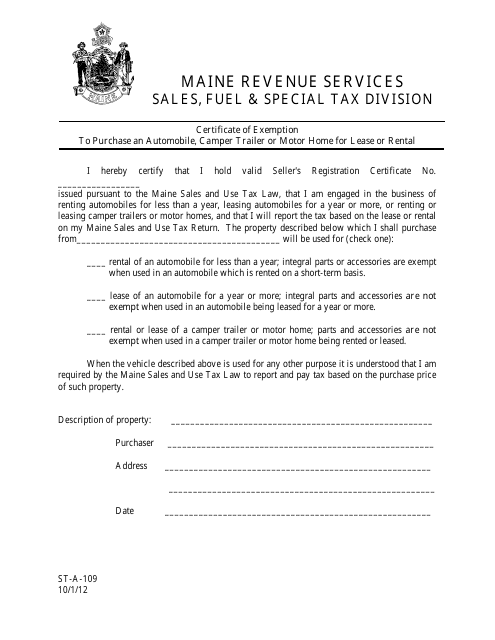

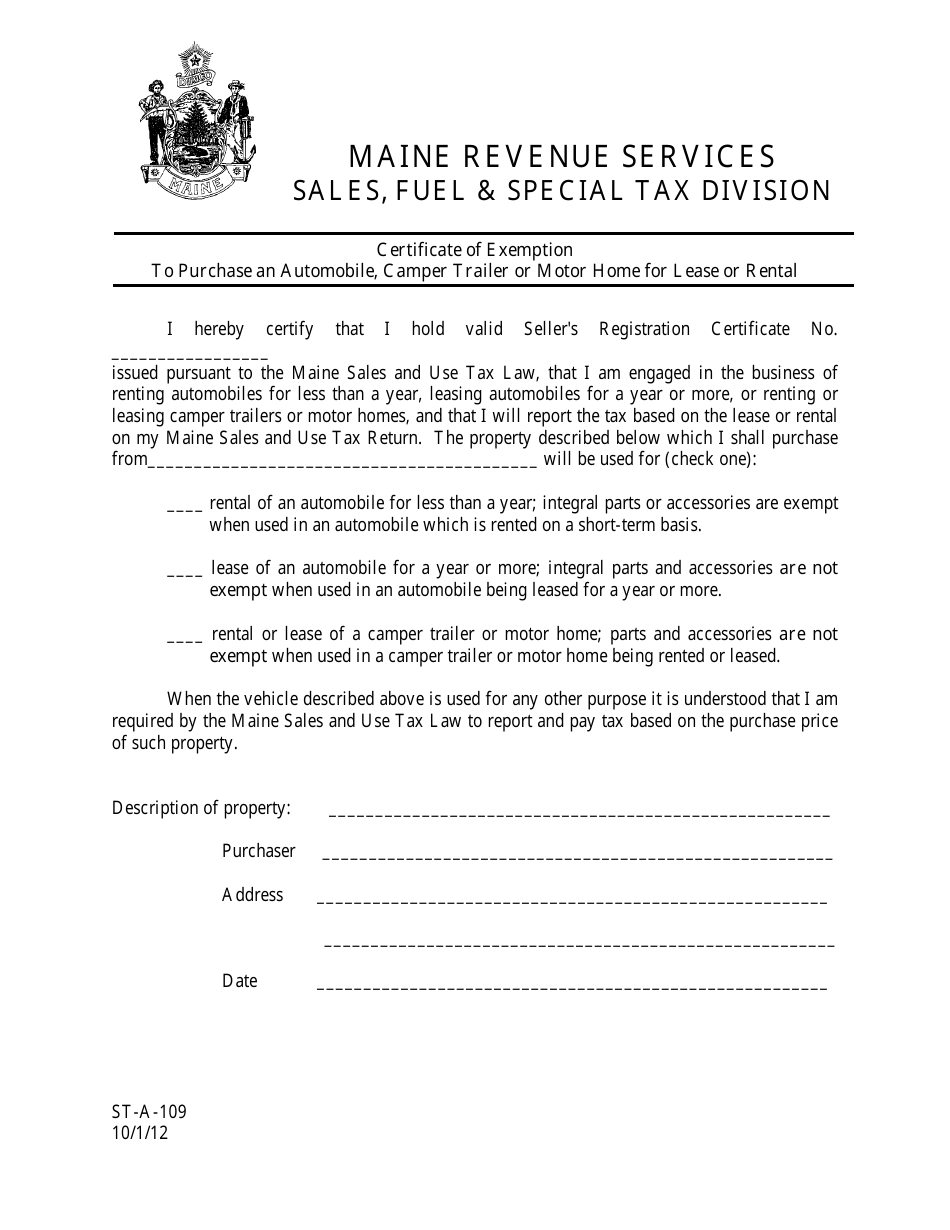

Form ST-A-109 Certificate of Exemption to Purchase an Automobile, Camper Trailer or Motor Home for Lease or Rental - Maine

What Is Form ST-A-109?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-A-109?

A: Form ST-A-109 is a Certificate of Exemption to Purchase an Automobile, Camper Trailer or Motor Home for Lease or Rental in Maine.

Q: Who needs to fill out Form ST-A-109?

A: Anyone who is purchasing an automobile, camper trailer, or motor home for lease or rental purposes in Maine needs to fill out Form ST-A-109.

Q: What is the purpose of Form ST-A-109?

A: The purpose of Form ST-A-109 is to claim an exemption from sales tax when purchasing an automobile, camper trailer, or motor home for lease or rental.

Q: What information do I need to provide on Form ST-A-109?

A: You will need to provide your name, address, business information, and details about the vehicle or camper trailer you are purchasing.

Q: How do I submit Form ST-A-109?

A: You can submit Form ST-A-109 by mail or in person to the Maine Revenue Services office.

Q: Is there a fee for filing Form ST-A-109?

A: No, there is no fee for filing Form ST-A-109.

Q: Are there any other requirements for claiming the exemption?

A: Yes, you must be engaged in the business of leasing or renting automobiles, camper trailers, or motor homes, and the vehicle must be transferred within 12 months of purchase.

Q: What happens after I submit Form ST-A-109?

A: After submitting Form ST-A-109, you will receive a Certificate of Exemption if your application is approved. You can then use this certificate to purchase the vehicle without paying sales tax.

Form Details:

- Released on October 1, 2012;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-A-109 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.