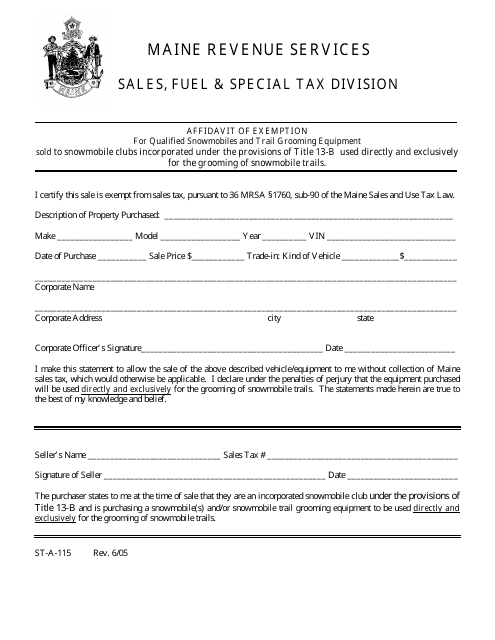

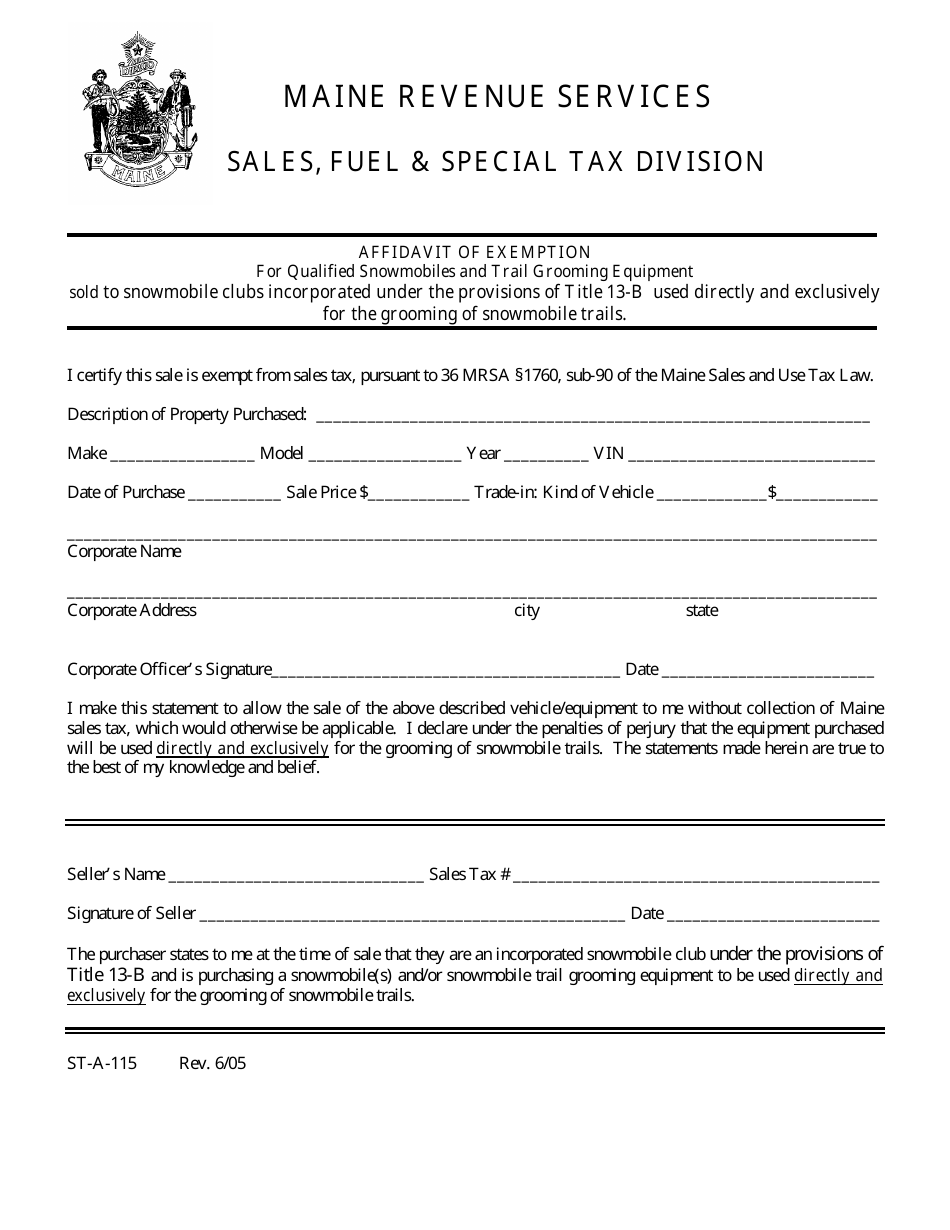

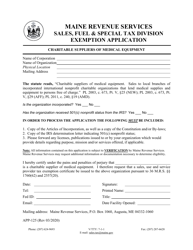

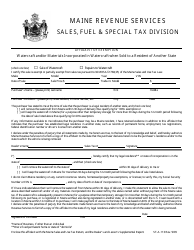

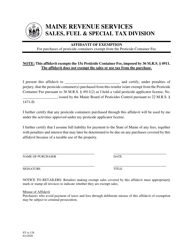

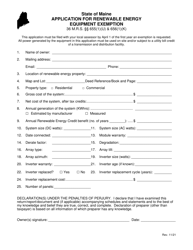

Form ST-A-115 Affidavit of Exemption for Snowmobile & Trailgrooming Equipment - Maine

What Is Form ST-A-115?

