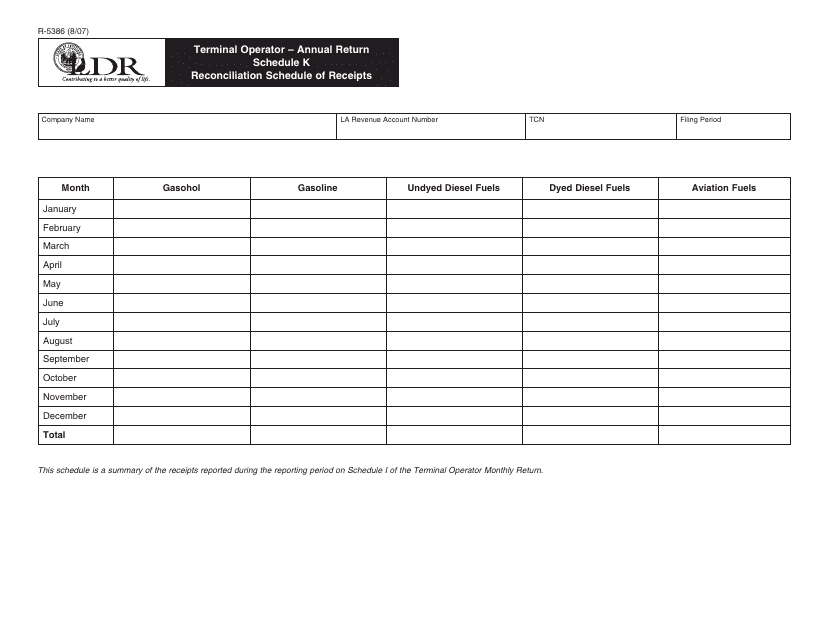

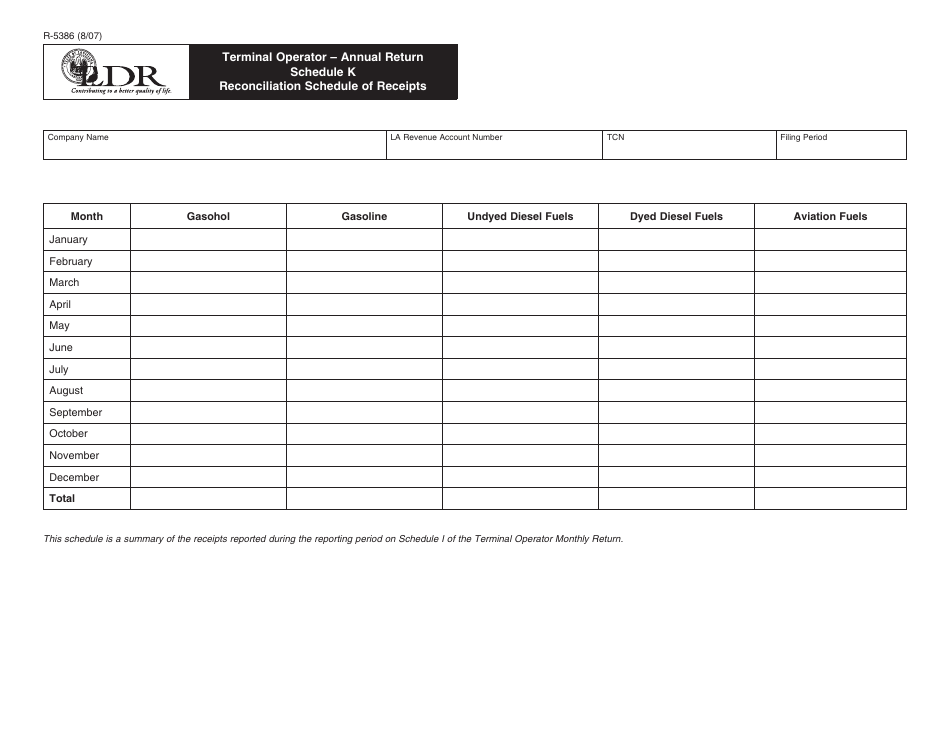

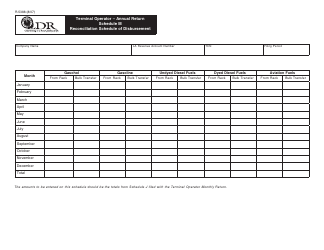

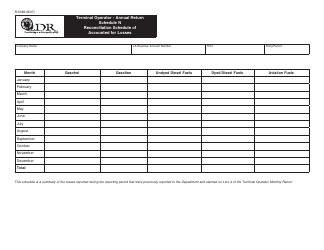

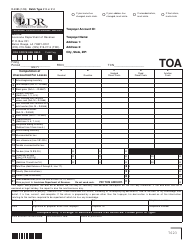

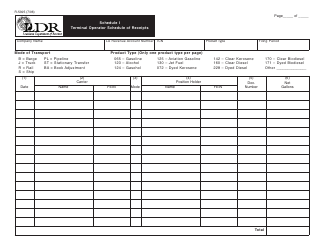

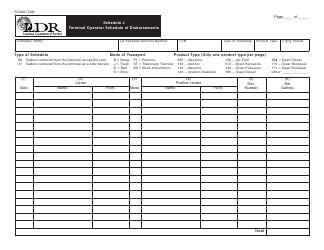

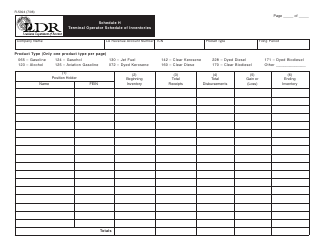

Form R-5386 Terminal Operator - Annual Return Schedule K - Reconciliation Schedule of Receipts - Louisiana

What Is Form R-5386?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5386?

A: Form R-5386 is the Terminal Operator - Annual Return Schedule K - Reconciliation Schedule of Receipts for Louisiana.

Q: What is the purpose of Form R-5386?

A: The purpose of Form R-5386 is to reconcile the receipts reported on the Terminal Operator Annual Return with receipts reported by suppliers.

Q: Who needs to file Form R-5386?

A: Terminal operators in Louisiana need to file Form R-5386.

Q: When is Form R-5386 due?

A: Form R-5386 is due on or before the 20th day of the month following the close of the reporting period.

Q: What information is required on Form R-5386?

A: Form R-5386 requires information such as the terminal operator's name, address, and tax identification number, as well as detailed information about the receipts being reconciled.

Q: Are there any penalties for not filing Form R-5386?

A: Yes, there are penalties for not filing Form R-5386, including late filing penalties and interest on any unpaid tax amounts.

Form Details:

- Released on August 1, 2007;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5386 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.