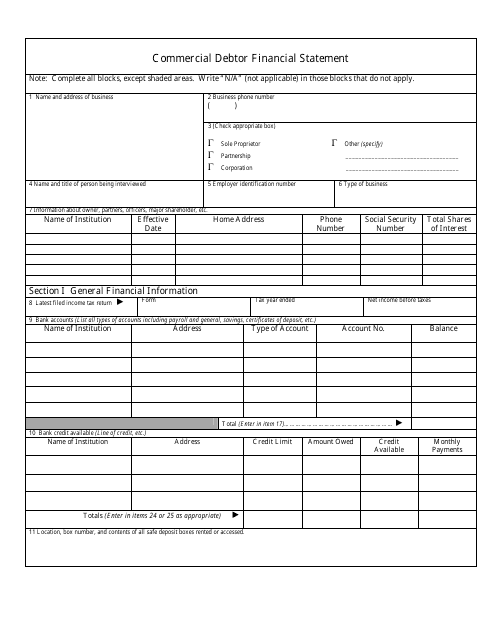

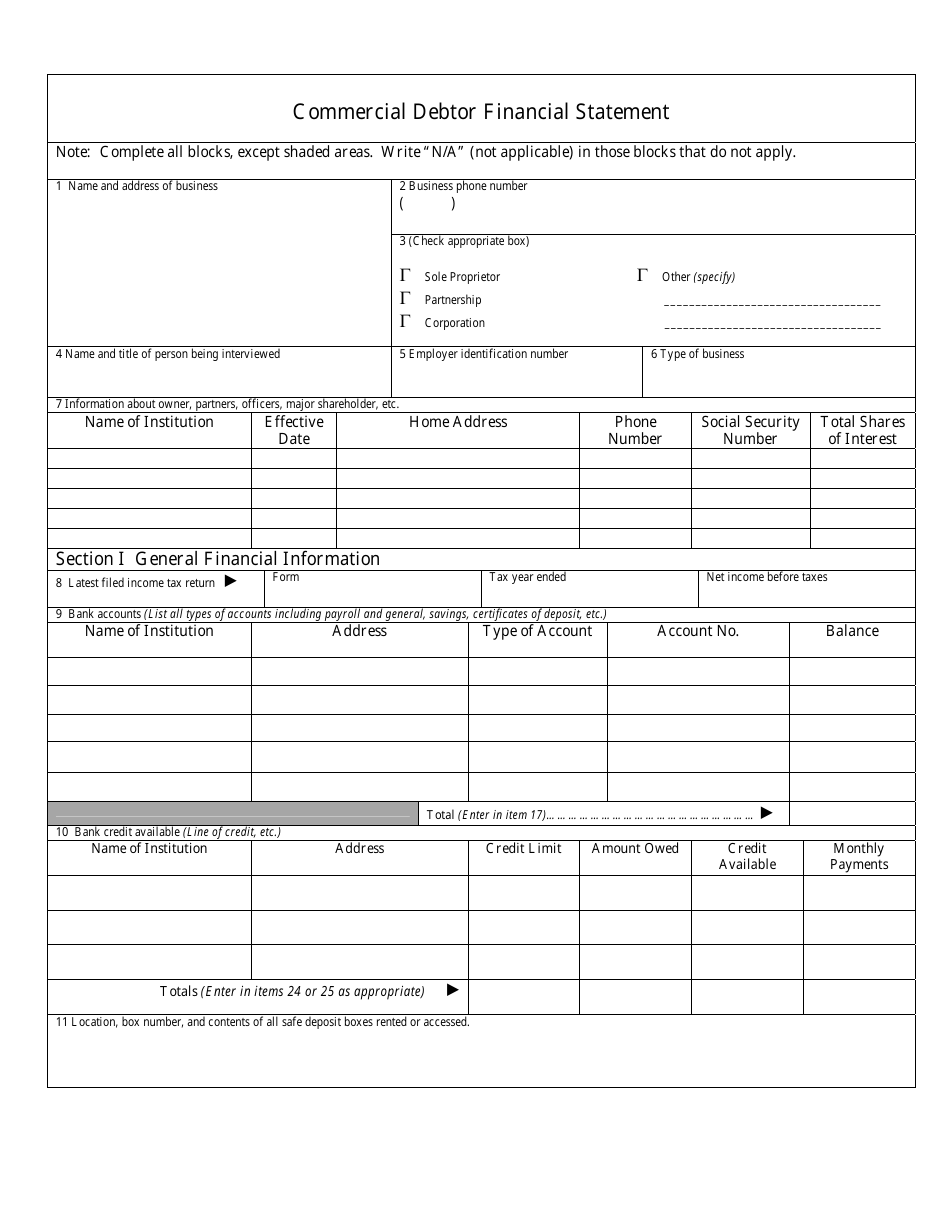

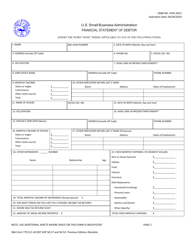

Commercial Debtor Financial Statement

Commercial Debtor Financial Statement is a 4-page legal document that was released by the U.S. Department of the Treasury - Bureau of the Fiscal Service and used nation-wide.

FAQ

Q: What is a Commercial Debtor Financial Statement?

A: A Commercial Debtor Financial Statement is a document that provides detailed information about the financial position of a business or individual who owes money to a creditor.

Q: Why is a Commercial Debtor Financial Statement important?

A: A Commercial Debtor Financial Statement is important because it helps creditors assess the borrower's ability to repay the debt and make informed decisions about granting credit or pursuing legal actions.

