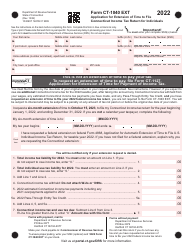

This version of the form is not currently in use and is provided for reference only. Download this version of

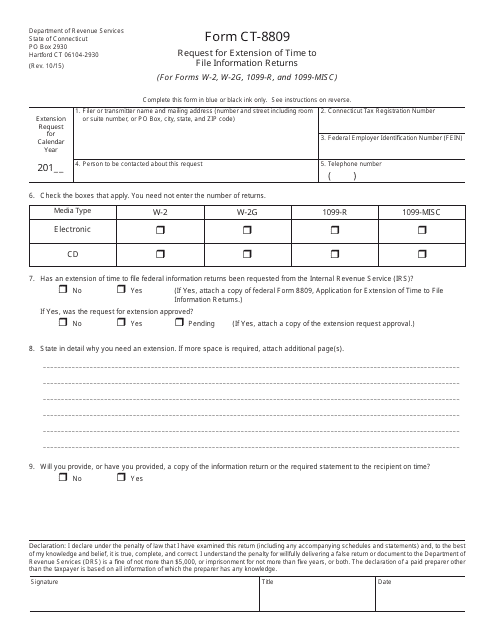

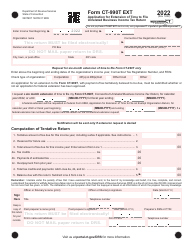

Form CT-8809

for the current year.

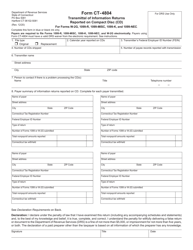

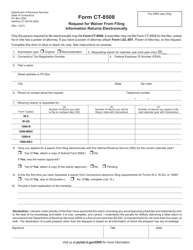

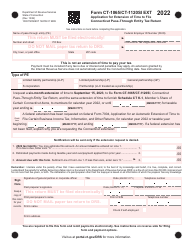

Form CT-8809 Request for Extension of Time to File Information Returns (For Forms W-2, W-2g, 1099-r, and 1099-misc) - Connecticut

What Is Form CT-8809?

This is a legal form that was released by the Connecticut Department of Revenue Services - a government authority operating within Connecticut. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CT-8809?

A: Form CT-8809 is a request for an extension of time to file information returns.

Q: What types of information returns can be extended using Form CT-8809?

A: Form CT-8809 can be used to extend the filing of Forms W-2, W-2G, 1099-R, and 1099-MISC.

Q: Why would I need to request an extension of time to file information returns?

A: You may need to request an extension if you are unable to file the information returns by the original due date.

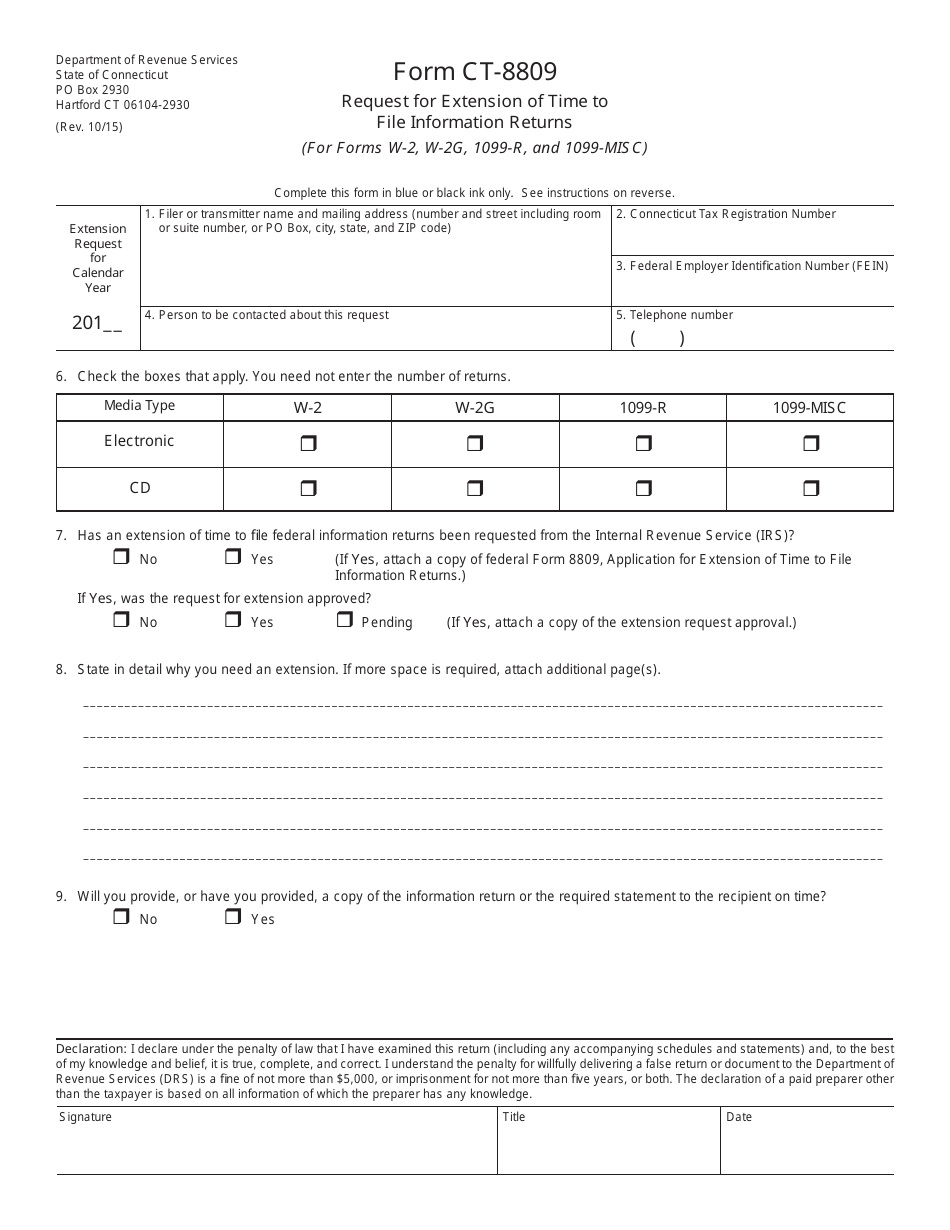

Q: How do I file Form CT-8809?

A: You can file Form CT-8809 by mail or electronically.

Q: What is the deadline for filing Form CT-8809?

A: The deadline for filing Form CT-8809 varies depending on the type of information return being extended.

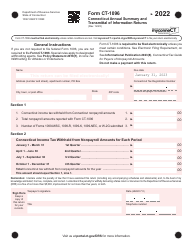

Form Details:

- Released on October 1, 2015;

- The latest edition provided by the Connecticut Department of Revenue Services;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CT-8809 by clicking the link below or browse more documents and templates provided by the Connecticut Department of Revenue Services.