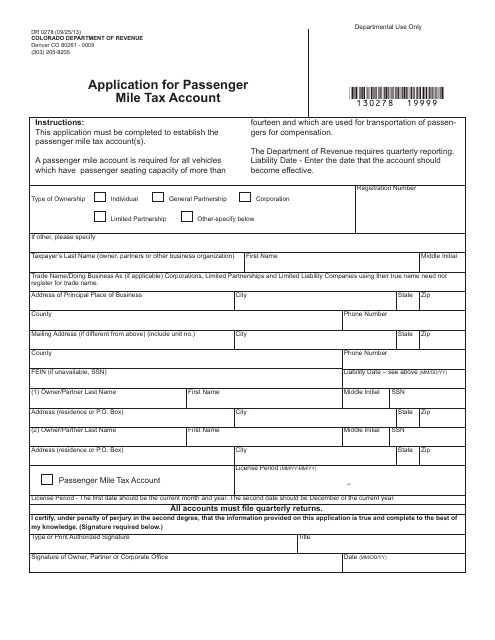

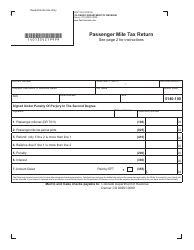

Form DR0278 Application for Passenger Mile Tax Account - Colorado

What Is Form DR0278?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0278?

A: Form DR0278 is the Application for Passenger Mile Tax Account in Colorado.