This is a legal form that was released by the Maine Department of Administrative and Financial Services - a government authority operating within Maine. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

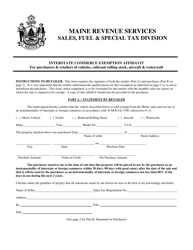

Q: What is Form ST-A-115?

A: Form ST-A-115 is the Affidavit of Exemption for Snowmobile & Trailgrooming Equipment in Maine.

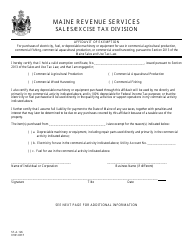

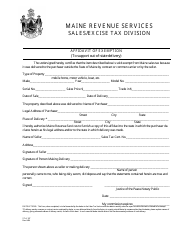

Q: What is the purpose of Form ST-A-115?

A: The purpose of Form ST-A-115 is to claim an exemption from sales tax for the purchase of snowmobile and trail grooming equipment in Maine.

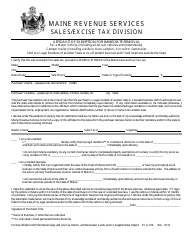

Q: Who needs to fill out this form?

A: This form needs to be filled out by individuals or businesses who are purchasing snowmobile and trail grooming equipment and want to claim an exemption from sales tax in Maine.

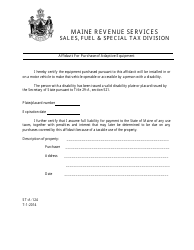

Q: What information is required on Form ST-A-115?

A: Some of the required information on Form ST-A-115 includes the buyer's name and address, the seller's name and address, a description of the equipment being purchased, and the reason for claiming the exemption.

Q: Are there any supporting documents required with this form?

A: Yes, you will need to attach a copy of the sales invoice or bill of sale to the completed Form ST-A-115.

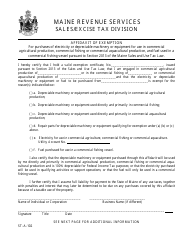

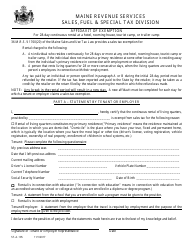

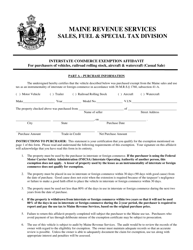

Q: Is there a deadline for submitting this form?

A: There is no specific deadline mentioned for submitting Form ST-A-115. However, it is recommended to submit the form as soon as possible after the purchase of the equipment.

Q: Can I claim an exemption for used snowmobile and trail grooming equipment?

A: Yes, you can claim an exemption for the purchase of used snowmobile and trail grooming equipment in Maine.

Q: What should I do if the exemption is denied?

A: If the exemption is denied, you may be required to pay the sales tax on the purchase. You can contact the Maine Revenue Services for further assistance.

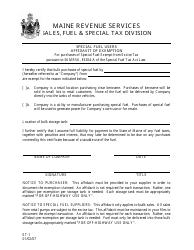

Q: Are there any penalties for providing false information on this form?

A: Yes, providing false information on Form ST-A-115 may result in penalties and potential legal consequences.

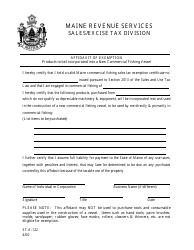

Q: Can I make photocopies of this form?

A: Yes, you can make photocopies of Form ST-A-115 for your records or for any additional purchases of snowmobile and trail grooming equipment.

Q: Is this form specific to Maine only?

A: Yes, this form is specific to Maine for claiming an exemption from sales tax on snowmobile and trail grooming equipment.

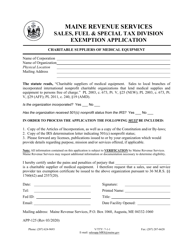

Q: Is there a fee for filing this form?

A: There is no mention of a fee for filing Form ST-A-115.

Q: Can I electronically submit this form?

A: There is no specific information mentioned about electronic submission of Form ST-A-115. It is recommended to check with the Maine Revenue Services for their preferred submission method.

Q: Can I use this form for other types of equipment?

A: No, Form ST-A-115 is specifically for claiming an exemption for snowmobile and trail grooming equipment.

Q: What should I do if I have more questions or need assistance?

A: If you have more questions or need assistance, you can contact the Maine Revenue Services directly.

Q: Can I claim a refund if I've already paid sales tax on the equipment?

A: No, Form ST-A-115 is for claiming an exemption at the time of purchase. If you have already paid sales tax, you cannot claim a refund through this form.

Form Details:

- Released on June 1, 2005;

- The latest edition provided by the Maine Department of Administrative and Financial Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form ST-A-115 by clicking the link below or browse more documents and templates provided by the Maine Department of Administrative and Financial Services.