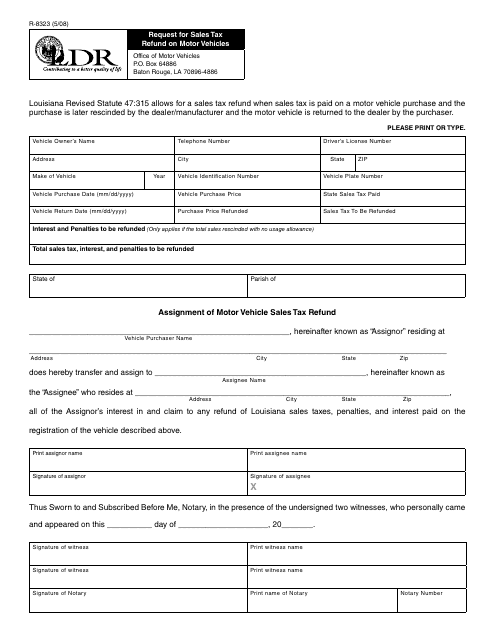

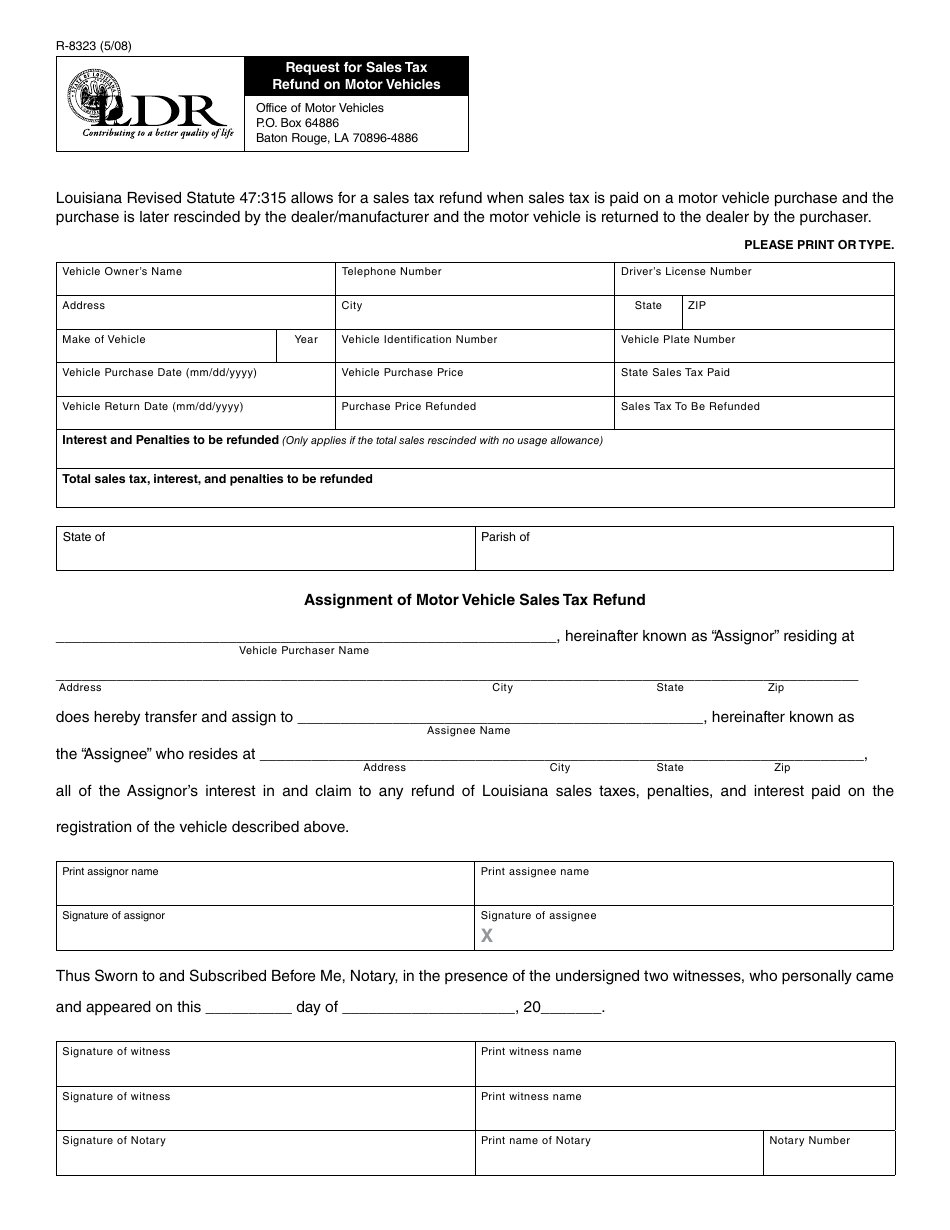

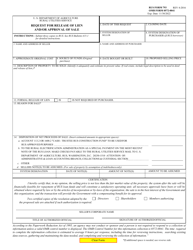

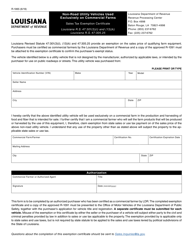

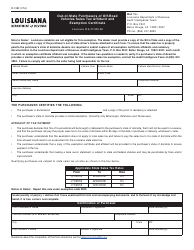

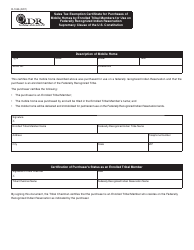

Form R-8323 Request for Sales Tax Refund on Motor Vehicles - Louisiana

What Is Form R-8323?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-8323?

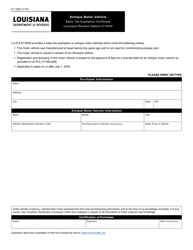

A: Form R-8323 is a request form used to claim a sales tax refund on motor vehicles in Louisiana.

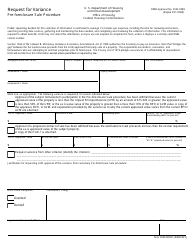

Q: Who can use Form R-8323?

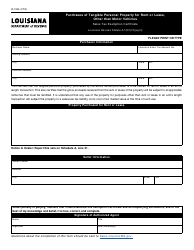

A: Any individual or business that purchased a motor vehicle in Louisiana and wants to claim a sales tax refund can use Form R-8323.

Q: What is the purpose of Form R-8323?

A: The purpose of Form R-8323 is to request a refund on the sales tax paid when purchasing a motor vehicle in Louisiana.

Q: What information is required on Form R-8323?

A: Form R-8323 requires information such as the vehicle's purchase date, purchase price, identification number, and the amount of sales tax paid.

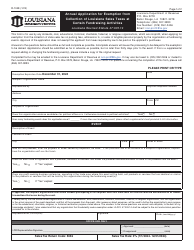

Q: When should I submit Form R-8323?

A: Form R-8323 should be submitted within three years from the date of the vehicle's purchase.

Q: How long does it take to process a Form R-8323?

A: The processing time for Form R-8323 may vary, but generally it takes several weeks to receive the refund.

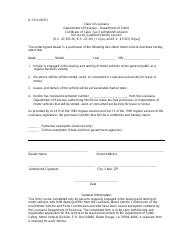

Q: What if my Form R-8323 is denied?

A: If your Form R-8323 is denied, you have the option to appeal the decision with the Louisiana Department of Revenue.

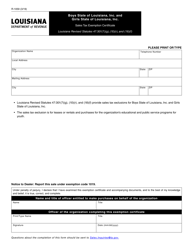

Q: Are there any fees associated with filing Form R-8323?

A: No, there are no fees associated with filing Form R-8323.

Form Details:

- Released on May 1, 2008;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-8323 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.