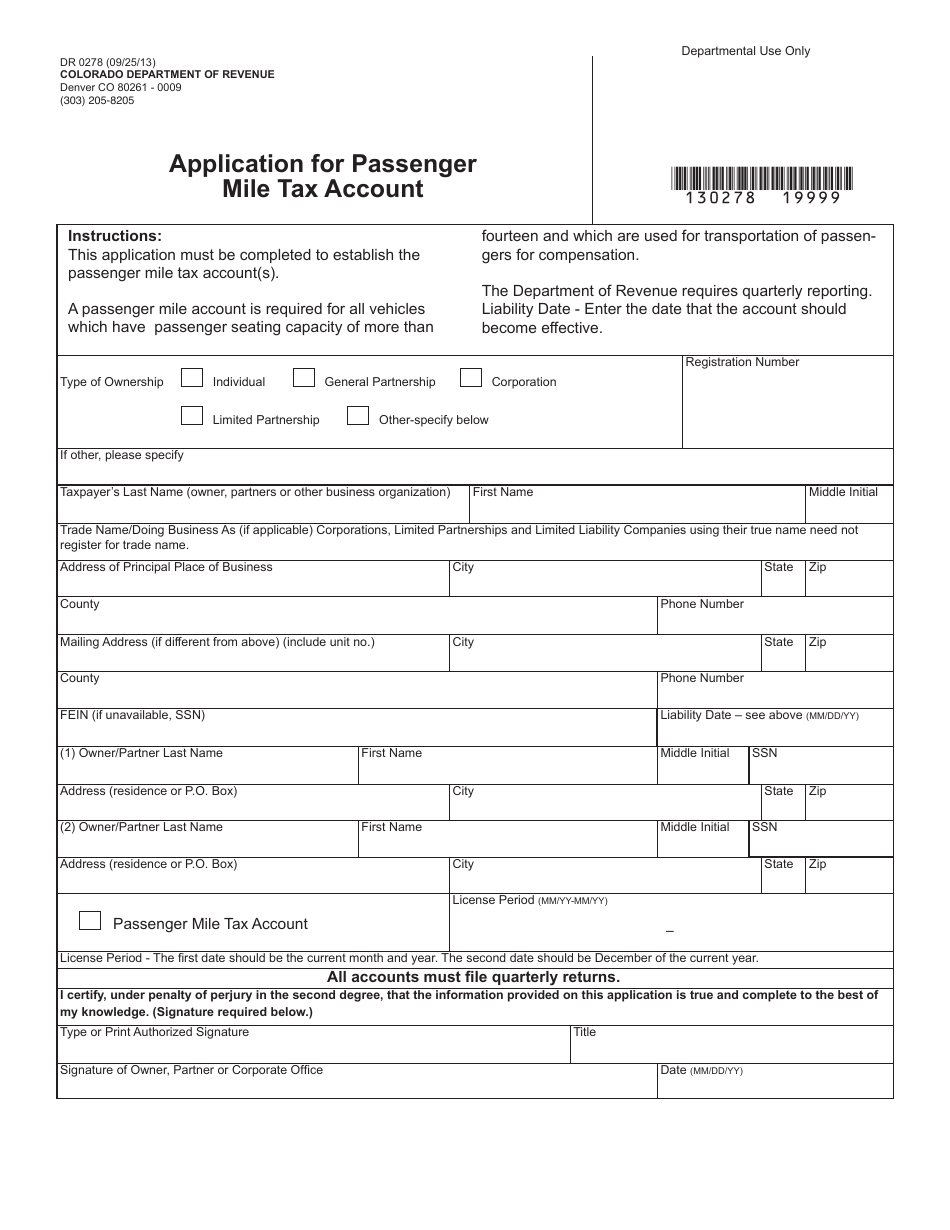

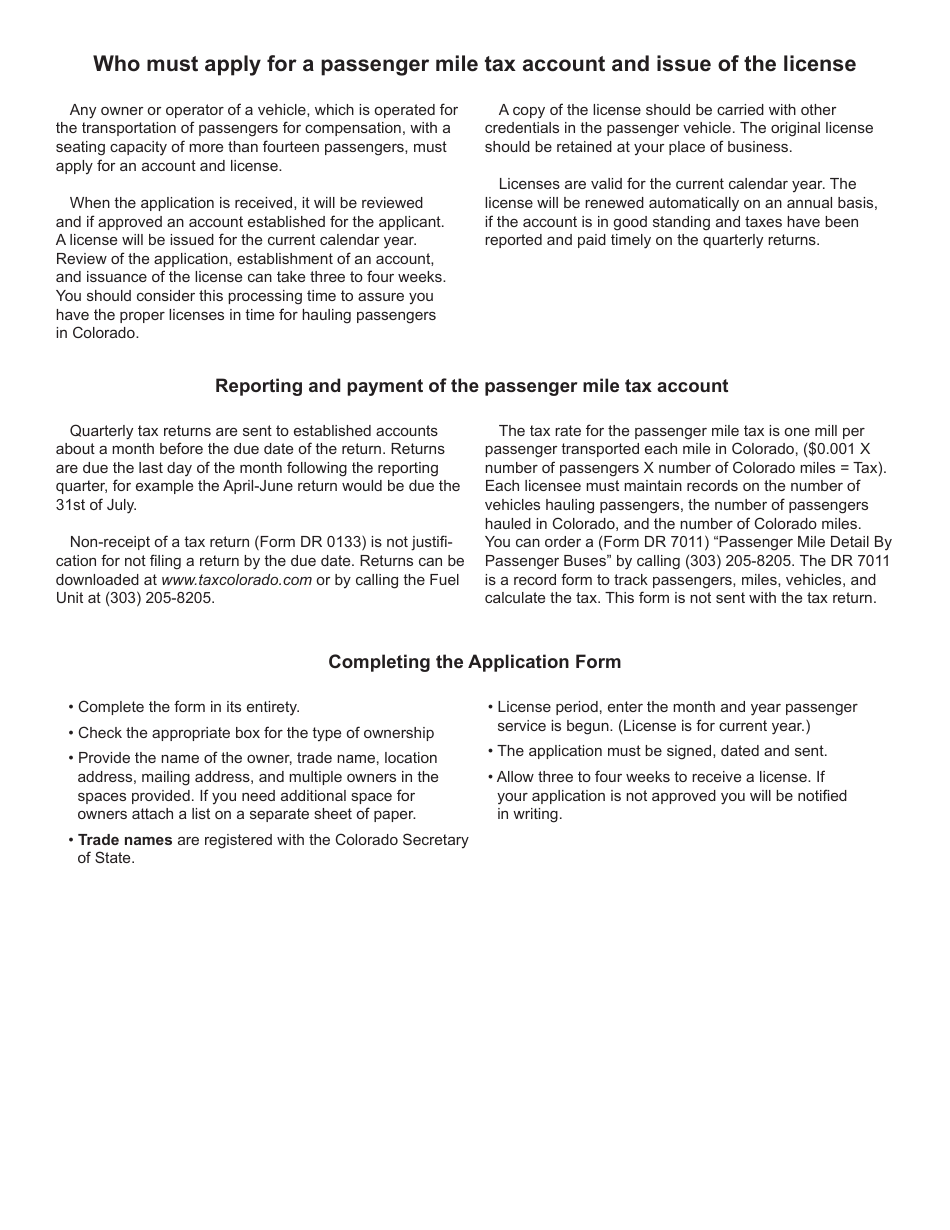

Q: Who needs to file Form DR0278?

A: Any individual or business that operates a qualifying vehicle on Colorado highways and is subject to the passenger mile tax needs to file Form DR0278.

Q: What is the purpose of the Passenger Mile Tax?

A: The Passenger Mile Tax is imposed on persons who operate vehicles for hire with a seating capacity of 16 or more passengers.

Q: How do I apply for a Passenger Mile Tax Account?

A: To apply for a Passenger Mile Tax Account, you will need to complete and submit Form DR0278 to the Colorado Department of Revenue.

Q: Are there any fees for applying for a Passenger Mile Tax Account?

A: Yes, there is a $10 annual fee to establish and maintain a Passenger Mile Tax Account.

Q: What information do I need to provide on Form DR0278?

A: On Form DR0278, you will need to provide information about your business, vehicle details, estimated number of miles traveled per quarter, and other relevant information.

Q: When do I need to file Form DR0278?

A: You need to file Form DR0278 before operating a qualifying vehicle on Colorado highways subject to the passenger mile tax.

Form Details:

- Released on September 25, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0278 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.