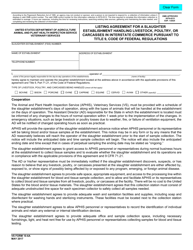

This version of the form is not currently in use and is provided for reference only. Download this version of

Form ST-A-111

for the current year.

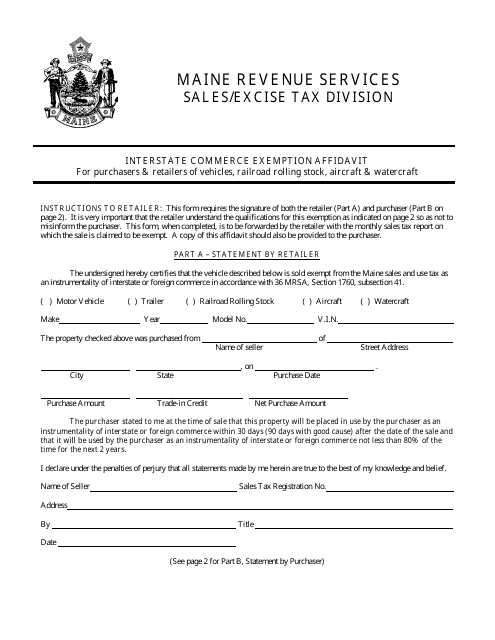

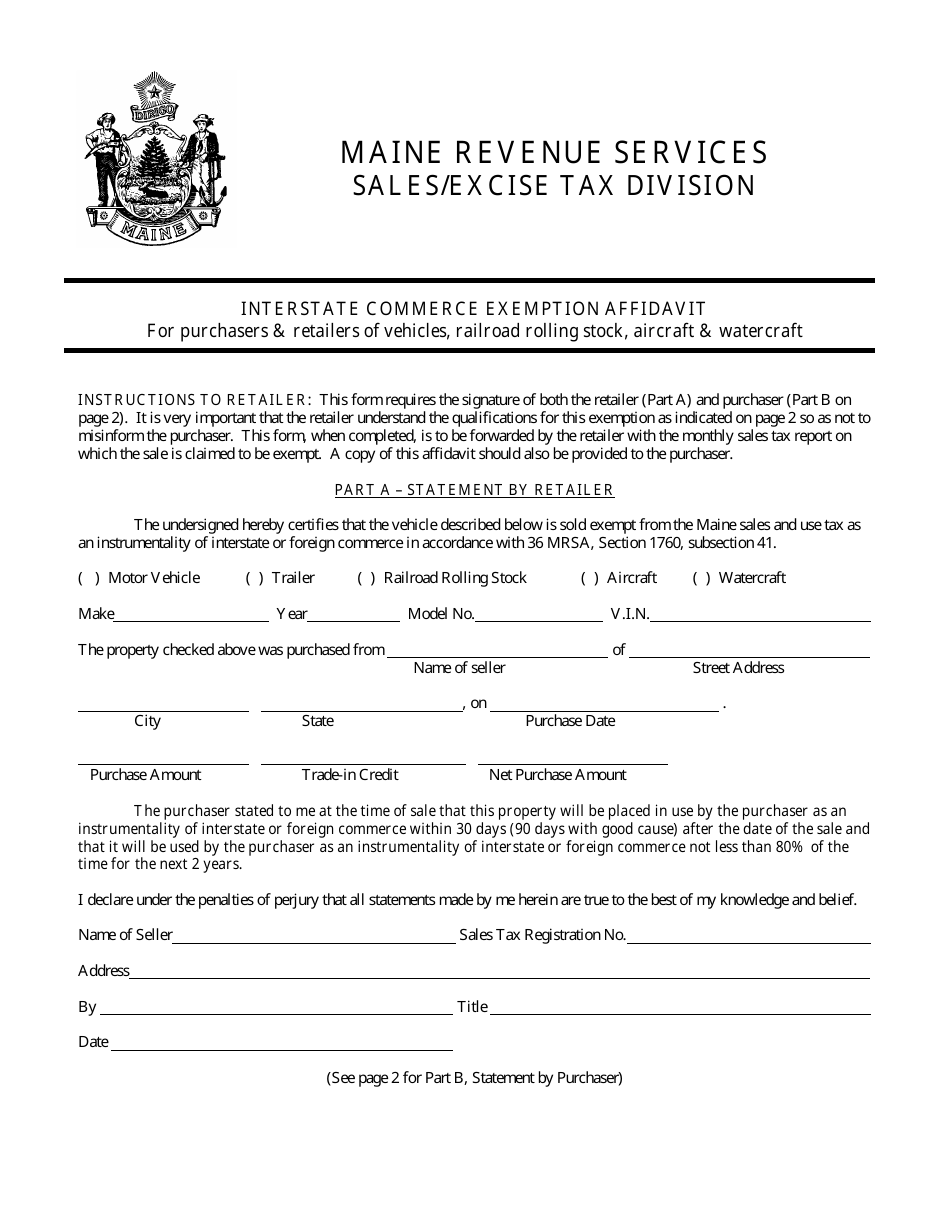

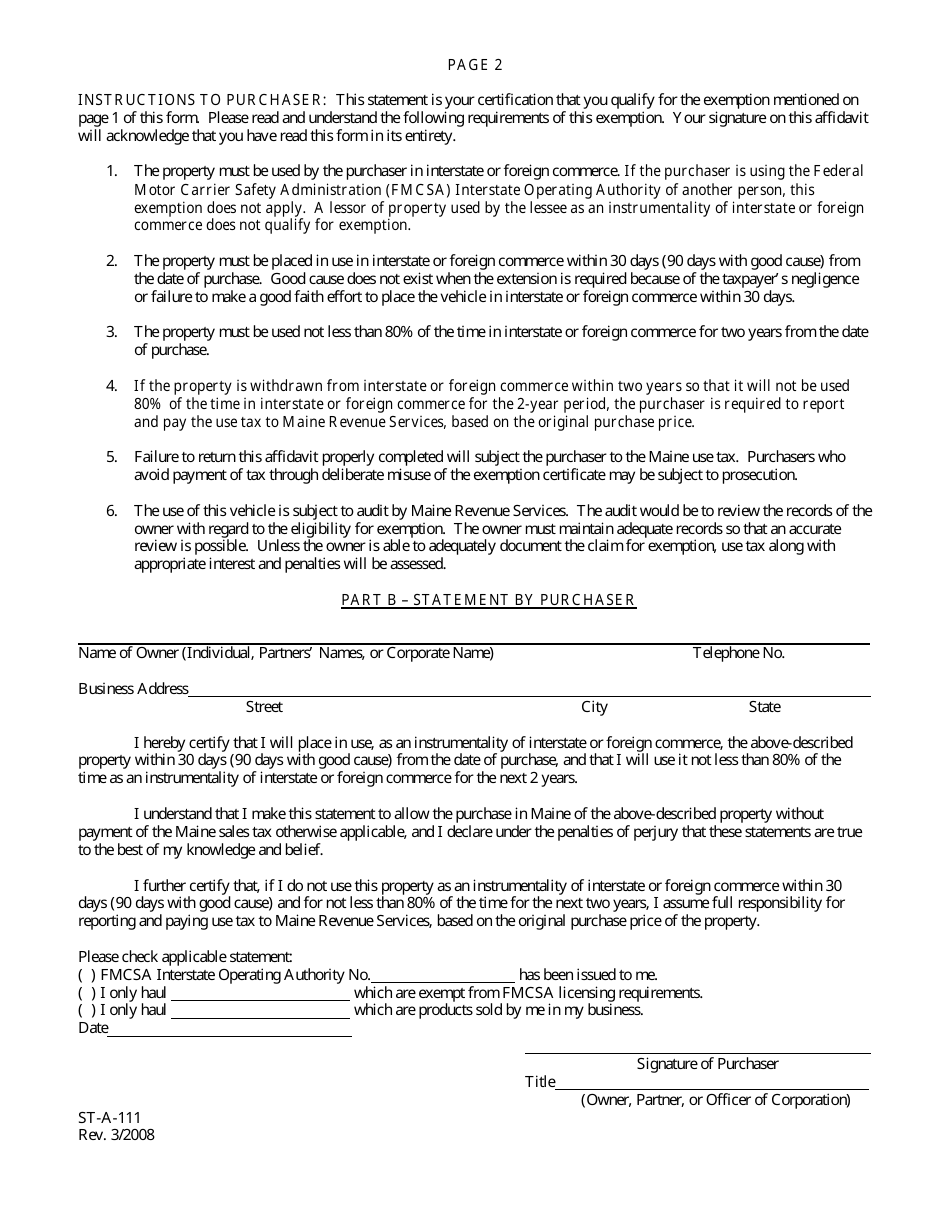

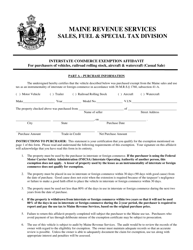

Form ST-A-111 Interstate Commerce Exemption Affidavit - Retail Sale - Maine

What Is Form ST-A-111?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

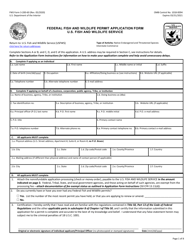

Q: What is Form ST-A-111?

A: Form ST-A-111 is an Interstate Commerce Exemption Affidavit for retail sales in Maine.

Q: Who needs to fill out Form ST-A-111?

A: Retail sellers who engage in interstate commerce and are exempt from sales tax in Maine need to fill out this form.

Q: What is the purpose of Form ST-A-111?

A: The purpose of Form ST-A-111 is to claim an exemption from sales tax on retail sales in Maine.

Q: What type of sales is Form ST-A-111 applicable to?

A: Form ST-A-111 is applicable to retail sales made as part of interstate commerce in Maine.

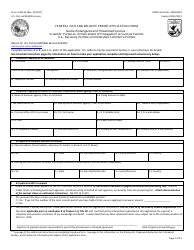

Q: Are there any filing fees for Form ST-A-111?

A: No, there are no filing fees for Form ST-A-111.

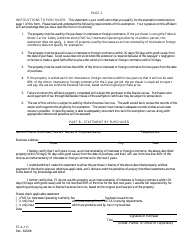

Q: What information is required on Form ST-A-111?

A: Form ST-A-111 requires information such as the seller's name and address, description of the sales, and explanation of the interstate commerce activities.

Q: When should Form ST-A-111 be filed?

A: Form ST-A-111 should be filed with the Maine Revenue Services at least 30 days prior to the first sale to claim the exemption.

Q: What should I do if I am no longer eligible for the exemption?

A: If you are no longer eligible for the exemption, you must notify the Maine Revenue Services within 60 days.

Q: What happens if Form ST-A-111 is filed late or not filed at all?

A: If Form ST-A-111 is filed late or not filed at all, the seller may be liable for sales tax on the retail sales in Maine.

Form Details:

- Released on March 1, 2008;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-A-111 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.