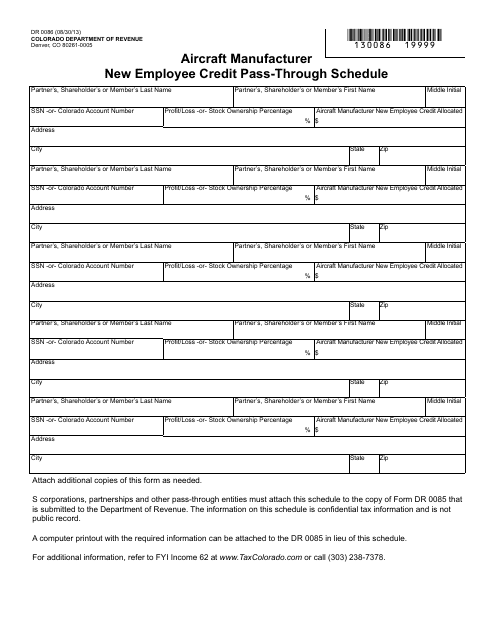

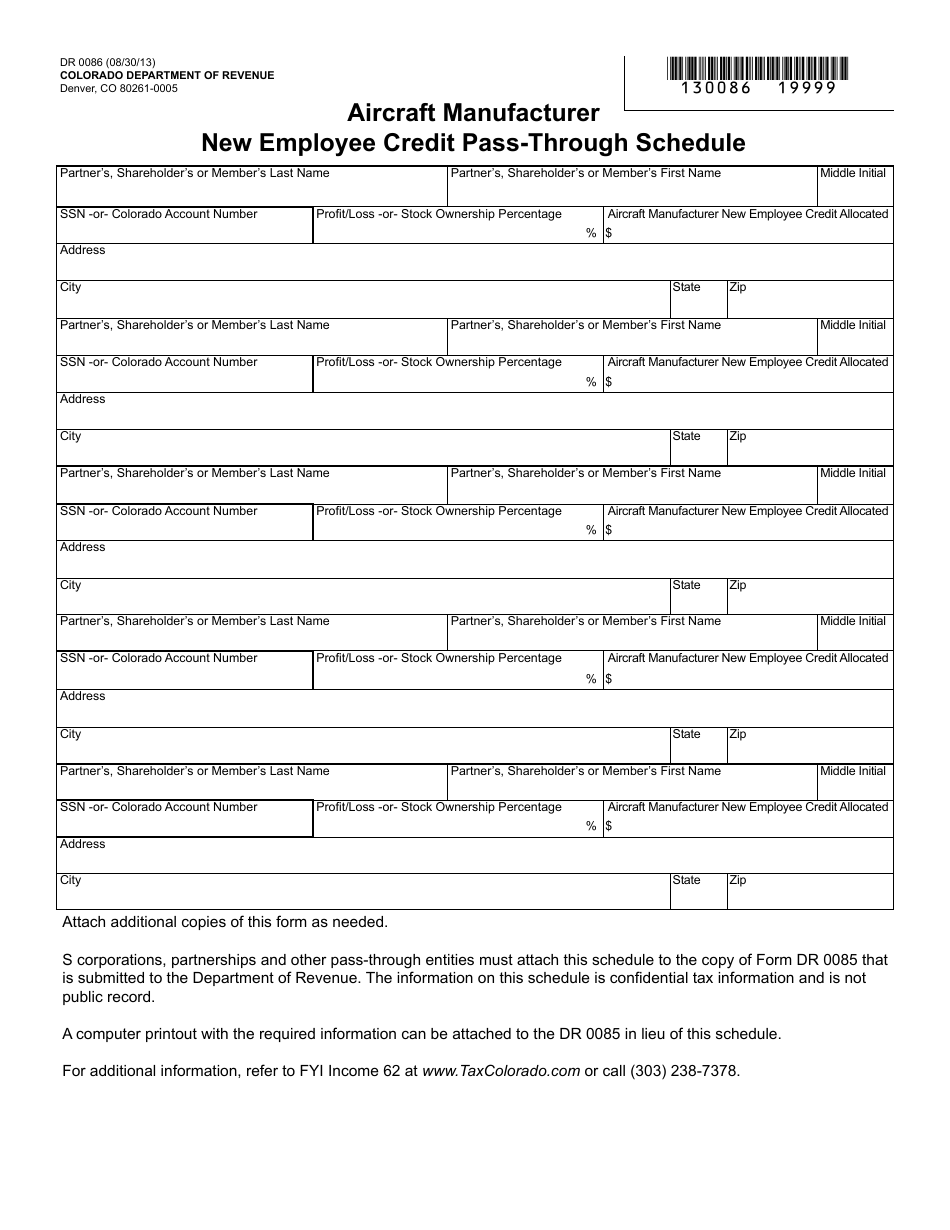

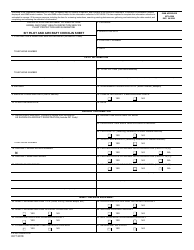

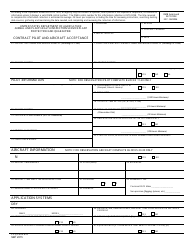

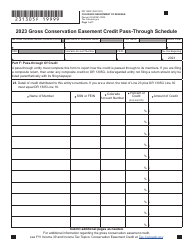

Form DR0086 Aircraft Manufacturer New Employee Credit Pass-Through Schedule - Colorado

What Is Form DR0086?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0086?

A: Form DR0086 is the Aircraft Manufacturer New Employee Credit Pass-Through Schedule specific to Colorado.

Q: Who is this form for?

A: This form is for aircraft manufacturers in Colorado who want to claim the New Employee Credit Pass-Through.

Q: What is the purpose of this form?

A: The purpose of this form is to allow aircraft manufacturers in Colorado to pass through the New Employee Credit to their owners, shareholders, partners, or members.

Q: What is the New Employee Credit?

A: The New Employee Credit is a tax credit provided to aircraft manufacturers who hire new employees.

Q: Who can the credit be passed through to?

A: The credit can be passed through to the owners, shareholders, partners, or members of the aircraft manufacturer.

Q: How should the form be filled out?

A: The form should be filled out by providing the necessary information about the credit and the pass-through recipients.

Q: Is this form required for all aircraft manufacturers in Colorado?

A: No, this form is only required for aircraft manufacturers who want to claim the New Employee Credit Pass-Through.

Form Details:

- Released on August 30, 2013;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0086 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.