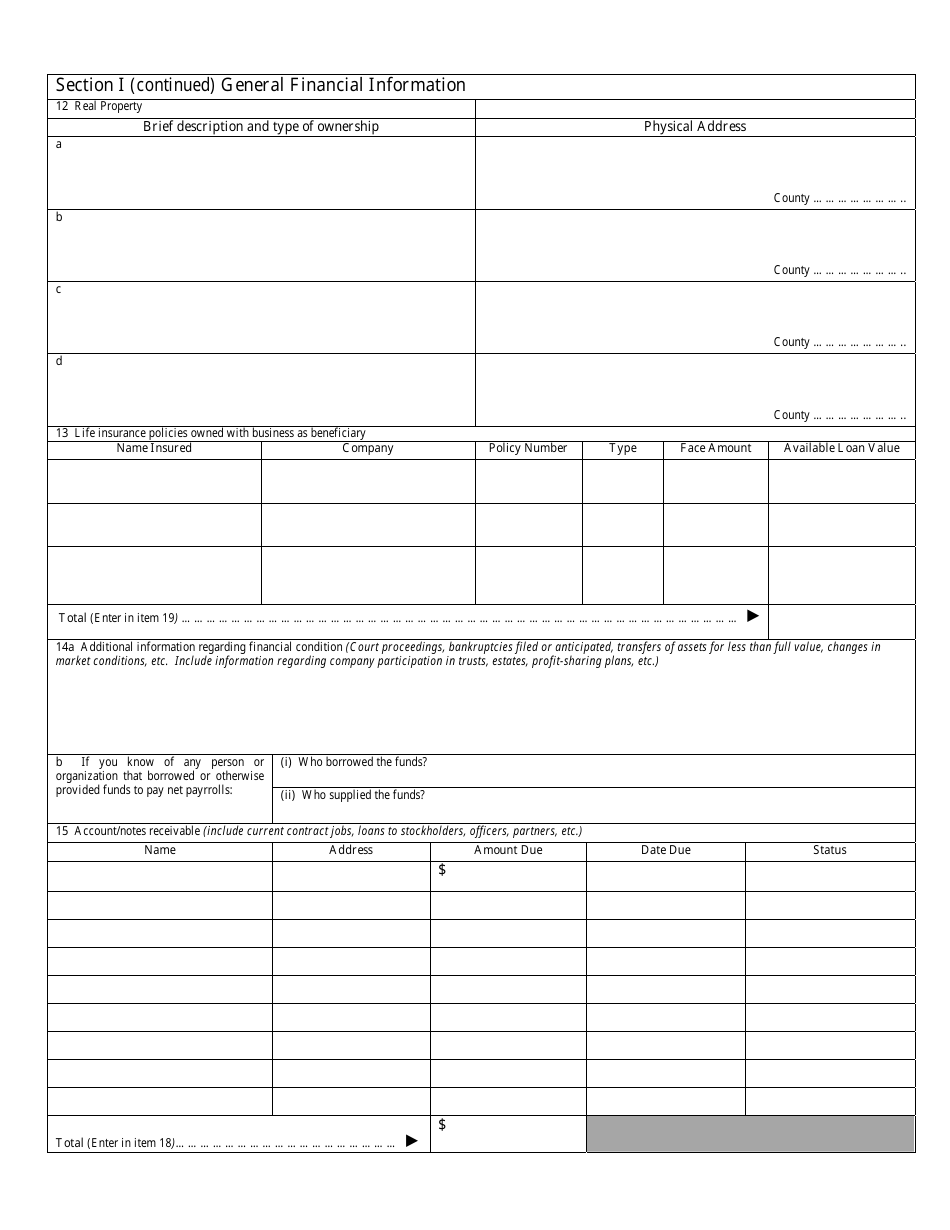

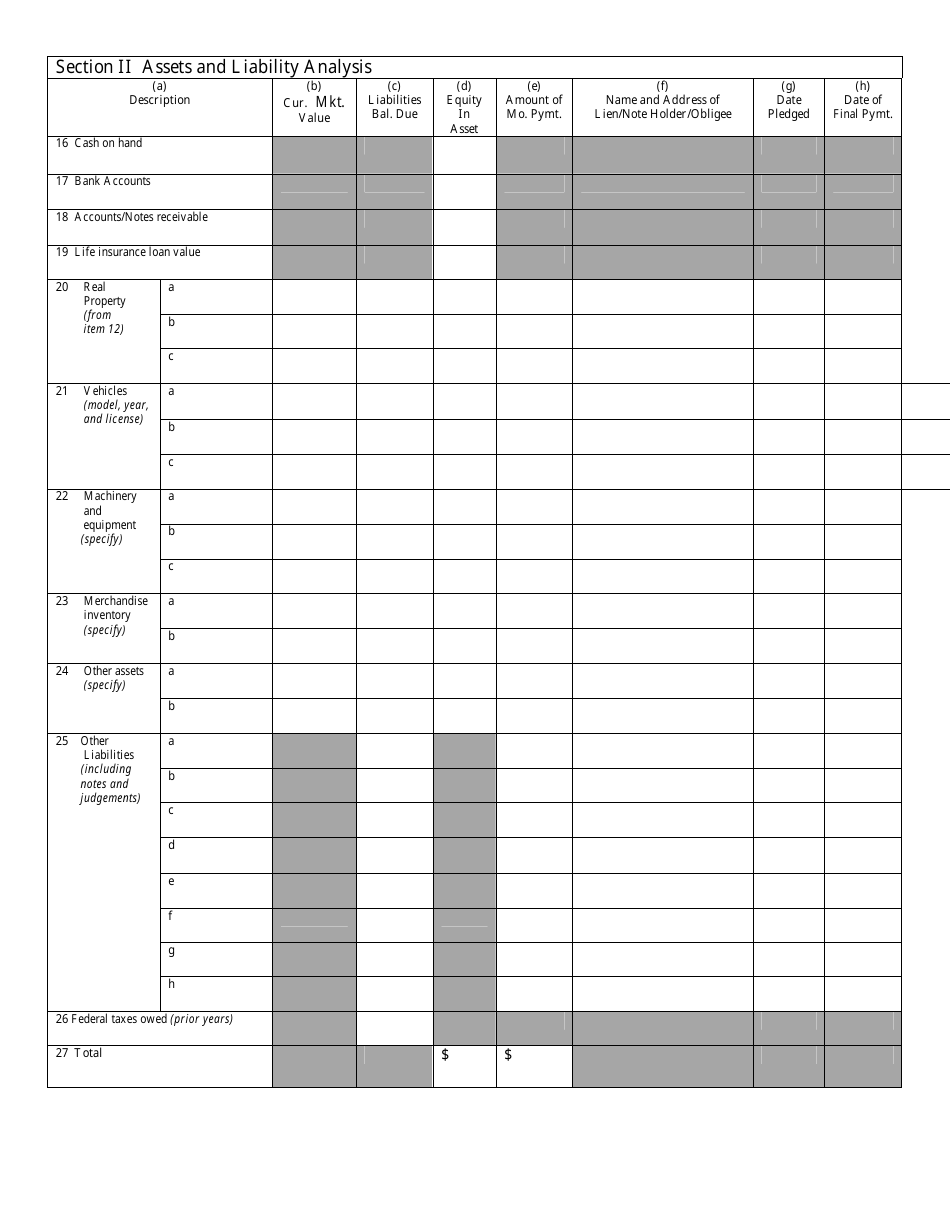

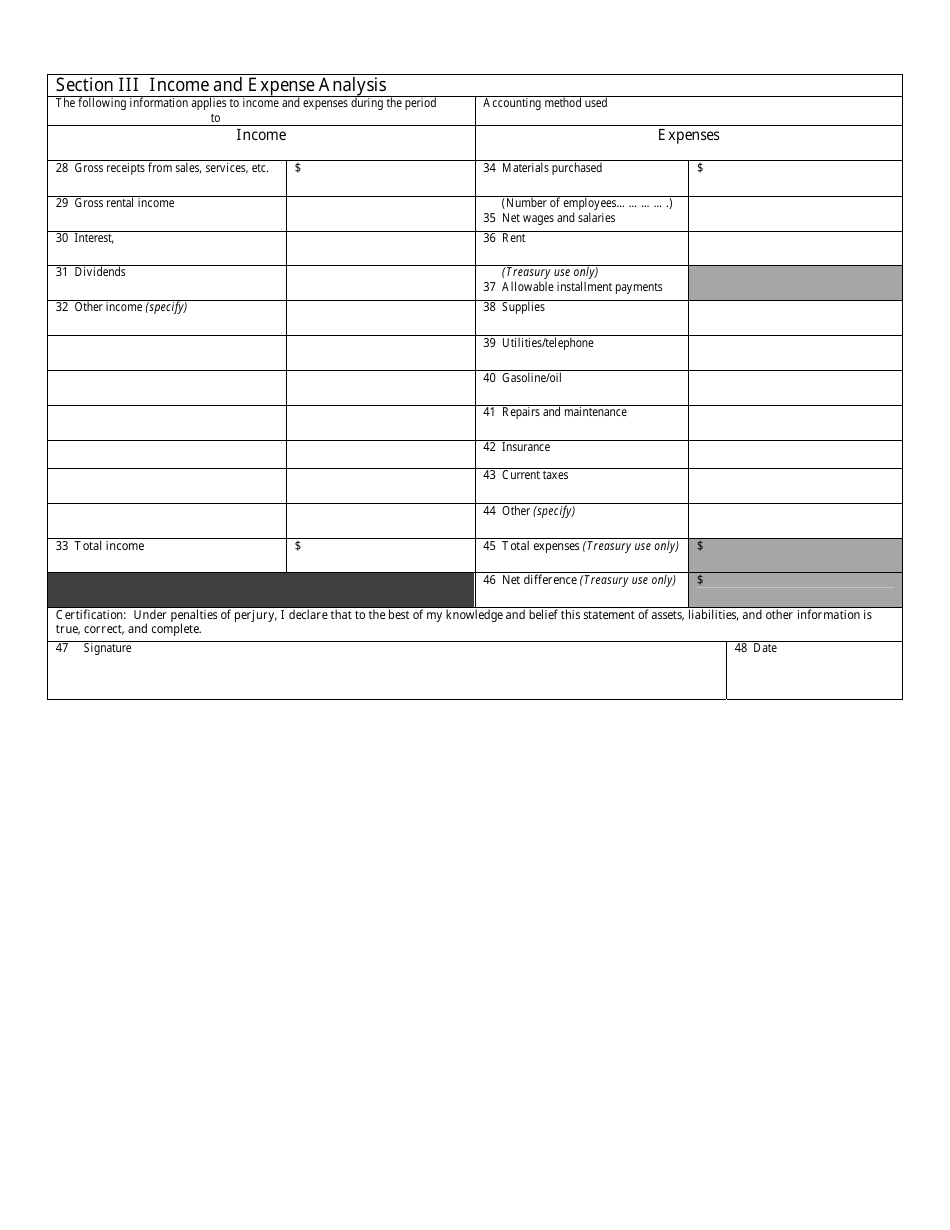

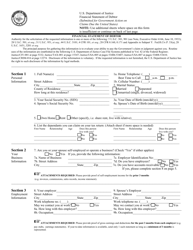

Q: What information is typically included in a Commercial Debtor Financial Statement?

A: A Commercial Debtor Financial Statement usually includes information about the debtor's assets, liabilities, income, expenses, and other financial details.

Q: Who uses Commercial Debtor Financial Statements?

A: Creditors, such as banks, financial institutions, and suppliers, use Commercial Debtor Financial Statements to evaluate the creditworthiness and financial stability of a business or individual.

Q: Are Commercial Debtor Financial Statements confidential?

A: The confidentiality of Commercial Debtor Financial Statements may depend on the specific circumstances and legal requirements. It is important to consult with a legal professional to understand the disclosure and confidentiality aspects.

Form Details:

- The latest edition currently provided by the U.S. Department of the Treasury - Bureau of the Fiscal Service;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more legal forms and templates provided by the issuing department.