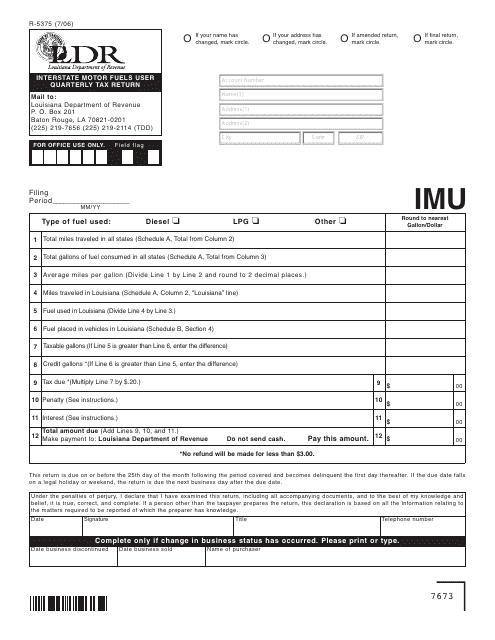

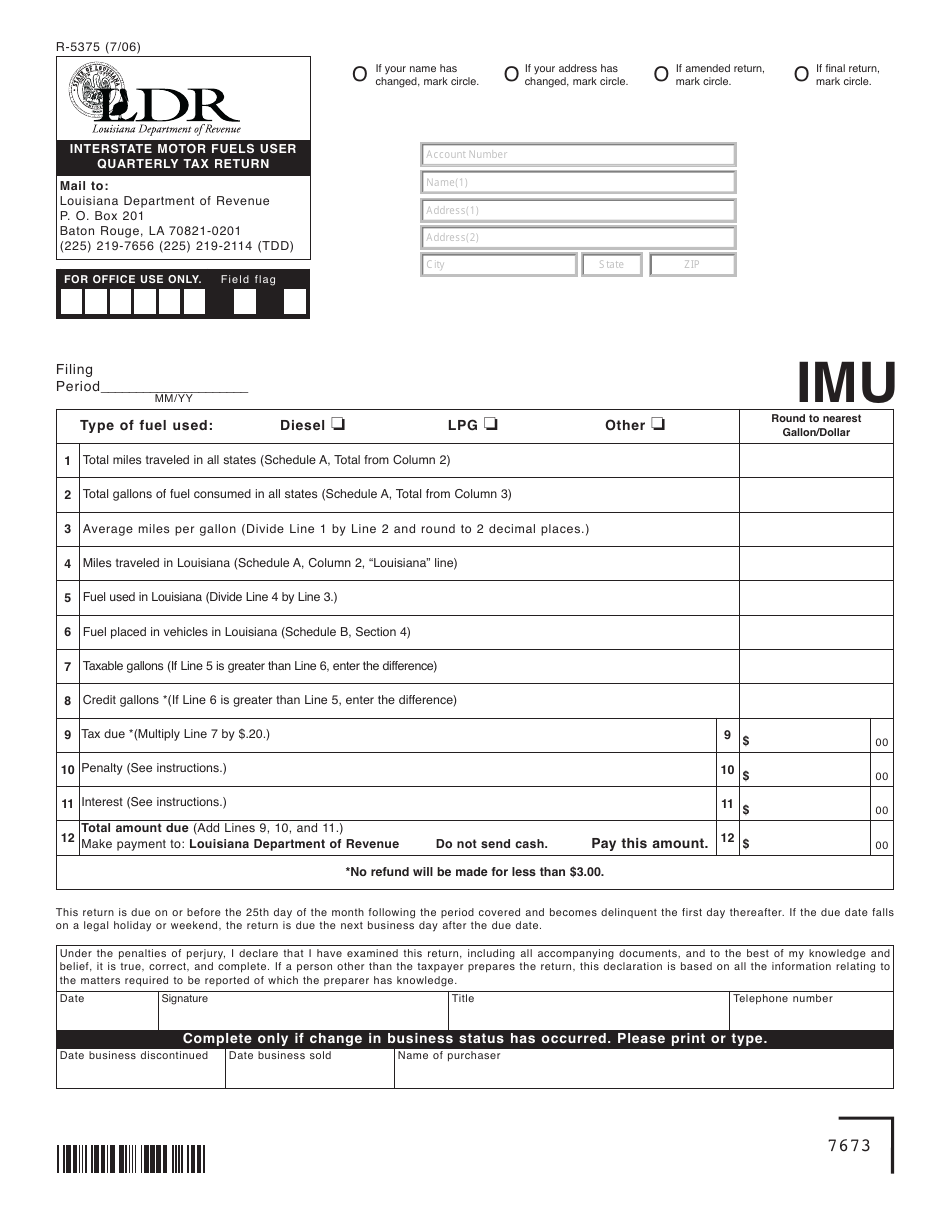

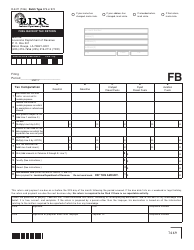

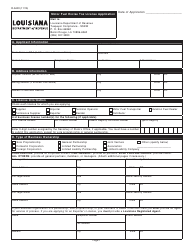

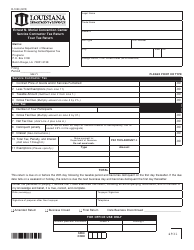

Form R-5375 Interstate Motor Fuels User Quarterly Tax Return - Louisiana

What Is Form R-5375?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is the Form R-5375?

A: The Form R-5375 is the Interstate Motor Fuels User Quarterly Tax Return in Louisiana.

Q: Who needs to file Form R-5375?

A: Any interstate motor fuel user in Louisiana needs to file Form R-5375.

Q: What is the purpose of Form R-5375?

A: The purpose of Form R-5375 is to report and pay taxes on motor fuel used in Louisiana.

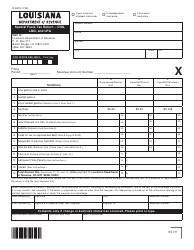

Q: What information is required on Form R-5375?

A: Form R-5375 requires information such as total gallons of motor fuel used, tax rates, and payment details.

Q: How often do you need to file Form R-5375?

A: Form R-5375 needs to be filed quarterly, on a regular basis.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5375 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.