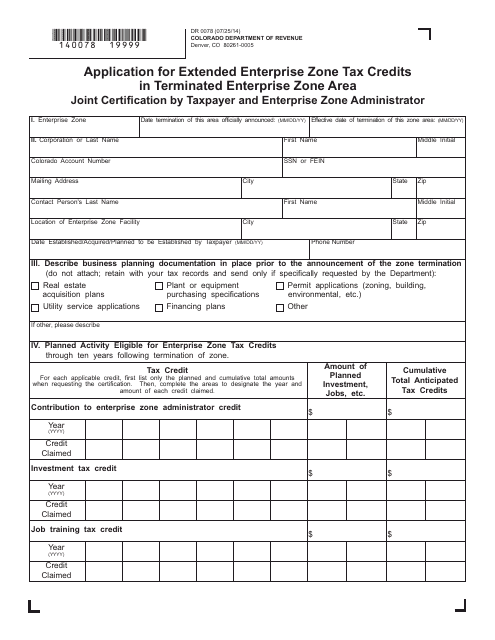

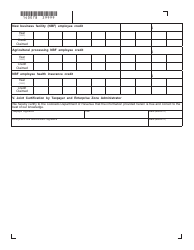

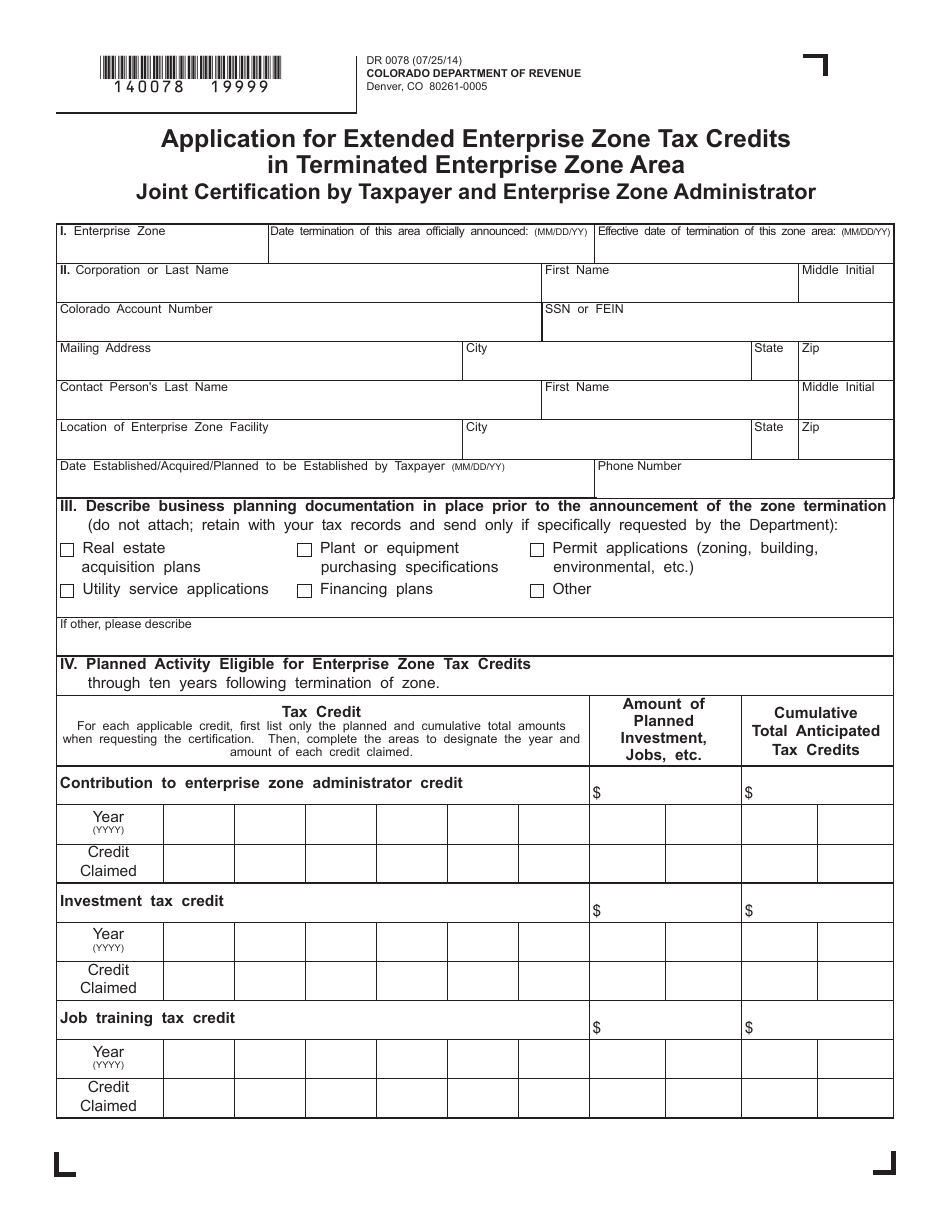

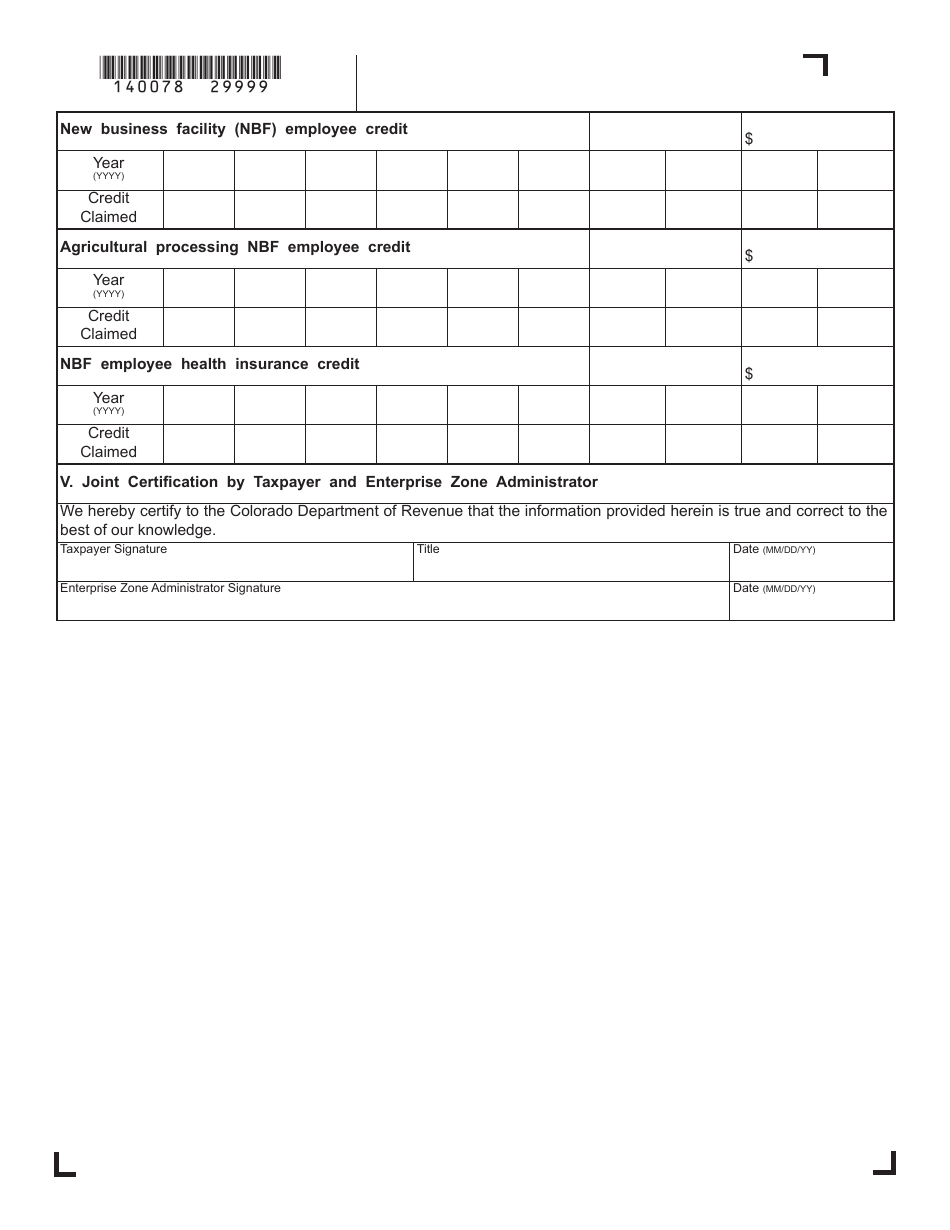

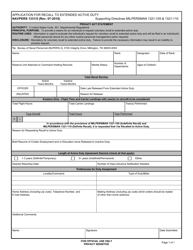

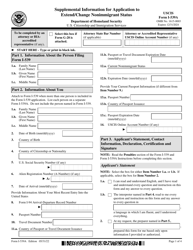

Form DR0078 Application for Extended Enterprise Zone Tax Credits in Terminated Enterprise Zone Area - Joint Certification by Taxpayer and Enterprise Zone Administrator - Colorado

What Is Form DR0078?

This is a legal form that was released by the Colorado Department of Revenue - a government authority operating within Colorado. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DR0078?

A: Form DR0078 is an application for extended enterprise zonetax credits in a terminated enterprise zone area in Colorado.

Q: Who is required to fill out Form DR0078?

A: Both the taxpayer and the enterprise zone administrator are required to jointly certify and complete Form DR0078.

Q: What is an extended enterprise zone tax credit?

A: An extended enterprise zone tax credit is a tax incentive provided to businesses operating in a terminated enterprise zone area to promote economic development.

Q: What is the purpose of Form DR0078?

A: The purpose of Form DR0078 is to apply for extended enterprise zone tax credits in a terminated enterprise zone area in Colorado.

Form Details:

- Released on July 25, 2014;

- The latest edition provided by the Colorado Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form DR0078 by clicking the link below or browse more documents and templates provided by the Colorado Department of Revenue.