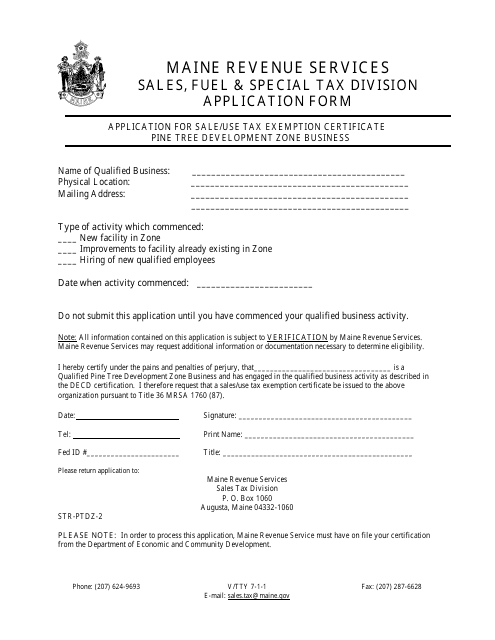

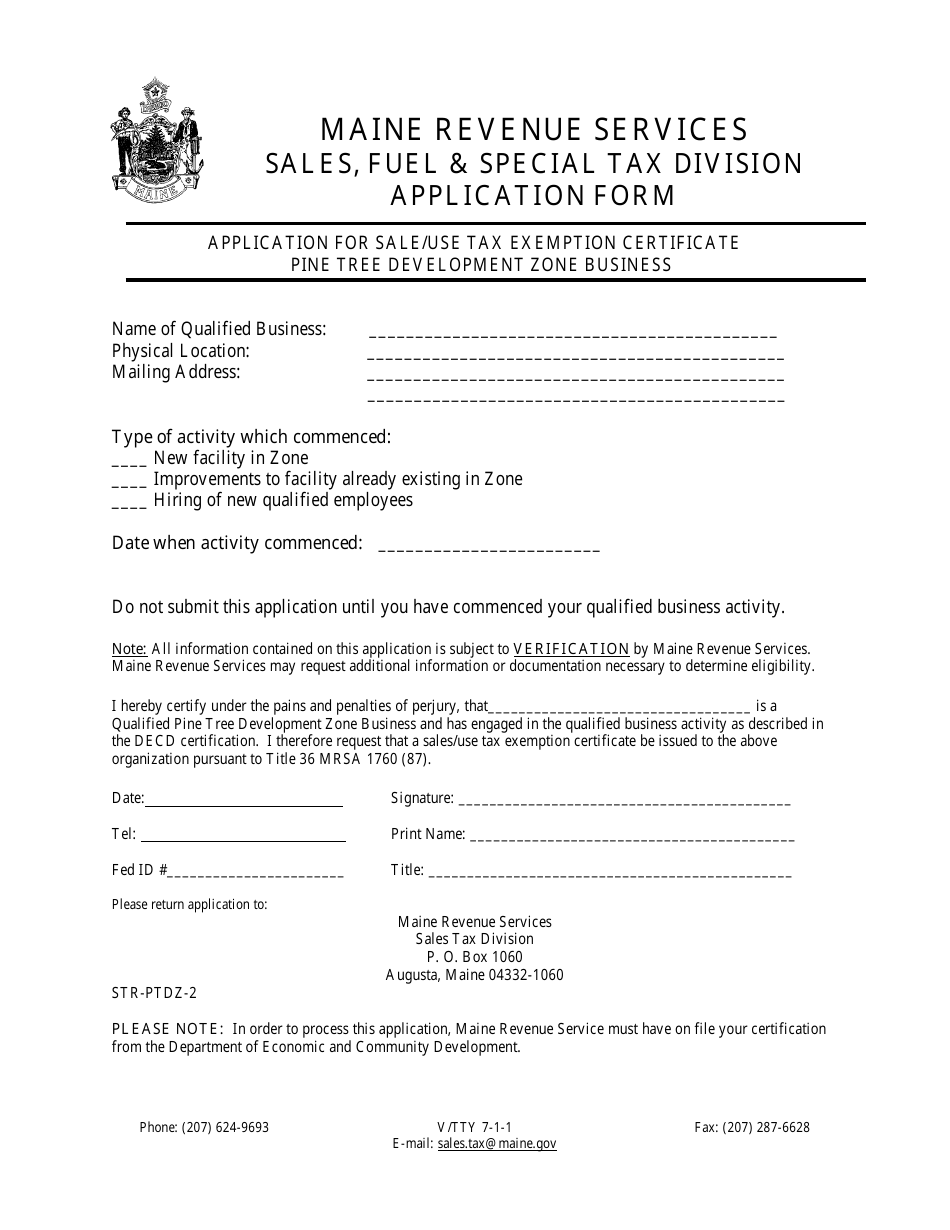

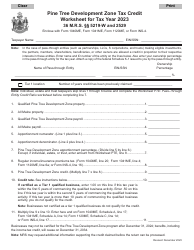

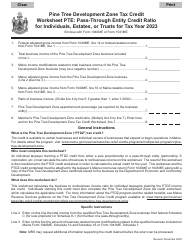

Form STR-PTDZ-2 Application for Sale / Use Tax Exemption Certificate - Pine Tree Development Zone Business - Maine

What Is Form STR-PTDZ-2?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form STR-PTDZ-2?

A: Form STR-PTDZ-2 is an application for Sale/Use Tax Exemption Certificate for Pine Tree Development Zone Business in Maine.

Q: Who is eligible to use form STR-PTDZ-2?

A: Pine Tree Development Zone Businesses in Maine are eligible to use form STR-PTDZ-2.

Q: What is the purpose of form STR-PTDZ-2?

A: The purpose of form STR-PTDZ-2 is to apply for a Sale/Use Tax Exemption Certificate for Pine Tree Development Zone Businesses.

Q: Is there a fee to file form STR-PTDZ-2?

A: No, there is no fee to file form STR-PTDZ-2.

Q: When should I file form STR-PTDZ-2?

A: Form STR-PTDZ-2 should be filed before making any qualifying purchases for which you are seeking a tax exemption.

Q: What documents should I include with form STR-PTDZ-2?

A: You should include supporting documentation such as a business license, proof of Pine Tree Development Zone status, and any other relevant documents.

Q: How long does it take to process form STR-PTDZ-2?

A: The processing time for form STR-PTDZ-2 varies, but you should allow sufficient time for the application to be reviewed and processed.

Q: What happens after my form STR-PTDZ-2 is approved?

A: If your form STR-PTDZ-2 is approved, you will receive a Sale/Use Tax Exemption Certificate for your Pine Tree Development Zone Business in Maine.

Form Details:

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form STR-PTDZ-2 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.