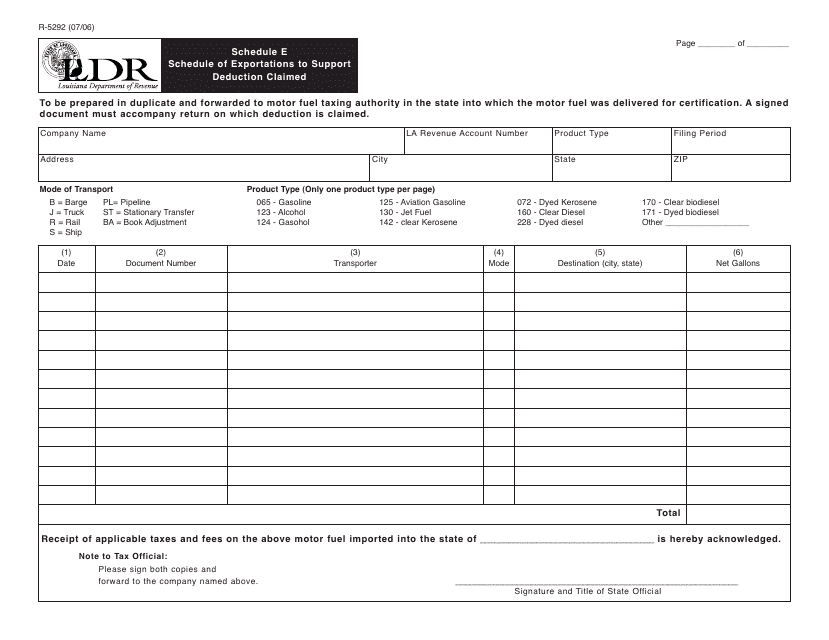

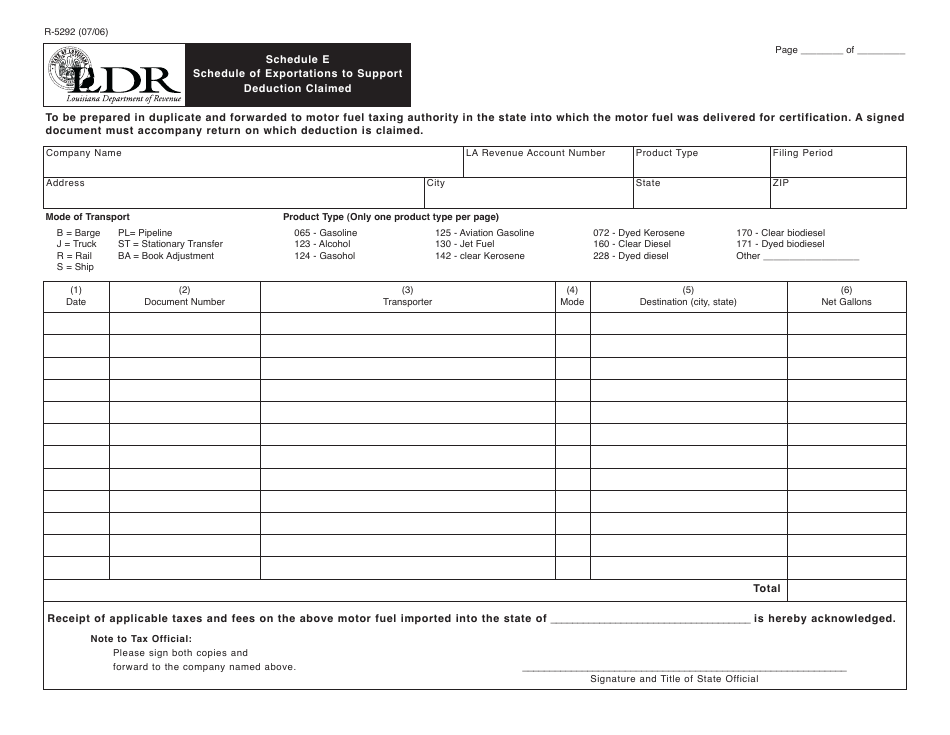

Form R-5292 Schedule E Schedule of Exportations to Support Deduction Claimed - Louisiana

What Is Form R-5292 Schedule E?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-5292 Schedule E?

A: Form R-5292 Schedule E is a schedule used in Louisiana to support deduction claimed for exportations.

Q: What is the purpose of Form R-5292 Schedule E?

A: The purpose of Form R-5292 Schedule E is to provide documentation of exportations to support deduction claimed in Louisiana.

Q: What information is required on Form R-5292 Schedule E?

A: Form R-5292 Schedule E requires information about the exportations being claimed for deduction.

Q: Who needs to file Form R-5292 Schedule E?

A: Taxpayers in Louisiana who are claiming deductions for exportations need to file Form R-5292 Schedule E.

Q: Is Form R-5292 Schedule E specific to Louisiana?

A: Yes, Form R-5292 Schedule E is specific to Louisiana and is used for state tax purposes only.

Form Details:

- Released on July 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-5292 Schedule E by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.