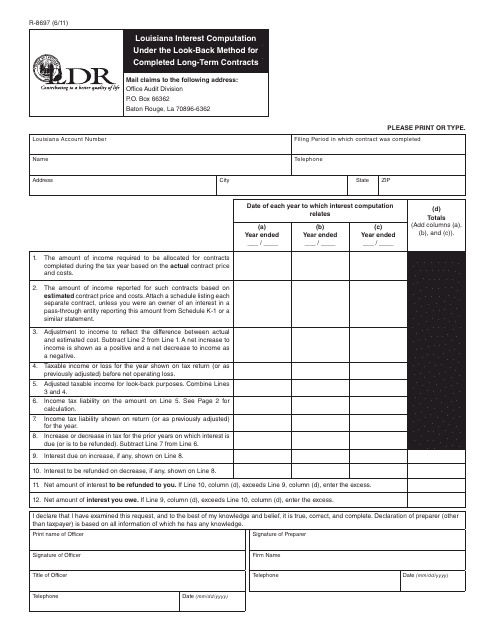

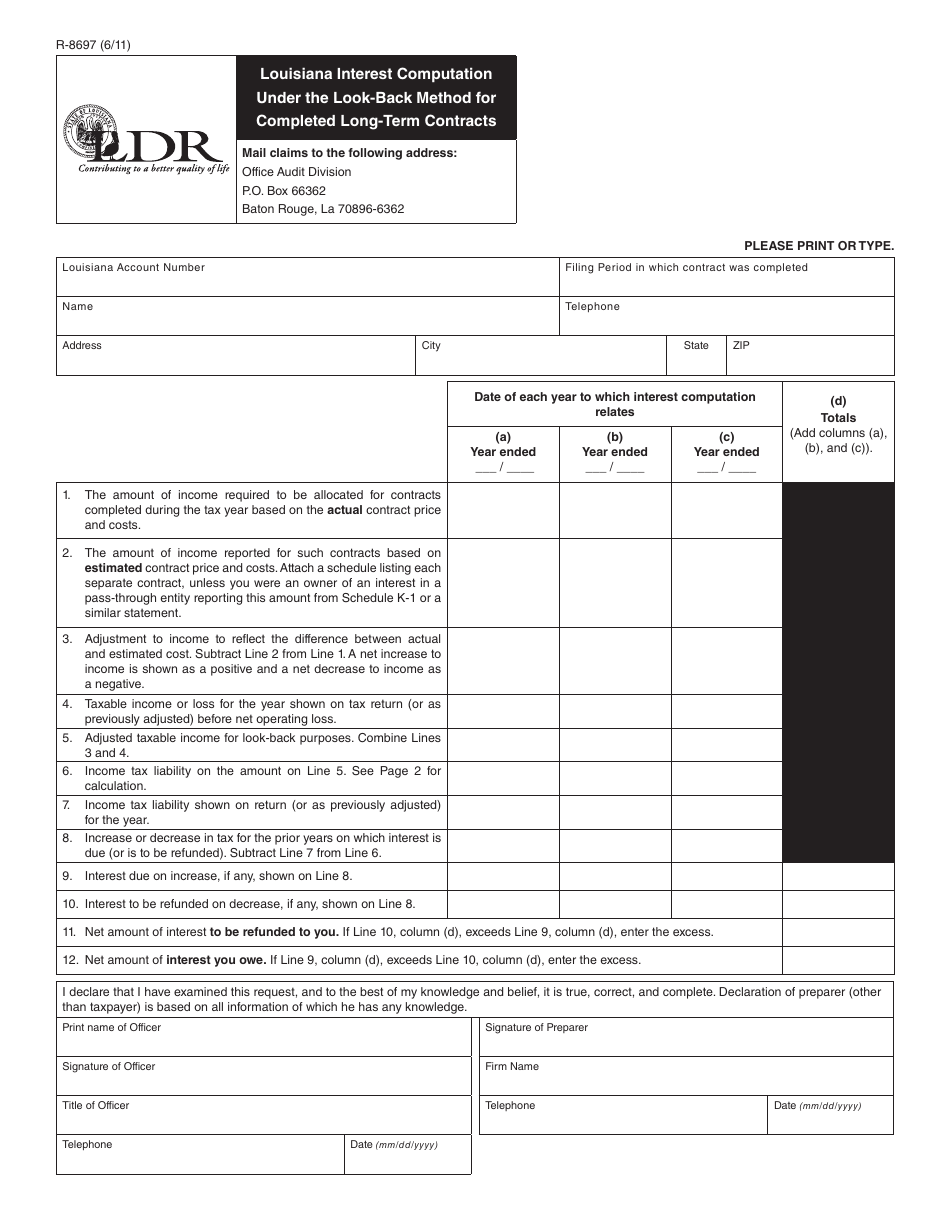

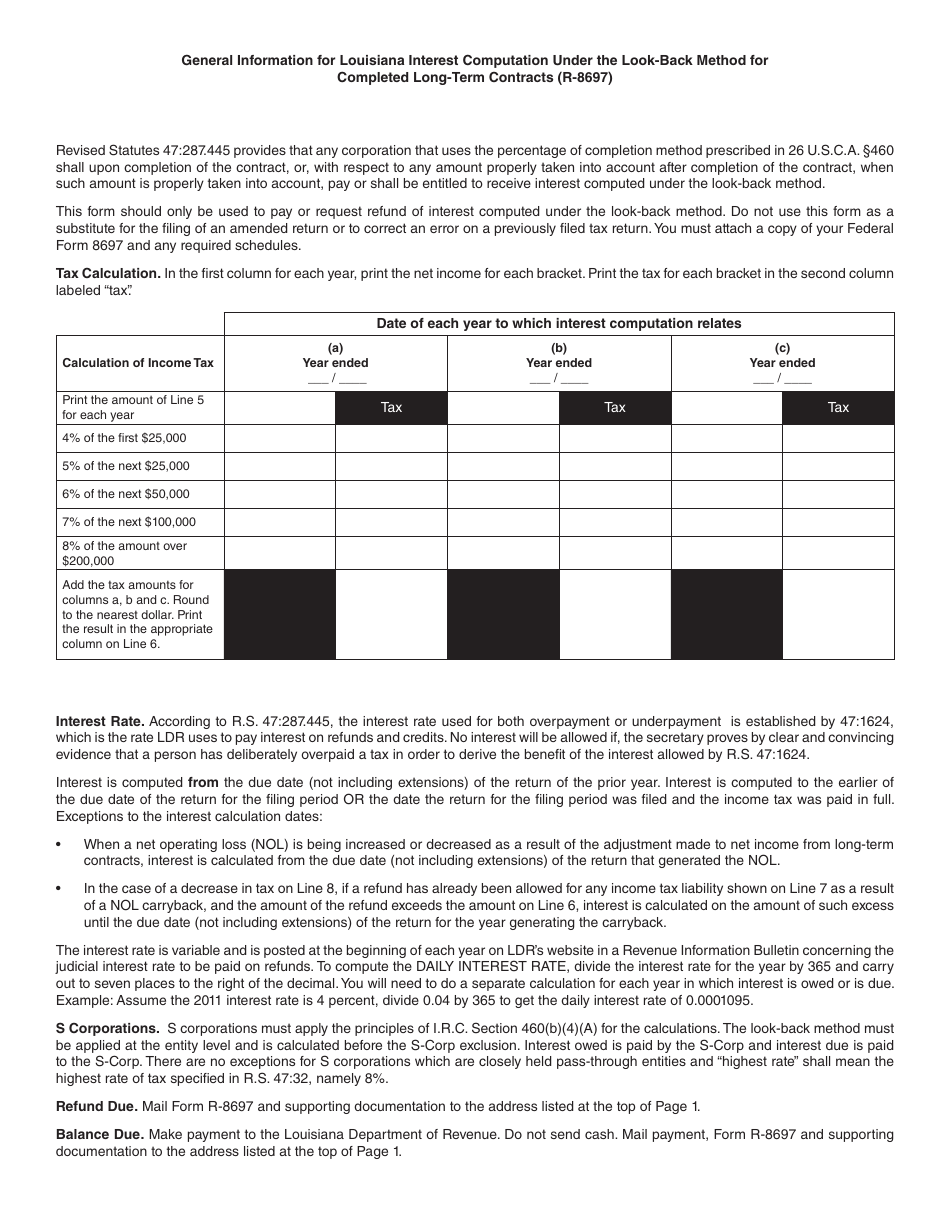

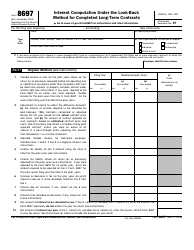

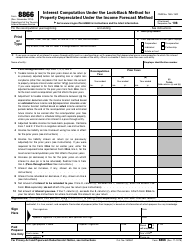

Form R-8697 Louisiana Interest Computation Under the Look-Back Method for Completed Long-Term Contracts - Louisiana

What Is Form R-8697?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8697?

A: Form R-8697 is a form used in Louisiana to compute interest under the look-back method for completed long-term contracts.

Q: Who needs to use Form R-8697?

A: Contractors in Louisiana who have completed long-term contracts need to use Form R-8697 to compute interest.

Q: What is the purpose of Form R-8697?

A: The purpose of Form R-8697 is to calculate interest on completed long-term contracts in Louisiana using the look-back method.

Q: What is the look-back method?

A: The look-back method is a method used to calculate interest on completed long-term contracts in Louisiana. It involves calculating interest on a yearly basis and adjusting it for the actual duration of the contract.

Q: How do I use Form R-8697?

A: To use Form R-8697, you need to provide information about the completed long-term contract and calculate interest using the look-back method.

Q: Are there any deadlines for filing Form R-8697?

A: Yes, there are specific deadlines for filing Form R-8697. You should consult the instructions or contact the Louisiana Department of Revenue for the exact deadlines.

Q: What happens if I don't file Form R-8697?

A: If you are required to file Form R-8697 and fail to do so, you may be subject to penalties and interest.

Q: Are there any special considerations or requirements for using Form R-8697?

A: Yes, there may be additional requirements or considerations when using Form R-8697. It is important to thoroughly read and follow the instructions provided with the form.

Form Details:

- Released on June 1, 2011;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8697 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.